Most are lagging, meaning they show past results rather than predict future ones. And they typically rely on data that is at least a month old, as well as estimated values and qualitative measures like business and consumer sentiment.

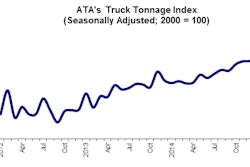

By contrast, telematics systems give fleets real-time, measurable data on their business activities and performance. According to a new study from FleetMatics, some of this performance data, if taken collectively, could be used as near-real-time economic indicators.

Fleetmatics provides cloud-based workforce management and telematics applications. Like many technologies of this type, the software captures a range of performance metrics like mileage, number of vehicle stops, and mileage per stop. While fleets use these metrics internally, they are also highly credible indicators for national and regional economic health, the study says.

To conduct the study, Fleetmatics partnered with Dr. Stephen Fuller, a university professor and director of the Center for Regional Analysis at George Mason University. Fleetmatics tracks the activities of approximately 552,000 residential and commercial service and delivery vehicles for over 25,000 businesses. Dr. Fuller used this data stored on Fleetmatics’ servers in the cloud to develop a data set that is representative of the activities of service-based small businesses.

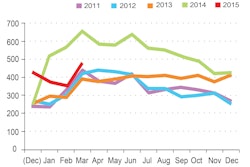

Regression analysis was used to compare 10.7 billion telematics-generated data points from over 400,000 commercial vehicles to nearly four years of monthly retail sales data from Moody’s and the U.S. Bureau of Census. The data from the two sets covered the same periods dating back to January 2011.

“What we found was an extremely high correlation between the retail data at both the national and metropolitan area levels,” he stated. “I believe the ability to analyze real-time telematics data can now be considered an accurate data source on the small business flow of goods and service.”

The findings suggest the performance of small service businesses have an impact on retail sales. In other words, retail sales are dependent on fleet activity, not the other way around.

“We believe this is because in order to generate retail sales, there first needs to be economic activity that allows for the retail sales to take place – most notably delivery of goods but also business and home services,” Fuller said.

On a national basis, the data suggests that as the total number of miles driven by small business services companies increases, so do retail sales.

The report also examined regional differences that drive the activities of service companies in four markets: New York, Chicago, San Francisco and Miami. The report breaks down the most prominent indicators of small business economic activity and correlation to retails sales in each core market.

As for the accuracy of the predictions, the report found that fleet activity during the first two months of 2015 – as measured by total miles driven, total number of active vehicle days, and the number of unique vehicles that experienced movement – decreased approximately 30 percent compared to the same period last year.

Does that spell doom for the economy? On the contrary, the report attributed the drop to unusual bad weather that many regions experienced in early 2015. Taking this aside, the data actually showed retail sales would increase in March 2015.

The Fleetmatics report came out in mid-April, about the same time that numbers for March retail sales were available. Retail sales rose for the first time since November as consumers stepped up purchases of automobiles and other goods, suggesting a sharp slowdown in economic growth in the first quarter was temporary.