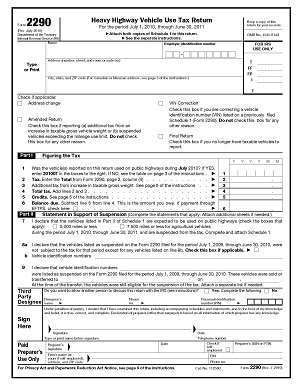

J.J. Keller & Associates once again is assisting carriers with the filing of their IRS Heavy Vehicle Use Tax through its online service, 2290online.com. The Internal Revenue Service mandates electronic filing of Form 2290 for companies with 25 or more motor vehicles over the 55,000-pound weight limit. However, any company with heavy vehicles can file electronically.

J.J. Keller says its 2290online.com enables users to e-file their 2290 information anytime, from anywhere. The system is designed to allow for centralized tax filing and issues e-mail reminders of annual filings; companies with multiple locations can maintain a simple repository of tax data and filing history, and multiple account management is available for third-party filers.

The site is designed for step-by-step navigation for data entry or import of vehicle data. J.J. Keller says the user can expect an electronic stamped Schedule 1 typically within 24 hours of filing.

“Since we launched the site in 2009, 2290online.com has helped over 15,000 carriers file their HVUT,” says Rustin Keller, vice president of business services. “Filing online through 2290online.com is a simple, quick and secure method that enables carriers of all sizes to stay compliant.”