Bandera, Texas-based Barton Logistics, a user of Trucker Tools’ integrated Load Track platform, is able to streamline its freight matching and tracking process.

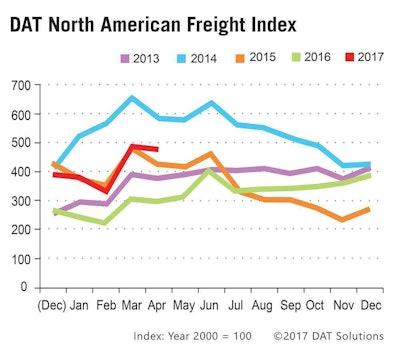

Bandera, Texas-based Barton Logistics, a user of Trucker Tools’ integrated Load Track platform, is able to streamline its freight matching and tracking process.Every Wednesday, Diane McHaney downloads rate data from DAT Solutions into spreadsheets. As the pricing analyst for Barton Logistics, a nonasset transportation company based in Bandera, Texas, she applies statistical tools to identify trends in spot and contract freight markets.

Of particular interest is the mode — the most frequently occurring value in the data set. Also important is the standard deviation of DAT’s rolling 15- and 30-day spot market rate data. Both of these statistical tools help identify early signs of rate volatility.

One year ago, this ongoing analysis led McHaney and Criss Wilson, Barton’s vice president of operations, to predict that rates would increase dramatically prior to December 2017 as more carriers came into compliance with the electronic logging device mandate.

Pricing would be much higher, they surmised, as ELDs took capacity away from small fleets and owner-operators by lowering their utilization.

Both now believe their predictions were wrong.

“We have learned that quite the opposite of that is happening,” McHaney says. As more carriers implement ELDs, rates actually are less volatile, she says.

“(ELDs) are not having any effect right now,” Wilson says. “There is nothing that leads us to believe there is any volatility in the market right now.”

Wilson believes that any rate increases will come from the demand side of the equation, but demand so far this year has been “tepid and anemic,” he says.

The last time Wilson saw positive volatility was last November and December. This was to be expected during the peak retail season, but then rates “tanked” after the second week of January, he says. Spot market rates have recovered gradually since but remain at a low average of $1.40 to $1.50 per mile.

Surprisingly, there has been more volatility with contract rates, where the mode “is all over the place,” Wilson says. But the volatility is not widespread, and the DAT rolling 30-day average for contract rates has “pretty much flat-lined,” he says.

The data leads Wilson to believe that any volatility in contract rates is short-lived and limited to certain geographic regions.

As for why the ELD mandate has not impacted rates as many believed it would, Wilson points to “an underlying structural change going on in the market.” What changed? Motor carriers are acting more like freight brokers, he says.

Many of the top freight brokers in the market today began as motor carriers. These asset-based transportation companies have grown their brokerage divisions rapidly by managing more freight in lanes that their carrier operations no longer can service due to higher costs and lower utilization, some of which can be attributed to the use of ELDs, Wilson says.

Asset-based transportation companies hold a marketing advantage with shippers since they directly control their equipment and drivers, but brokerage and third-party logistics providers have leveled the playing field with technology. Nonasset companies can provide shippers with the same supply chain visibility — if not better, Wilson says.

Barton would like all of its carriers to use freight-tracking apps from Trucker Tools and MacroPoint. “Carriers that resist using these free tools are not likely using ELDs, either,” he says.

Wilson estimates that less than half of the carriers that work with Barton have not implemented ELDs yet, based on their pushback when required to use tracking tools. “If you haul for Barton Logistics, you agree to use tracking tools,” he says.

Status quo — for now

From what TransRisk has seen in the data the futures provider uses from DAT Solutions, spot-market rates are coming back up, says Craig Fuller, TransRisk founder and CEO.

From what TransRisk has seen in the data the futures provider uses from DAT Solutions, spot-market rates are coming back up, says Craig Fuller, TransRisk founder and CEO.ELDs aren’t likely to have much of an impact on trucking rates prior to December 2017, says Craig Fuller, founder and chief executive officer of TransRisk. Fuller believes any impacts are more likely to be seen in the spot market – until March 2018.

Although enforcement is supposed to begin in December, the execution of the mandate likely will be different by state, Fuller says. True enforcement may not begin until more insurers start requiring carriers to provide proof of ELD compliance before selling policies, he says.

Fuller has a vested interest in rates becoming volatile because of ELDs and other factors. He founded TransRisk to offer a “trucking futures market” to shippers, brokers and carriers seeking to hedge rate volatility risk.

Similar to futures and derivatives markets for other industries, contracts with TransRisk will be settled financially rather than exchanged for actual goods or services.

“A truck will not show up at your door because you bought a future (contract),” he says.

Fuller got the idea for TransRisk in 2014 while consulting for a high-tech brokerage firm and day-trading on the side. He researched a futures market for maritime transportation called the Baltic Exchange.

TransRisk provides rate data and information to its market participants. From what Fuller has seen in the data the company uses from DAT, spot-market rates are “slowly but surely coming back up,” but there has not been much volatility caused by ELDs or any other source.

Anecdotally, carriers that have implemented e-logs have indicated they’ve lost between 2 and 6 percent utilization, he says. Even if the overall trucking industry were to lose 2 percent of its total capacity in the next 12 months, the rate impact would be minimal, Fuller believes.

But if 6 percent of capacity were taken out of the market, the impact on rates would be “exponentially more” because of how the supply chain works, he says. Shippers likely would overbid rates to move their loads more quickly.

Fuller says trucking capacity may decrease by a “couple percent” in 2018 because a small segment of the industry – primarily small fleets and owner-operators – could lose their profit margins due to hours-of-service compliance.

The ELD rule’s full impact will be difficult to gauge, he argues, since other variables could play a factor for the remainder of 2017 and into 2018, including e-commerce growth, changes in trade policy, government spending and more.

While owner-operator analyst Todd Amen agrees that any bump in rates from the ELD mandate will come later than initially thought, he foresees a slightly different timeframe.

Amen is president of ATBS, the country’s largest owner-operator business services firm that works with about 40,000 drivers — the well from which the company draws its mileage and income data.

“We believe a rate increase is coming, not by the end of 2017, but in 2017 and into 2018,” says Amen, who predicts ELD implementation will spur rate growth until about mid-2018 and that rates could grow by as much as 10 percent during that time.

Some indications that rate volatility could begin ahead of the December 2017 mandate are starting to appear. In May, Walmart sent a letter to motor carriers and 3PLs participating in its annual bid.

The retail giant noted that a “high variance in rates” was submitted for its truckload bid. In response, the company announced it would invite additional nonincumbent parties to participate in a third round. Historically, Walmart has conducted only two rounds of bidding before awarding lanes.

While the Walmart bids may show signs of carriers re-evaluating their rate structures because of ELDs, they also show the pressure that Walmart and other retailers are facing to compete with Amazon’s rapid growth.

Making up lost productivity

One possible reason why e-logs have not had a measurable impact on capacity may be that fleets also use other technologies alongside their ELD applications.

Pete Allen, executive vice president of sales for MiX Telematics, says that sophisticated fleets are leveraging their investments in e-logs with companion applications that help maximize fuel efficiency and safety.

MiX is one of many ELD providers that offer platforms with performance applications — including video event recorders and route planning tools — that help fleets generate additional returns on investment.

Fleets that use a simple ELD solution for compliance alone are “missing out on the opportunity that the mandate is bringing,” Allen says. “ELDs are not designed to improve productivity, but fleet management technology is.”

ELDs alone can offer some returns by eliminating time that drivers spend filling out logs and the subsequent back-office administration. They also can increase drive time by 15 minutes a day or more, since ELDs record duty status activities to the minute rather than in 15-minute increments on paper log grids, Allen says.

Better in the end

“Electronic logs woke us up and made us understand we were losing money. We had no choice but to give up or raise our rates.”

Steve Rush, president of Wharton, N.J.-based Carbon Express

For Carbon Express, e-logs have been a catalyst for profitable growth during the past nine years. The Wharton, N.J.-based company has grown from 23 trucks to more than 50 during that time.

Steve Rush, Carbon’s president, credits e-logs for forcing management to become both profitable and safe by re-evaluating the fleet’s lane profitability. The company raised rates in lanes where it could and grew its brokerage division to transport loads that it couldn’t service profitably with its own assets.

“Electronic logs woke us up and made us understand we were losing money,” Rush says. “We had no choice but to give up or raise our rates.” Carbon’s customers have taken notice of the company’s culture and stability and “want to know that when the ELD mandate hits in 2017, you are going to keep on going,” he says.

Carbon made another significant change in 2010. To increase both capacity and revenue, it replaced its fleet of sleeper cabs with daycabs. The decision gave the company 20 percent more capacity than competitors that run sleeper cabs, but it came with the added cost of hotel rooms for drivers.

“When we got rid of sleeper cabs, we did it to get more business,” Rush says. “At the end of the day, we also saw what hotel rooms did for our drivers. It improves their self-respect and dignity.”

Rush credits e-logs and hotel stays, along with increased driver pay, for an annual turnover rate in the single digits. Drivers have “got it down to a science” of where to stay along their routes, he says.

Carbon planners use real-time driver log data from the fleet’s Omnitracs mobile platform in its TMW Suite dispatch system to match loads with drivers and provide them with consistent schedules and sleep patterns.

Carbon also uses the data for pricing. The company charges premiums for delivery appointments after hours and on weekends that could require adjusting drivers’ schedules and sleep patterns.

“People want a routine that fits them,” Rush says.

Carbon pays drivers by the hour for loads of less than 250 miles and a mileage rate for longer hauls. The company also pays for all pickups and deliveries, and drivers get a bonus when circumstances require them to take a 34-hour reset on the road.

“We firmly believe that the combination of going to e-logs and running legally, coupled with the elimination of sleeper cabs from our fleet and putting our drivers in hotels, has been the driving force in our success in the areas of safety, low driver turnover and the enhancement of our drivers’ self-esteem,” Rush says.