The freight environment of 2023 was challenging to say the least, and barring some major event it’s not likely to change dramatically this year.

But Avery Vise, vice president of trucking at FTR Transportation Intelligence, said the outlook for 2024 is stable with “very incremental improvement."

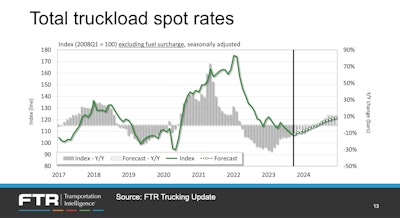

Spot rates saw a strong buildup during the pandemic before collapsing, plummeting about 38% in 2023, and though contract rates haven’t seen the same kind of collapse, they’re down about 12% below the peak at the beginning of 2022.

Vise said FTR is forecasting stagnant utilization into the second quarter of this year with only modest recovery throughout the rest of the year and into 2025, with van segments expected to perform a little better than specialized segments.

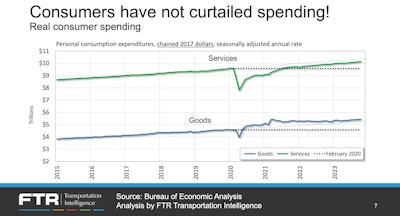

That’s due in large part to lack of growth in manufacturing as well as partly because of consumer spending, said Eric Starks, FTR chairman of the board.