The bill’s text has not yet been produced, but the unlikely bipartisan duo says in their summary of the legislation that the 6.5 percent rate would incentivize companies to move their foreign earnings stateside. The two estimate that roughly $2 trillion in earnings by U.S. companies would be eligible for the repatriation incentive.

All money earned by the repatriation tax will go directly to the Highway Trust Fund, according to the bill’s summary.

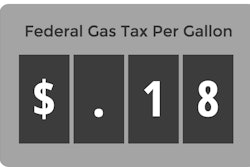

The Boxer-Paul bill follows a bipartisan highway bill introduced in the U.S. House last week, which would boost at-pump taxes on gasoline and diesel by tying them to inflation. Click here to read CCJ’s coverage of that bill.

Boxer and Paul’s plan for boosting highway funding is similar to that of President Barack Obama’s, whose Grow America proposal relies heavily on a similar repatriation tax for funding. Click here to read more about the White House plan.

![PRES-Inspection-Essentials[1]](https://img.ccjdigital.com/files/base/randallreilly/all/image/2015/04/ccj.PRES-Inspection-Essentials1.png?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)