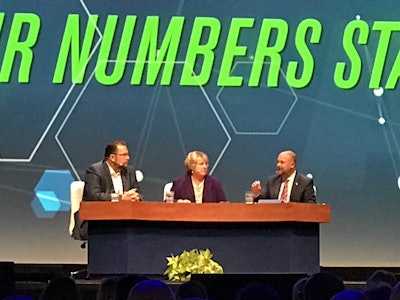

Werner Enterprises’ Derek Leathers, ATRI’s Rebecca Brewster and ATA chief economist Bob Costello discuss freight conditions, the driver shortage and trade policy at the 2017 American Trucking Associations Management Conference & Exhibition.

Werner Enterprises’ Derek Leathers, ATRI’s Rebecca Brewster and ATA chief economist Bob Costello discuss freight conditions, the driver shortage and trade policy at the 2017 American Trucking Associations Management Conference & Exhibition.Trucking conditions continue to improve in the final half of 2017. Bob Costello, chief economist for the American Trucking Associations, said that while the forecasted growth for loads in 2017 is 2.5 percent compared to last year, loads in the last five months has grown at a 4 percent pace. Leading the way during that time is temperature-controlled segment with an 11.6 percent increase, followed by 1.1 percent for dry van, tanker (2.1 percent), flatbed (1.4 percent) and dry van (1.1 percent).

Some of that growth has come at the expense of the less-than-truckload segment, which is forecast to grow at just 1.1 percent in 2017 after a 0.7 percent decline in 2016. “While truckload hauls more manufacturing product, it’s also now a higher percentage of the LTL business, and that has hit LTL fleets,” said Costello, during an economic panel presentation at the American Trucking Association’s 2017 Management Conference & Exhibition in Orlando.

Fellow panelist Derek Leathers, president and CEO of Werner Enterprises, said right-sizing inventory levels has played a part in improving trucking conditions. “Inventories have been right-sized into a new normal that created tighter supply chains,” said Leathers. “More retailers are now looking forward to peak season and the demand is real.”

Driver pay is increasing as market conditions improve, and driver-related costs have replaced fuel costs as the number-one cost per mile, said Rebecca Brewster, president and COO of the American Transportation Research Institute.

Driver turnover increased to 90 percent in the second quarter of 2017, indicating the driver market is heating up again, said Costello. The current level of 864,000 professional tractor-trailer drivers active in the for-hire trucking industry is roughly 50,000 short of what the industry needs to meet current freight demand, an all-time high.

“If things don’t change, from where we are today, by 2026 the industry will be short by 174,000 drivers,” said Costello.

Leathers said low wages and a lack of respect contribute greatly to both turnover and the driver shortage. “We ought to be paying folks and taking care of them every way we can and stop the [turnover] merry-go-round of sign-on bonuses,” said Leathers.

The driver shortage comes at a time when construction has added 1.3 million jobs in the last five years. To keep pace with projected freight demand, Costello said trucking will have to attract 900,000 new drivers to the industry in the next 10 years.

“The real issue we are faced with is a ‘quality’ driver shortage, those that can meet the quality expectations we all have,” said Leathers. In 2017, Werner has received more than 100,000 driver applications but has hired at a rate of 2.7 percent. “There is a larger population than ever of people that aren’t meeting industry criteria.”

Another threat, said Brewster, is the aging workforce in the trucking industry. Citing ATRI research, Brewster said 57 percent of drivers are 45 or older. “The challenge for us is we have just 4.4 percent of our workforce in the 20- to 24-year-old age bracket,” she said. “We are not bringing in young people to this industry in the numbers and volumes we need to.”

Leathers said the industry needs to create more awareness for young people entering the U.S. workforce before they turn 21.

“We have to stay diligent to make young people think about trucking as a viable alternative,” said Leathers. “We need to get at the secondary level to attract and retain the best and brightest individuals not going down a college career path,” suggesting a graduated CDL program that would allow under-21 drivers to start careers in trucking before they find jobs in other industries.

In addition to the driver situation, potential changes in U.S. trade policy could negatively impact trucking operations. Costello said U.S. truck-transported trade with NAFTA partners Mexico and Canada totals $6.5 billion and 12 million border crossings per year.

Since NAFTA took effect in 1995, Costello said surface trade with Canada has increased 70 percent with Canada and 372 percent with Mexico.

Costello said the notion that NAFTA has resulted in a loss of U.S. manufacturing jobs to Mexico is largely a misnomer. “There is no doubt that some of that has gone on, but it is more complex than that,” he said, adding the United States added half a million jobs in the manufacturing sector from 1994 until 2000. “In 2000, China joined World Trade Organization. From 2000 to 2007, we lost 3.9 million jobs. Mexico gets a lot of unfair blame in all this.”

Leathers is cautiously hopeful the current focus from the Trump administration on renegotiating NAFTA will lead to new opportunities for trucking. “As long as we are looking to remodel the house and not do a teardown, then this process has promise,” he said. “But the confluence of economic reality and political rhetoric can be messy.”