When evaluating the value chain of their businesses, fleet executives and managers are not likely to include compliance as a differentiator, even if they are very good at it.

Fleets that outsource compliance with J.J. Keller have access to a web-based Client Information Center to view information on the status of their hours of service, vehicle licensing, fuel tax, driver qualification files and more.

Fleets that outsource compliance with J.J. Keller have access to a web-based Client Information Center to view information on the status of their hours of service, vehicle licensing, fuel tax, driver qualification files and more.Increasingly, fleets are outsourcing some or all of their compliance processes as technology is making it possible for third parties to act as a virtual extension of their businesses.

The extension comes from various tech-enabled services that fleets can use to enhance their own compliance processes.

As the cost and complexity of regulations continues on an upward trajectory, six areas of outsourcing seem to be catching on:

1. Driver screening

Pre-employment background checks are one the most widely used outsourcing services due to the fact that carriers need the information quickly to make hiring decisions.

Most carriers use a single vendor for employee background reports to assure continuity and consistency, says Lana Batts, co-president of DriverIQ.

Federal regulations require commercial and private fleets to review safety performance records of drivers for the preceding three years. The review must include DOT-recordable accidents and previous drug and alcohol test results.

Federal regulations do not require employers to check criminal records, but many do — especially larger or more profitable carriers, Batts says.

Any background report – an MVR, criminal record, or employment verification – is considered a consumer report and subject to the Fair Credit Reporting Act (FCRA). As such, carriers must first obtain the applicant’s oral or written authorization, she says.

At Fleetworthy’s office in Madison, Wis., the client services team manages compliance for the assets and drivers of its customers.

At Fleetworthy’s office in Madison, Wis., the client services team manages compliance for the assets and drivers of its customers.“Most important to the carrier is making sure the criminal record used in the employment decision is compliant with FCRA regulations,” she says. “For example, doing a Google search is not allowed under the FCRA.”

DriverIQ has a driver monitoring report to alert fleets to any moving violations or criminal activity that occurs during employment. The report can be tailored to alert to crimes that would disqualify a driver based on the carrier’s hiring criteria such as aggravated assault, she says.

2. Logbook auditing

As motor carriers transition to electronic logs, the difficulties of managing hours-of-service data do not evaporate. On the contrary, carriers may have more data to manage.

A number of firms offer logbook auditing services. Recently, these services have evolved to automatically match electronic data from fuel purchases and other sources to audit “on duty not driving” activities in Line 4 of a logbook grid.

Fleetworthy Solutions, formerly known as ITS Compliance, offers such a service that compares fleet dispatch data, fuel receipts, tolls and GPS records to electronic log records. The company extracts this data automatically through integration with its customers’ telematics and other IT systems, says Kim Brunner, vice president of client services.

Vusion, which shares an office with fellow Trimble company PeopleNet, also uses real-time integrations it has with electronic logging devices, GPS telematics and dispatch software.

Vusion provides IFTA and weight-mileage tax compliance and data analytics to trucking companies. Logbook auditing was a logical extension to its services since the company already gets fuel tax data from most of its customers, says Carl Robinson, vice president.

Vusion’s logbook auditing product compares logbook data to events from fuel purchases and GPS records to determine if the driver accurately logged “on duty not driving” time.

Vusion’s logbook auditing product compares logbook data to events from fuel purchases and GPS records to determine if the driver accurately logged “on duty not driving” time.This service compares logbook data to work-related events from fuel purchases and GPS records and determines if the driver logged a sufficient duration of time, he says. To simplify the audit process, fleets can choose a minimum time that certain activities, such as fuel stops, should take.

J.J. Keller has used supporting documents to provide its clients with a driver’s log falsification auditing service for a number years. The company also retains supporting documents for carriers, says Chad Govin, vice president of sales.

Fleets that use J.J. Keller’s ELD and Encompass cloud service can choose to retain supporting document images in the system and whether or not to conduct these audits themselves using the program’s functionality or outsource the work to J.J. Keller, he says.

The company also accepts HOS data from other ELD providers using its Driver DataSense service to conduct audits on behalf of the customer, he says.

Lytx RAIR compliance services recently added the capability to validate electronic and paper logs with events and supporting documentation against the driver’s duty status. These log falsification checks are validated using data from fuel cards, GPS, EZPass, roadside inspections, accidents, and more.

3. Fuel and mileage taxes

In addition to filing quarterly IFTA fuel taxes, carriers that operate through Kentucky, New Mexico, Oregon and New York have to file mileage-based tax reports.

Oregon will be increasing its vehicle mileage tax by 25 percent in January, 2018, from the rate of 13.6 cents per mile to 20.48 cents. The increase is for commercial vehicles weights of up to 80,000 pounds, says Vusion’s Carl Robinson. Based on an average of 7.0 mpg for a vehicle, this tax increase equates to a $1.43 increase for a gallon of diesel, he says.

Weight and mileage taxes are another example of complexity, especially for fleets that operate in the state of New York. The highway use tax in New York involves a calculation of taxable miles (some toll roads are excluded), gross weight and unloaded weight.

Using the integrations it has with telematics and dispatch software systems, Fleetworthy says it can accurately track the loaded and unloaded miles to prepare and file the tax returns.

“If we consume the data we can help them save money,” Brunner says.

4. Records retention

Records retention is another reason why outsourcing is growing. The International Registration Plan (IRP) in 2015 announced that auditors can assess a 20 percent fee on top of a carrier’s annual vehicle registration and licensing costs if the carrier has inadequate records.

IRP auditors can ask for up to 6.5 years of vehicle licensing data, she says, and the fee rises to 50 percent if the carrier assessed the 20 percent fee has inadequate records during the next audit. The third time is 100 percent.

From attending IRP conferences, Vusion’s Robinson says the fee is something that auditors use mostly as a way to trigger a response from fleets when they request records.

“The first step is more of a threat,” he says.

Photo courtesy of J.J. Keller

Photo courtesy of J.J. KellerWhereas fleets typically retain driver logbook records for six months, the mileage and GPS data from ELD and telematics systems should be retained for a minimum of four years in the event of an IFTA audit, says Fleetworthy’s Brunner.

The International Fuel Tax Agreement (IFTA) has implemented a similar audit practice to assess fees to carriers that have inadequate records. As of January 1, 2017, IFTA auditors can lower a carrier’s mpg to 4.0 or reduce the stated mpg by 20 percent in a carrier’s fuel tax report to calculate the new tax liability.

To protect themselves from audits, carriers will need to store additional data, such as calculated mileage distance by jurisdiction, location of latitude and longitude readings, and routes of travel for a much longer time period — up to four and a quarter years for IFTA and six and a half years for IRP, says J.J. Keller’s Govin.

“In many instances, we see record retention and audit support going hand in hand,” he says. “Decentralized companies in particular look to aggregate data to get one-source visibility, which we provide.”

5. Full-service compliance

Outside of reducing the cost of compliance, one of the main reasons fleets choose to outsource to a third party is to have access to additional professional resources and subject-matter experts who monitor and keep up on changing rules, interpretations, and audit practices, Govin explains.

“When fleets choose to do this internally they may not have the required expertise, or can be at risk when this subject matter gets centralized with only one or two employees,” he says. “In addition, when fleets choose to do this internally they will most likely have to manage their own audits versus the audits being managed by the outsource provider.”

Brunner and other Fleetworthy executives sees the demand for outsourcing continuing to grow as fleets are grappling with the complexity of doing it themselves. The company has more than 125 employees who are experienced in areas such as IFTA fuel taxes, hours of service auditing, IRP registration and licensing, driver qualification files, electronic document management, background investigation, drug and health screening, online training and testing, consulting and more.

6. Compliance portals

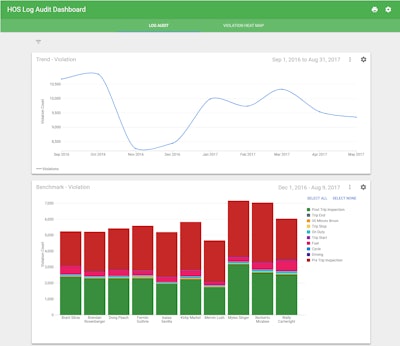

All of the firms mentioned in this article have customer-facing web portals that give their customers a dashboard view of their compliance status.

Fleetworthy’s customer portal has a dashboard of tiles that show fleets their own compliance metrics.

Fleetworthy’s customer portal has a dashboard of tiles that show fleets their own compliance metrics.Fleetworthy Solutions is planning a number of new features and updates to its portal named Comply, says Michael Precia, senior vice president of sales and account management.

The dashboard currently has a series of “tiles” and reporting functions that show fleets where they stand on hours-of-service, driver applications, and “whatever else they are measuring compliance on,” he says.

New products will expand the online platform to help fleets assess risk and chart a path beyond compliance, he says. Besides using telematics data, the company plans to integrate with additional technologies fleets use such as CRM and accounting packages to consume the data and “lay algorithms on top of it.”

If a fleet has a problem with driver turnover, for example, the fleet could use the portal to monitor turnover predictors such as home time, income as well as other risk factors like fatigue from data sourced from various systems.

“We want to be the one stop shop,” he says.

Fleets login to the Vusion portal to view dashboards of the data analytics of their business they use and to export state-by-state vehicle mileage data for IRP licensing. The Web portal includes a scorecard that points out areas of concern to help fleets proactively fix issues, Robinson says.

Vusion also provides fuel economy analytics and driver utilization analytics related to logs that show which pockets of drivers are most efficient at using their available 11 hours. Fleet managers can compare these metrics across company divisions. They can also compare how their companies stack up to industry benchmarks for their sector, such as dry van haulers, he says.

J.J. Keller gives its Managed Service clients access to all their data through its online Client Information Center. The web portal keeps customers informed of the compliance work we’re managing on their behalf, Govin says, with a dashboard-style interface with links to details on specific employees, locations or records.

The Lytx RAIR workspace dashboard gives its customers a quick glance of five measurement categories to view compliance violations and rankings. Each category has drill-down features to view the details on each.