Don’t count on another 2004 or 2005, but a steady economic recovery and ongoing capacity constraints could make 2011 a good year.

Coming out of the Great Recession, just about any improvement in or even leveling off of business conditions feels like good times. For many trucking companies, 2010 was a transition year that started out almost as badly as 2009 – one of the worst years ever – but improved by the second quarter. As the year wore on, however, the recovery’s pace seemed to slow. “We have seen a slowing of our business since we had our highest volumes in June,” says Clifton Parker, president of Gaston, S.C.-based G&P Trucking.

In 2011, most analysts see the economy gradually returning to something approximating what we have come to think of as normal. Meanwhile, trucking operations are only just beginning to put idled trucks on the road and adding to their fleets, and the industry faces continued constraints on capacity, including a driver shortage and a greater focus on safety and compliance through the Federal Motor Carrier Safety Administration’s new Compliance Safety Accountability (CSA) initiative. As freight demand strengthens in 2011, the trucking industry’s survivors should enjoy the pricing and profitability benefits of all downsizing that occurred in 2008 and 2009.

“It will be A ‘Tale of Two Cities,’” says Donald Broughton, managing director and transportation analyst for Avondale Partners. With housing and employment weak and credit markets still mostly frozen, 2011 will start out as more of the same. As those factors improve, however, and trucking capacity holds steady, things will start to look very different. “By the end of the year, truckers will have the opportunity to capture the strongest pricing power in recent history.”

“I think it will get quite a bit better than we have seen in the past three or four years,” says John Larkin, managing director and transportation analyst for Stifel, Nicolas & Co. “That will become evident around the end of the second quarter.”

Many carriers are similarly upbeat, especially in light of CSA. “We are very bullish on 2011,” says James Towery, president of Springfield, Mo.-based flatbed carrier Steelman Transportation. “We have survived and now we are out selling on safety record, performance and stability.”

Not all carriers are so optimistic, but almost everyone sees that the greatest benefits will be on the capacity side, not demand. “I expect freight demand to grow somewhat faster than the supply of capacity, tightening things up a bit,” says Brian Kinsey, president of Lithonia, Ga.-based Brown Trucking Co. “But it will still not be robust either way.” Gary Salisbury, president of Hope, Ark.-based flatbed carrier Fikes Truck Line, sees a similar dynamic. “Freight volumes on a whole will remain flat,” he says. “However, because of a driver shortage, demand for truck capacity will continue to grow. I do see the overall economic picture improving throughout 2011.”

Starting out slowly

The last time the trucking industry enjoyed widespread boom times – roughly 2004 through 2006 – carriers benefitted from both strong freight demand and tight capacity. Consumer spending was high, and the housing market was surging, generating strong demand for construction materials and home furnishings.

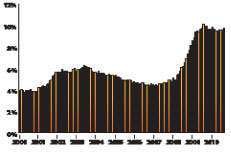

Manufacturing Activity: Above 50, manufacturing sector is growing

Manufacturing Activity: Above 50, manufacturing sector is growingAlthough the recovery is still young, this time around the freight market isn’t nearly as hot, at least not yet. Gross Domestic Product (GDP) likely will rise 2 percent or just slightly higher in the first half, growing to around 3 percent by the end of 2011, says Bob Costello, chief economist for the American Trucking Associations. By comparison, GDP growth was 3.6 percent in 2004 and 3.1 percent in 2005.

“The fourth quarter of 2010 is better than I thought it would be,” Costello says, adding that the job market is outpacing his expectations slightly. “There still are some headwinds – housing and the credit situation, which while improving is still not good.” The recent tax credit for buying a house expired in April, and it appears that it didn’t generate new demand but rather just pulled forward future demand, he says.

“The downside risks are starting to fade,” says Eric Starks, president of freight transportation forecasting firm FTR Associates. Housing doesn’t look to improve, but it’s not getting worse, he says. “It’s unlikely that the housing market will unfreeze in the first quarter, but it could accelerate in the second half.” Meanwhile, personal income levels are starting to firm up, and the bleeding in employment levels has stopped.

“The consumer is still holding back for the most part on spending,” Starks says. “If consumers want to go out there and spend, they finally have some cash.” Meanwhile, there are upside opportunities in the form of strong manufacturing demand, low inventory levels and pent-up business demand for equipment and parts replacement, he says. “As things start to improve, people will start upgrading. Businesses out there are flush with cash.” Freight is choppy now, Starks says, but he sees demand trending upward in the second half of 2011.

Costello also expects noticeable improvements in the economy and freight market to come in the second half of 2011. Manufacturing likely will continue to be strong as the segment continues to benefit from a relatively weak dollar. There’s also pent-up demand, especially among businesses, he says. “We’re not producing a lot of consumer goods here. It’s the higher-value, more complicated technology that’s driving manufacturing.”

Broughton agrees that a surge in consumer spending isn’t essential to get the economy going. “This is a recovery that will be led by exports and domestic manufacturing and assembly.” That rebound is driven largely by a relatively weak dollar, low interest rates and aggressive growth in the money supply. And even for consumers, the outlook is changing, he says. The unemployment rate is a lagging indicator because businesses tend to stretch current labor resources in the early stages of a recovery. “From here I expect the trend to be incrementally more positive on job creation and the unemployment rate.”

Another strength some see for the economy is the amount of cash available for investment once Corporate America decides it’s ready to spend. Banks alone have built up more than a trillion dollars in reserves since the financial crisis of September 2008, when they practically stopped lending and the federal government started pumping hundreds of billions of dollars into the system.

“If banks start disseminating cash, that will be a good thing,” Starks says. At least that’s true in the short-term. In the longer run, it could add to inflationary pressures, which in turn could force interest rates higher and erode consumers’ buying power. “We’ll worry about that after we get out of this mess.” In the near term, inflation simply isn’t a worry because of the weak housing market and high unemployment.

What might get banks and corporations to start spending? Larkin thinks it will be “renewed confidence on the part of the private sector that we have seen the worst of the anti-business regulation sentiment in Washington. Perhaps that will loosen up the purse strings of people who have been sitting on the sidelines.”

Starks does see one real worry for recovery: The European financial crisis. “That’s not a good picture,” he says. “If it turned ugly, that could change things significantly.”

Barring a shock like that, FTR projects freight growth in 2011 in all major segments except refrigerated, which the firm believes will be flat with the possibility for growth if the jobs picture improves. The dry van market will still be fairly healthy with 3.5 percent growth, Starks says. The same goes for the tank/bulk market. Flatbed should grow about 7 percent off what has been a low base due to improvements in steel markets, highway construction and the beginnings of a housing recovery, he says.

All about capacity

Going into 2011, the trucking industry is smaller than it was at the end of the last boom period. The truckload segment has already lost 20 percent of its capacity from the peak, Larkin says. About two-thirds of that is due to carriers getting smaller, and only about a quarter was due to failures, he says.

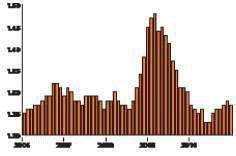

Inventory to Sales Ratio: Total business, seasonally adjusted

Inventory to Sales Ratio: Total business, seasonally adjustedSo what happens when sustained freight demand does return? “We got a glimpse of the future back in the spring,” Costello says. Carriers during that brief period were finding it harder to cover loads and find drivers. “But then the economy went sideways.”

When the economy is more firmly on the rebound, carriers should achieve better financial performance. “There is no doubt that we have seen an historic drop in supply,” Costello says. “We need a further improvement in demand or reduction in supply.”

“We are continuing to see things constrained,” says Starks. Carriers seem more interested in rate increases than in adding trucks, which are expensive and require more drivers. CSA will be a constraint as government and tort liability concerns force carriers to be more selective on drivers, he says.

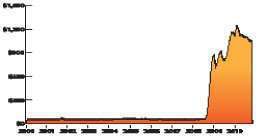

Diesel Prices: Nationwide average. Two wildcards in the trucking outlook for 2011 are where diesel prices will go and what banks and the rest of Corporate America will do with the massive reserves of cash. Diesel prices have increased gradually over the past couple of years but have risen more rapidly in the fourth quarter of 2010. Another surge like the one in 2008 could put many weak carriers out of business. Meanwhile, since the financial crisis of September 2008, banks have hoarded cash even as the federal government has pumped hundreds of billions of dollars into the system.

Diesel Prices: Nationwide average. Two wildcards in the trucking outlook for 2011 are where diesel prices will go and what banks and the rest of Corporate America will do with the massive reserves of cash. Diesel prices have increased gradually over the past couple of years but have risen more rapidly in the fourth quarter of 2010. Another surge like the one in 2008 could put many weak carriers out of business. Meanwhile, since the financial crisis of September 2008, banks have hoarded cash even as the federal government has pumped hundreds of billions of dollars into the system.For Costello, there are two types of driver shortages that can occur: quality shortages and quantity shortages. A quality shortage exists today, but a quantity shortage of some degree is coming, he says. How large of a shortage? “There are too many unknowns right now. Nobody can say how many drivers will be lost.” But regardless of the timing, Costello is confident drivers are destined to be in short supply.

CSA’s potential impact goes beyond driver availability, says Broughton. The new regime is already digging into productivity as proactive carriers install electronic onboard recorders (EOBRs) as a way to avoid log violations. As FMCSA forces more carriers to use EOBRs through enforcement, productivity will suffer, reducing effective capacity.

Another factor that eventually will affect driver productivity will be the new hours-of-service regulations, Broughton notes. “I see more trailers, more relays and fewer trucks per dispatcher because dispatchers will have to think a couple of chess moves ahead.” Changes in hours of service won’t have much of a direct impact – if any – in 2011 because FMCSA likely won’t issue the rule until July, and there will be some time lag until implementation. But just the fear of upcoming changes in the rules could make shippers more willing to listen to carrier demands for a higher rate or greater flexibility on delivery schedules, Broughton says.

Bank Reserves: In billions

Bank Reserves: In billionsLarkin sees similar capacity-constraining benefits and adds to it upcoming measures that will make it harder for illegal aliens to get commercial drivers’ licenses. “I don’t see any way that transportation capacity will respond that quickly,” Larkin says. “Good shippers are building price increases into their budgets.”

Aging equipment – some of which was cannibalized for parts during the downturn – could be another constraint on capacity. For many carriers, trucks are beyond their economic life, but equipment is too expensive or credit too tight for them to renew their fleets.

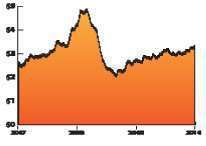

Unemployment Rate: Some of the strengths for trucking going into 2011 are lean inventories relative to sales, setting the stage for more transportation activity, and a strong manufacturing market as signified by a manufacturing sector that has been in expansion since August 2009, according to the Institute for Supply Management. But there are headwinds as well, including high unemployment that constrains consumer spending and a housing market that refuses to rebound from the bottom.

Unemployment Rate: Some of the strengths for trucking going into 2011 are lean inventories relative to sales, setting the stage for more transportation activity, and a strong manufacturing market as signified by a manufacturing sector that has been in expansion since August 2009, according to the Institute for Supply Management. But there are headwinds as well, including high unemployment that constrains consumer spending and a housing market that refuses to rebound from the bottom.But suppose a carrier could swing not only replacing aging trucks but adding a few to its fleet. “Until you can get trucks that can drive themselves, an additional truck does you no good,” Costello says.

In a survey last month of more than 60 senior trucking executives, CCJ found that 44 percent expect to grow their fleets in 2011. But half of all carriers surveyed plan to add owner-operators, which suggests that many expect to grow by adding existing capacity.

Most talk of capacity is in the truckload market, which is most susceptible to swings in driver availability. But the less-than-truckload (LTL) market has its own capacity issue, and the proverbial – perhaps literal – elephant in the room is YRC Worldwide, whose imminent demise has been predicted for several years now. “If they go out of business or get dramatically smaller, it could go a long way to absorbing the excess capacity in LTL,” Larkin says.

A year ago, Broughton said he would be flabbergasted if YRC was still in business by April 1, 2010. He was wrong on the date, but his assessment hasn’t changed. “I am flabbergasted that YRC still exists and will continue to be flabbergasted until I’m right.”

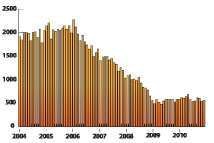

Housing Starts: Seasonally adjusted annual rate, in thousands

Housing Starts: Seasonally adjusted annual rate, in thousandsLTL as well as intermodal and dedicated could reap some benefits from capacity constraints in truckload as early as the second quarter, Larkin predicts.

Unbalanced benefits

While a rising tide lifts all boats, the rebound in 2011 stands to benefit larger carriers more than smaller ones, analysts say.

“The bigger will continue to get bigger,” Broughton says. He sees continued consolidation not only through acquisition but also through lease agreements. One solution to many of the financial and regulatory pressures on smaller carriers is to sign a contract with a Schneider or Werner to become an owner-operator fleet, Broughton notes.

“The situation creates almost a perfect positive storm for the bigger carriers,” Larkin says. Those trucking companies are already installing EOBRs, and they generally know to recruit drivers better. And they can deal better with brokers and have the financial resources to keep their fleets up to date, he says.

But large or small, carriers that have made it to 2011 stand to do much better. “The real story is the supply side,” concludes ATA’s Costello. “We could lose some capacity because of potential government regulations. In the second half of the year, we will be on the cusp of some of the best years in trucking.”

Trucking executives echo that sentiment. “If we don’t shoot ourselves in the foot on pricing, 2011 could be a really good year, says Patrick Gault, president of Patrick Transportation Co., a small trucking company based in Philadelphia. “But if everyone increases capacity and goes out to cut rates to keep them running, we have gained nothing.”

2011 at a glance

Higher demand

• Stronger manufacturing

• Lean inventories

• More jobs

• Renewed tax relief

Tighter capacity

• CSA

• Electronic onboard recorders

• Cost of new equipment

• High fuel costs

TOP CHALLENGES IN 2011

Driver availability — 32%

Pricing — 24%

Driver pay — 8%

Volume — 14%

Regulation — 8%

Other — 14%