Elephants or goldfish? Shippers and carriers both say “we have long memories” when the power dynamics change in freight markets. When capacity gets tight, however, it is carriers who most resemble goldfish. They tend to have short memories and behave opportunistically, according to research by the MIT Center for Technology & Logistics (MIT CTL).

In November 2020 an MIT CTL research team published a paper based on analysis of a large dataset of freight transactions. One conclusion was that strong shipper-carrier relationships in a soft market are not predictive of how carriers will perform in the next tight cycle.

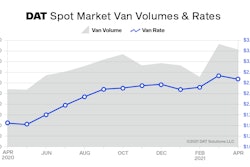

Shippers that worked hard to maintain relationships when the market turned soft around 4Q 2018 and continued through 1Q 2020, might have expected that carriers would show more loyalty when the market tightened in the second half of 2020. Capacity is now as tight as it’s ever been, according to a recent report by CCJ.

Isolating behaviors

The dataset the MIT CTL researchers analyzed had more than 1.9 million dry van truckload freight transactions provided by a third-party logistics company. The transactions took place from September 2015 to May 2019 and included loads offered by 71 shippers to 1,650 contracted carriers.

Graduate assistant and PhD candidate Angela Acocella led the research and isolated the strength of shipper-carrier relationships to a single variable — the load acceptance ratio of carriers.

[Related: March was possibly the ‘strongest freight market ever’ for carriers]

Shipper contracts generally do not require that carriers accept all load offers. They only set agreements for lanes and pricing. When markets tighten, carriers tend to reject a greater percentage of load offers for pre-negotiated contract rates.

Angela Acocella, graduate assistant to the MIT Center for Transportation & Logistics, and PhD candidate.

Angela Acocella, graduate assistant to the MIT Center for Transportation & Logistics, and PhD candidate.

The MIT CTL paper cites a body of research that shows for-hire truckload carriers, on average, accept about 72% of load offers from shippers for contracted lanes, and that shippers fulfill 6% of their loads using spot capacity when contract carriers reject loads. The average rates in the spot market generally exceed contract prices by 23 to 35%.

Researchers used statistical models to find the degree by which shippers and primary carriers held to their freight contracts when market conditions changed from soft to tight. The analysis showed that favorable soft market behaviors of shippers did not significantly impact the load acceptance rate by carriers during tight market periods.

The average weekly load acceptance rate when the freight market went from soft to tight around Q3 of 2017, for example, was 81.9%. The acceptance rate fell to 68.5% when the market changed from tight to soft around Q4 of 2018. Meanwhile, the average weekly cost per load increased between these periods from $1,156 to $1,420.

Looking beyond price

When markets were tight the MIT CTL study found that price is not the only tool that helped shippers increase load acceptance rates. Shippers that offered more consistent freight volumes and lead times for orders were also successful. Based on interviews with truckload carriers the researchers found the sweet spot for lead times is three days before pickup.

Additionally, carriers responded with higher acceptance rates for loads that had reduced delays at pickup and delivery locations, which helps carriers boost profits and retain drivers.

The MIT CTL study did not have data from 2020, but Acocella told CCJ that she expects that results, for load acceptance rates and other variables, would be “what typically happens during hot markets,” with some anomalies expected due to the COVID-19 pandemic.

[Related: Top 5 bidding strategies to improve freight opportunities]

For the past year, most shippers have been trying to ensure their rates stay competitive by “updating their rates more frequently, doing more mini bids, and making sure they were changing behaviors to follow the market,” she said.

Larger shippers tend to be better insulated from the impacts of the market and maintain better carrier relationships since they can offer carriers more volume and consistency, Acocella noted.

As a top performing Walmart carrier, Baylor Trucking was able to expand its relationship in 2020 by 58.5% in terms of load count across Walmart’s dry, refrigerated and consolidated freight networks.

With capacity tight, shippers and freight brokers are making it for carriers to do business with them. Shown here is the sales floor of Austin, Texas-based Arrive Logistics.

With capacity tight, shippers and freight brokers are making it for carriers to do business with them. Shown here is the sales floor of Austin, Texas-based Arrive Logistics.

Baylor Trucking held fast to contracted rates and lane commitments despite an unprecedented surge in demand for the company’s services during the COVID-19 pandemic, said Cari Baylor, president of the Milan, Ind.-based fleet.

“We were able to grow our relationship with Walmart when America needed us most,” Baylor said. “We always want to do the right thing. For us this means honoring our lane and rate commitments with customers and making sure that our professional drivers always know we are there to support them.”

[Related: ELD outage at Baylor Trucking raises industry questions for compliance, legal liability]

Going forward, Acocella said that shippers will want price concessions from carriers when they negotiate future contracts, since 2020 and 2021 have blown their transportation budgets out of proportion. This comes with tradeoffs, however.

“Shippers trying to cut down on their budget from the 2020 timeframe might go for lower priced options, and maybe not see the performance they are expecting to see,” she said.

A broker’s perspective

Freight brokers are also dealing with the impacts of tight capacity in the freight market. This is leading to new strategies and technologies to make it easier for carriers to do business with them.

“[Carriers] have to want to work with you. It has to be easy to do business,” said Justin Frees, chief capacity officer of Arrive Logistics, a fast-growing freight broker based in Austin, Texas. “If it is not seamless, easy and efficient they can go somewhere else.”

Arrive Logistics recently added a portal for carriers to book loads and make offers to streamline freight transactions.

Arrive Logistics recently added a portal for carriers to book loads and make offers to streamline freight transactions.

The company also has book it now features through integrations with the major freight marketplaces.

“We are trying to bring together a platform that makes it easier and more efficient for everyone to do business with us,” said Michael Senftleber, chief technology officer at Arrive.

Arrive also recently integrated with Triumph Pay’s payment processing platform. Any carrier that wants to use a Quick Pay option to receive a two-day payment for a 2% fee can do so through Triumph Pay’s platform, along with having visibility to receivables from other shippers and freight brokers they do business with.

“This is another place for us to meet carriers where they are,” Frees said of the Triumph Pay integration.

Editor’s note: Click here to download the MIT CTL paper authored by Angela Acocella, “Elephants or goldfish?: An empirical analysis of carrier reciprocity in dynamic freight markets.”