CCJ Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

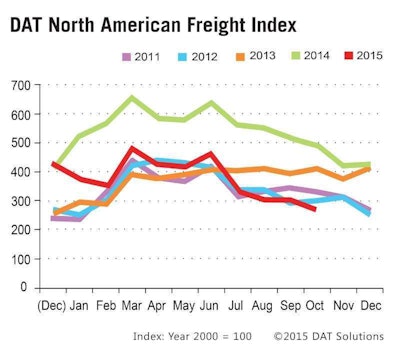

Freight volume drops on spot market: The amount of freight available on the spot market last month fell 9.7 percent from September, according to DAT’s monthly North American Freight Index. October’s freight volume was also down 44 percent from October 2014 — a record-setting month in a record-setting year. Year-to-date, however, spot market freight volume is up, DAT says.

Available van freight fell 13 percent, DAT reports, while reefer fell 16 percent and flatbed fell 4.5 percent. Line haul rates followed suit, dropping a few percentage points in each segment, DAT says.

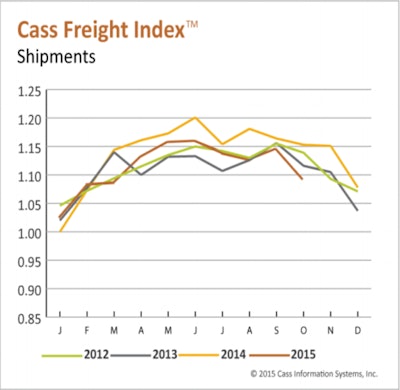

More on October freight: Cass chalks October’s tumble in freight shipments and freight expenditures to seasonal trends, saying 2015 followed the same line seen in the previous four years. But, Cass reported in its monthly freight indices, freight shipments hit their lowest point since October 2011. “Bloated inventories,” it said, has put pressure on imports and domestic manufacturing, slowing U.S. freight movement. Cass expects the trend to continue, as retail and wholesale inventories are already “ample…for the holiday season.”

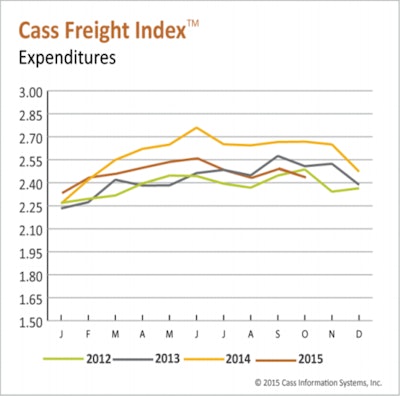

Meanwhile, freight expenditures fell partially due to the freight slowdown in the month, but also because spot market rates continue to sag. Freight expenditures in the month fell 8.7 percent from last October:

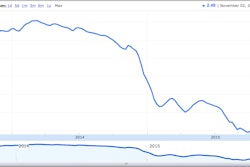

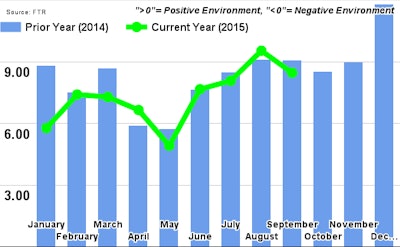

Trucking Conditions dip, should improve in ’16: FTR’s monthly Trucking Conditions Index, a measure of market conditions for trucking companies, fell slightly in September from August’s reading, and it’s expected to continue to slide the rest of the year, FTR says. However, expect the index — and rates — to climb in 2016 as freight picks up and capacity tightens, FTR says.