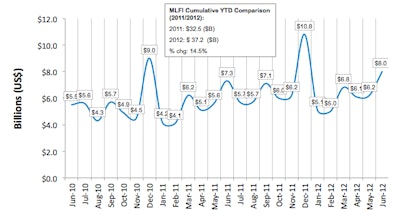

The Equipment Leasing and Finance Association’s Monthly Leasing and Finance Index, which reports economic activity for the $628 billion equipment finance sector, showed overall new business volume for June was $8 billion, up 9.5 percent from volume of $7.3 billion in the same period in 2011. Volume was up 29 percent from the previous month. Year-to-date cumulative new business volume increased 14.5 percent.

Receivables over 30 days were 2.4 percent, down from 2.7 percent in May and down slightly when compared to the same period in 2011. Charge-offs increased to 0.6 percent in June, up from 0.5 percent the previous month and down by 45.4 percent compared to the same period last year.

Credit approvals increased to 78.7 percent in June from 78.3 percent in May. Sixty-five percent of participating organizations reported submitting more transactions for approval during June, down from 75 percent in May.

Finally, total headcount for equipment finance companies increased slightly from the previous month, but declined 2.6 percent year over year. Supplemental data show that trucking and construction led the underperforming sectors, followed by small and medium-sized enterprises.

Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index for July is 51.5, up from the June index of 48.5, and reflects continuing concern over external economic factors and regulatory and political uncertainty.

“Despite recent reports of a softening economy, the level of capital investment by U.S. businesses – both large and small – continues to accelerate,” said William Sutton, ELFA president and chief executive officer. “In fact, the volume of equipment financed in June surpasses that of any single month except for yearend December activity since the beginning of the Great Recession in 2008. We hope that, in spite of the factors adversely affecting economies overseas, our businesses here at home will be able to continue to invest in productive assets.”