The best description for much of the freight transportation system heading into 2015 is “turmoil,” but despite – or perhaps, in some ways, because of – several significant challenges to freight movement, rates could grow by double-digits next year, according to economist Rosalyn Wilson.

Wilson’s explanation and outlook comes from her update to the 25th Annual “State of Logistics Report,” presented this week in a conference call hosted by Stifel Capital Markets.

The congestion at the ports deteriorated over the month of October and has reached “crisis proportions,” particularly at the Ports of LA/Long Beach, which handle more than 40 percent of all U.S. ocean imports and a “disproportionately large” percent of consumer goods – the very goods that are supposed to be stocking shelves for the upcoming holiday buying season, explained Wilson, senior business analyst with Parsons.

“Everyone is feeling the effect of a three-week delay now at the Port of LA/Long Beach,” she said.

The underlying problem is primarily supply: Trucks, especially drayage trucks, are hard to come by and the profitability of that segment continues to fall because of the decreasing number of turns they can make.

The ports of NY/NJ and Norfolk are also experiencing congestion problems, though not as severe as LA/Long Beach, Wilson noted.

The issue is that new, larger container ships bring more cargo in a condensed time frame and there is not enough equipment available to handle the surge, and this is particularly true of chassis.

“Truckers are waiting hours in line to pick up a container, only to find that no chassis is available to move the container out of the port.,” Wilson said. “And because of hours-of-service, that pretty much makes the day a total loss.”

The lack of an ILWU contract is contributing to the slowdowns on the West Coast as communication between parties has “degenerated to trading barbs in the media.”

Also contributing to the turmoil, transportation supply and demand are out of balance throughout the country, the result of a production/consumption imbalance that is “stranding” equipment in some areas and causing truck shortages in others.

Wilson

Wilson“Repositioning is becoming a big issue,” Wilson said, adding this is an expected consequence of the economic recovery – only one that has been slower in coming than she and other economists had anticipated.

Indeed, “the economy is still strengthening, with growth in areas that are good for the freight,” she said. “I see nothing but good things in the future.”

Among the good news in the economy:

- Residential construction was up 6.3 percent in September.

- Consumer sentiment has also reached a seven-year high due to drops in gas prices and labor market gains.

- The unemployment rate, which was 7.2 percent at this time last year, is now at 5.8 percent.

“I’m fairly positive that we’re not going to end 2014 with a big drop like we’ve seen in the last three years,” Wilson said. “The economics of supply and demand are going to come into play. Everybody should be expecting rates to continue to move up more quickly in the coming months. I do not think that 8 to 10 percent increases by the end of the second quarter are out of the question.”

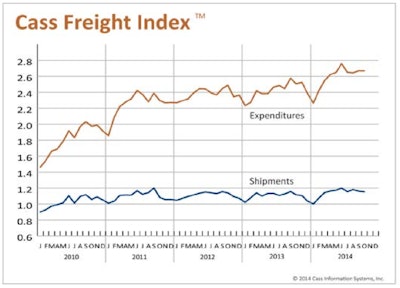

Wilson also provides insight for the monthly Cass Freight Index report (Slide 2).

On the shipment activity side, the overall number of shipments fell another 0.9 percent from September to October, according to the latest report. On a year over year basis for October, the number of shipments is 3.3 percent higher than levels in October 2013. (Slide 3)

The October freight payment index rose 0.1 percent, somewhat lower than the 0.8 percent rise the previous month. October freight expenditures were 6.4 percent higher than the corresponding month a year ago and 11.8 percent higher than December 2013, according to the report. (Slide 4)

“Freight rates are finally starting to move and shippers are pushing back, but in most cases they have no choice but to accept the rate hikes due to parallel capacity issues,” Wilson says. “Most of the small parcel carriers have announced substantial rate increases in advance of the holiday season. With the scarcity of equipment and drivers, rates have only one way to move.”