Click here to download the full copy of CCJ’s 2015 Trucking Outlook report.

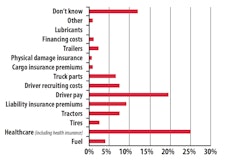

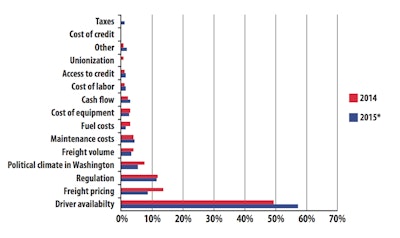

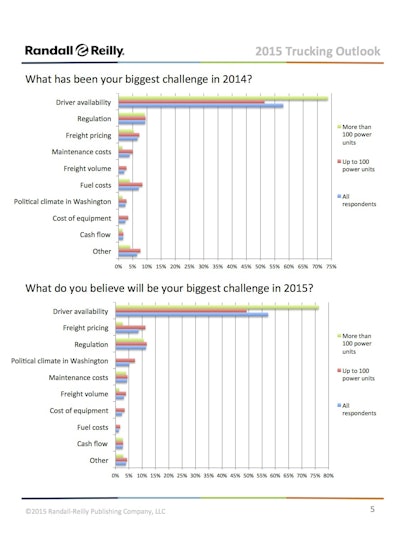

Rankings of carriers’ top concerns for 2015, according to CCJ’s annual readership survey.

Rankings of carriers’ top concerns for 2015, according to CCJ’s annual readership survey.But 2014 wasn’t without its own challenges. The hours-of-service rules that took effect in July 2013 crimped fleet productivity anywhere from 3 to 5 percent. Infrastructure issues and increased congestion on America’s highways also took bites out of an otherwise great year. A recent study by the American Transportation Research Institute said trucking companies lost 141 million hours of productivity in 2013 as a result of congestion on the nation’s Interstate system, amounting to about $9.2 billion in lost revenue and the equivalent of 51,000 truck drivers being idle for one year.

While infrastructure and congestion issues were still a challenge last year and will remain so in 2015, the rollback of the HOS provisions as part of the latest spending bill that halts two requirements – that a 34-hour restart must contain two consecutive 1-5 a.m. periods and the restart must be limited to once per week – should allow carriers to recoup some of the resulting productivity losses experienced in the last year and a half. But the driver shortage and the impact of new and forthcoming regulations both threaten to erode fleet profitability.

Mixed emotions

Industry analysts unanimously are bullish on their outlooks for the trucking industry this year. According to FTR’s Trucking Conditions Index for October, “market fundamentals remain strong for carriers as we approach the end of 2014,” said Jonathan Starks, FTR’s director of transportation analysis. “Our expectations for the TCI are for it to remain at its current high level throughout 2015, as we continue to see a very positive market for fleets and drivers for at least the next year.”

Click here or the photo to download the full copy of CCJ’s 2015 Trucking Outlook report.

Click here or the photo to download the full copy of CCJ’s 2015 Trucking Outlook report. FTR isn’t alone in its optimism for 2015. When asked to assign a letter grade to the trucking industry’s prospects this year, both Donald Broughton, managing director and senior research analyst for Avondale Partners, and Jim Meil, principal of industry analysis for ACT Research, gave it an “A” without hesitation. Bob Costello, chief economist and senior vice president at ATA, gives it a “B,” noting it would likely be an “A” if the economy were growing at a 3.5 percent rate rather than his forecasted 2.7 percent rate in 2015.

Strong order activity for Class 8 trucks echo analysts’ positive outlook. In October, truck orders hit their second-highest level ever and remained strong in November, but FTR notes that most order activity is replacement rather than additional capacity as carriers chase better fuel economy, lower maintenance costs and improved driver recruiting.

Higher Class 8 truck order activity “will continue into next year, but won’t last forever,” says Broughton, citing the strong correlation between tonnage and truck orders. “[The industry] has some work to do to bring the average age of fleets down. Coming out of the recession, large fleets are going from five-year to four-year trade cycles, and now four-year to three-year trade cycles.”

Despite the uniform optimism from analysts and favorable indicators, carrier sentiment about prospects for 2015 swings wildly, according to open-ended responses to Commercial Carrier Journal’s 2015 Economic Outlook survey.

“We feel that there is still uncertainty in the economy moving forward,” said one respondent for a large for-hire carrier. “Capacity has not tightened as expected, drivers are still very hard to come by, and the political environment changes from day to day. Overall, we feel 2015 should be better than 2014, but we are cautiously optimistic.”

Here is a look at the top four concerns for carriers heading into 2015 based on 411 respondents to the CCJ 2015 Economic Outlook survey.