Stay Metrics, providers of a driver engagement and research platform that motor carriers use to increase retention and identify root causes of turnover, announced a new set of products to give its clients deeper insights into why their drivers are leaving.

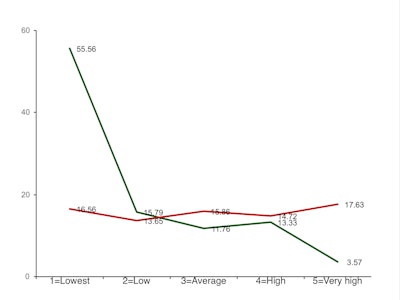

In this real-life example, Stay Metrics used its predictive turnover model to find a unique “predictive index” for one fleet (in green). The index shows the likelihood that drivers will leave based on responses to certain questions in Stay Metrics’ annual driver satisfaction survey (shown on x-axis). Drivers responded to questions using a scale from 1 to 5, with 1 being the lowest level of satisfaction. The red line shows what happens when the carrier’s predictive index was applied to other Stay Metrics clients: nothing stands out. This shows that each fleet has unique predictors for turnover.

In this real-life example, Stay Metrics used its predictive turnover model to find a unique “predictive index” for one fleet (in green). The index shows the likelihood that drivers will leave based on responses to certain questions in Stay Metrics’ annual driver satisfaction survey (shown on x-axis). Drivers responded to questions using a scale from 1 to 5, with 1 being the lowest level of satisfaction. The red line shows what happens when the carrier’s predictive index was applied to other Stay Metrics clients: nothing stands out. This shows that each fleet has unique predictors for turnover.Stay Metrics has released a new version of its Driver Survey product suite with updated questions and research methods to more accurately measure driver satisfaction and obtain feedback at critical points in the employment lifecycle.

“Our Driver Survey products have always been able to identify drivers who are in danger of leaving due to dissatisfaction,” said Tim Hindes, CEO of Stay Metrics. “During the past year, our development efforts have been focused on achieving the next breakthrough for clients — the answer to ‘why are my drivers leaving?’”

Industry research shows that one-third of new driver hires quit within three months of service and half within the first six months. Stay Metrics administers driver orientation surveys at the 7 and 45-day period. The surveys measure driver satisfaction in a variety of areas that relate to their expectations and early experiences on the job.

The Stay Metrics platform sends immediate alerts to fleet managers if driver responses indicate a high level of dissatisfaction. This enables a proactive approach for reducing driver turnover.

Stay Metrics also provides an annual driver satisfaction survey. This in-depth research tool identifies areas of strength and weakness for clients by using comparative industry data and year-over-year trend analysis.

The version 2.0 Driver Survey products integrate with a new predictive model developed by Dr. Timothy Judge, Stay Metrics’ director of research. The model is customized for each client to determine which areas of job dissatisfaction are predictive for driver turnover.

“Rather than use a ‘one size fits all’ approach, we have found that the areas of dissatisfaction that drive turnover for one carrier often are different from another carriers,” said Judge, who also is a professor at the Mendoza College of Business at the University of Notre Dame and a leading researcher in the field of organizational behavior. “The advantages this provides to the carrier are profound. It enables us to scientifically determine what is causing their turnover.”

Rather than make recommendations based on general findings, Stay Metrics says it can now help clients further improve retention by implementing practices specifically tailored to their needs and their specific operating environment.

Load One, one of the five largest ground expedite carriers in North America, has been using the Stay Metrics platform for approximately three years. The company has an annual growth rate of 22 percent due in part to its success in retaining drivers.

“We have done a lot of work to match drivers’ expectations and experiences in the expedite industry,” says John Elliott, CEO of the Taylor, Mich.-based carrier. Load One also uses the platform to engage drivers in its culture, including those employed by leased fleet operators.

“We are working with our fleet owners to set the right expectations and make sure their drivers are engaged,” he says. “Turnover costs them and us. If we can help them succeed we win.”