Port of Oakland

Port of OaklandEven as labor issues remain unresolved, import cargo volume at the nation’s major retail container ports is expected to see a final surge and set a new monthly record in October as the holiday season approaches, according to the monthly Global Port Tracker report by the National Retail Federation and Hackett Associates.

“Increasing congestion at the nation’s ports as well as the ongoing West Coast labor negotiations are ongoing concerns and retailers are making one last push to make sure they’re stocked up for the holidays,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold says. “Retailers are working hard to make sure customers can find what they’re looking for regardless of what happens at the ports.”

Import volume at U.S. ports covered by the Global Port Tracker report is expected to total 1.53 million containers this month, topping the 1.52 million monthly record set in August.

Cargo volume has been well above average each month since spring as retailers have imported merchandise early in case of any disruption on the docks, NRF notes.

The contract between the Pacific Maritime Association and the International Longshore and Warehouse Union expired on July 1, prompting concerns about potential disruptions that could affect back-to-school or holiday merchandise. Dockworkers remain on the job as negotiations continue but the lack of a contract and operational issues have led to record congestion at the ports, prompting NRF last week to write a letter to both sides, urging a “successful and speedy conclusion” to the negotiations.

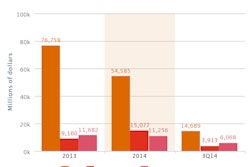

The 1.52 million Twenty-Foot Equivalent Units handled in August, the latest month for which after-the-fact numbers are available, was up 1.5 percent from July and 2.1 percent from August 2013. One TEU is one 20-foot cargo container or its equivalent.

September was estimated at 1.48 million TEU, up 2.8 percent from the same month last year, and October’s forecast of 1.53 million TEU would be up 6.4 percent from last year. November is forecast at 1.39 million TEU, up 3.7 percent, and December at 1.37 million TEU, up 3.9 percent.

Those numbers would bring 2014 to a total of 17.1 million TEU, an increase of 5.3 percent over 2013’s 16.2 million. Imports in 2012 totaled 15.8 million. The first half of 2014 totaled 8.3 million TEU, up 7 percent over last year.

The import numbers come as NRF is forecasting 4.1 percent holiday season sales growth and 3.6 percent growth for 2014 overall.

Cargo volume does not correlate directly with sales but is a barometer of retailers’ expectations.

“The consumer is back,” Hackett Associates Founder Ben Hackett says, citing reduced unemployment, improved consumer confidence and other indicators. “That’s all good news for retailers, ports and shipping lines.”