CCJ‘s Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

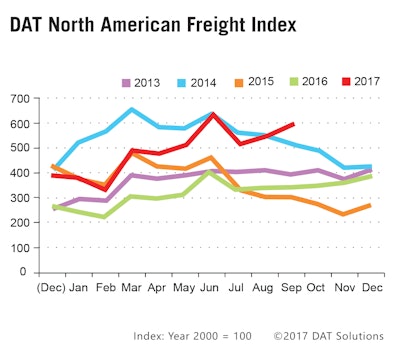

Available loads on DAT’s loadboard were 74 percent higher than the same month last year, DAT reported.

The dry van segment in particular saw major gains, with freight activity climbing 15 percent from August and up 80 percent from September 2016. Rates, meanwhile, gained 19 cents a mile from August and were up 35 cents from last September, DAT reported. The load-to-truck ratio hit 6.6 to 1 — the highest average in 8 years.

Reefer demand grew 4 percent from August and 70 percent from last September, pushing rates up 15 cents from August. DAT says harvest season in the pacific northwest and upper midwest, as well as late harvests in California, drove the segment’s surge.

The number of flatbed loads grew 3 percent from August. Though flatbed freight activity typically declines in September, recovery and rebuilding efforts in storm-stricken areas helped boost the segment this year, DAT says. Rates in the segment climbed 8 cents in September.

DAT says it expects the elevated spot market activity to continue at least until February.

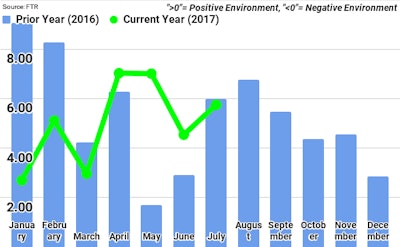

Though market tightness has prompted a flutter of spot market activity in recent months — and driven rates higher on the spot market — such capacity constraints have yet to affect the contract pricing market, on which FTR bases its monthly index. Likewise, disruptions from major hurricanes Harvey and Irma will affect industry capacity and rates, but those changes won’t be seen until FTR releases its September reading.

“The truck market is currently in the middle of a significant change in conditions,” says FTR Chief Operating Officer Jonathan Starks. “While the recent weather events made it feel like it happened all at once, spot markets have actually been moving in this direction for the past year. Load activity was rising, truck availability was falling, and rates were already up 20 percent year over year before the storms hit. Spot market rates are a leading indicator. And, although there is a lag, contract markets are starting to follow suit. Shippers are now taking notice and are getting worried about dealing with double-digit rate increases as we head towards bid season.”

FTR bases its index reading on a variety of key market factors affecting trucking companies, including freight volume, freight rates, fleet capacity, fuel prices, fleet bankruptcies and more.