The U.S. Senate this week began debating how to fund surface transportation programs, ahead of the expected Thursday release of a multi-year federal plan. Collegial pledges of bipartisanship, however, don’t pay the bills.

“The bottom line is that you can’t have a big-league quality of life or big-league economic growth with little-league infrastructure,” said Senate Finance Committee Chairman Ron Wyden, opening the Tuesday hearing on fixing the failing Highway Trust Fund. “It’s important not to punt investments further into the future. Maintaining a good-quality road is cheaper than rebuilding a failing one – especially while interest rates are low – and it’s tougher to invest in new transportation projects if the country’s roads and highways are falling into disrepair. The price tag for a strong national infrastructure will only grow in the future, so it’s time to get to work.”

The trust fund faces insolvency late this summer due to a revenue shortfall that will force states to either to make up the difference or effectively cut thousands of jobs. The American Association of State Highway and Transportation Officials has said at least 6,000 projects across the country could be halted due to the shortfall.

The White House recently presented its four-year, $302 billion plan to Congress, making up for the projected funding gap largely with a loosely defined corporate tax reform plan, aimed at profits being banked overseas.

But finance committee Republicans question whether such reform is the proper solution.

“Make no mistake, I believe we should have a robust discussion as to how our tax system should deal with overseas earnings,” said Finance Committee Ranking Member Orrin Hatch. “However, given the economic implications of any changes to this system, that discussion should take place in the context of a broader debate about tax reform, not as part of an ad hoc effort to pay for a highway bill.”

Hatch supports preserving the traditional user-pays system and doesn’t want federal infrastructure programs to become another “tax extender” dependent on cash infusions from the general fund every year or two.

Hatch called for a “complete examination” of the spending side of the equation, taking particular aim at the use of trust fund revenue to pay for “an increasingly broad scope of activities” such as bike paths. He also noted the “many requirements and regulations” that increase the costs of federal highway projects.

The trust fund shortfall is projected to be $18 billion in the coming fiscal year, and $13 to $18 billion though 2024, based on current spending levels, according to Dr. Joseph Kile of the Congressional Budget Office.

The formula for solving the problem is straightforward, Kile explained to the committee: reduced spending by 30 percent or so, increase revenue (each 1 cent increase in the gasoline tax would raise $1.5 billion) or use money from the general fund.

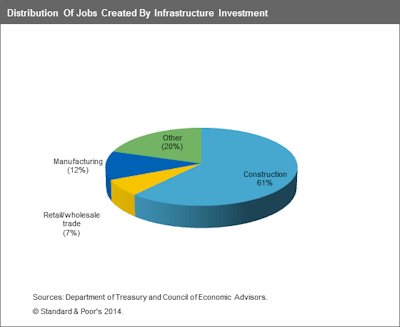

Other panel witnesses discussed the use of private capital to make up the deficit, with as much as $200 billion available, according to Jayan Dhru of Standard & Poor’s.

S&P graphic

S&P graphicA new S&P report shows that a $1.3 billion investment in 2015 would likely add 29,000 jobs to the construction sector and will add even more jobs to other infrastructure-related industries. That investment would also likely add $2 billion to real economic growth and reduce the federal deficit by $200 million for that year.

Foxx answers to Finance committee

The Senate Committee on Commerce, Science, and Transportation followed up Wednesday with a reauthorization hearing of its own.

Chairman Jay Rockefeller said the nation has “gotten into a rut,” and no longer dares to dream and lead when it comes to building “the greatest bridges, interstates, tunnels, canals, ports and railways.”

“We’re unable to pass long-term funding transportation bills rooted in bold ideas. Instead, we’re now focused on the nickels and dimes of our deficit – and mainly because of the high political costs associated with proposing any kind of revenue increase,” Rockefeller said. “Collectively, Congress has shown neither the will nor the courage to put aside differences and work to find a long-term solution.”

The remarks were a toned-down version of his speech at the finance committee hearing the day before, which he recalled as being “terrific” and which gained some media attention for its sharp attack on members of Congress generally– and Republicans particularly.

In it he berated politicians for being afraid to “do anything which displeases the voters.”

Sens. Jay Rockefeller, left, and John Thune lead the Senate Committee on Commerce, Science, and Transportation as Congress looks for ways to fund transportation programs.

Sens. Jay Rockefeller, left, and John Thune lead the Senate Committee on Commerce, Science, and Transportation as Congress looks for ways to fund transportation programs.“I understand part of it. For some, it’s just we don’t want anything good to happen under this president, because he’s the wrong color,” Rockefeller said.

Sen. John Thune, ranking member of the commerce committee and a former transportation committee member on the House side, said he was “skeptical” about the White House tax reform plan.

As had Hatch, he noted that it fails to provide a long-term solution to the trust fund shortfall.

And Sen. Barbara Boxer, chairman of the Environment and Public Works Committee put in an appearance as well, promising to deliver her committee’s reauthorization bill on Thursday.

“It’s fiscally conservative in the sense that it’s current spending plus inflation,” Boxer said.

The only witness before the commerce committee was Transportation Secretary Anthony Foxx, who defended the administration’s transportation plan. Foxx explained that the “pro-growth” tax reform would fully fund the bill and provide an additional $90 billion in funding over the next four years – and that spending “will support millions of jobs.”

“We believe there’s room for agreement here – not just on bipartisan reforms, but on funding, too,” Foxx said. “For more than half a century, Congress has consistently recognized that as America grows, so must our investment in transportation. In almost every case, each new transportation authorization has increased investment by almost 40 percent. And Congress passed them with broad, bipartisan support in both houses. I see no reason why Congress can’t do so again.”

Questions from senators, however, were focused more on DOT policies than funding infrastructure, as several asked – repeatedly – about the department’s handling of the Chevrolet recall and about recent derailments of trains carrying crude oil.

Trucking issues came up as well.

Regarding the administration’s plan to remove the prohibition from tolling Interstates, Foxx emphasized the states would have to develop any such tolling program and the proposals will have to be evaluated and approved by DOT.

He dodged the question from Sen. Deb Fischer who asked whether the administration was concerned about the impact of Interstate tolling proposal on small-business truckers.

And Foxx was evasive when asked by Thune about the administration’s reluctance to consider an increase in the motor fuels tax.

“Our proposal is our proposal,” Foxx said, calling the trend in fuel tax revenues “a downward-facing curve.” But he added that the administration is “open” to ideas from Congress.

Similarly, Foxx said he would submit responses later when asked about the department’s response to government reports critical of CSA, and about the DOT’s assessment of the changes to the hours-of-service rule.

Sen. Kelly Ayotte said the changes have been “a substantial problem,” with a “staggering” impact.

CCJ has requested a copy of the DOT replies.

THUD appropriations

Also this week, a House Appropriations subcommittee put out its 2015 budget bill for the transportation and housing departments.

For DOT, the bill reduces discretionary spending by $727 million to $17 billion. It includes $40 billion for highways, $16 billion for aviation programs, $10.5 billion for transit projects, $1.4 billion for the Federal Railroad Administration.

The bill also reduces TIGER grants from $500 million to $100 million, and would not allow the discretionary grant program to fund bike and pedestrian project.

A rider in the bill also allows truck size and weight increases in three states.

Much of the spending is contingent on the surface transportation reauthorization.

House Appropriations Chairman Hal Rogers credited the subcommittee for its “commitment to restoring thoughtfulness and restraint to the budgeting process,” and he noted that “overspending, overtaxing, and over-regulating are a drag on the job market.”

“This bill rejects the administration’s attempt to move highway programs onto the mandatory side of the ledger,” Rogers said. “Mandatory spending continues to rise at an unsustainable rate. It’s unconscionable. … Such spending ties the hands of Congress and the people.”

The full committee is expected to review the bill later this month.