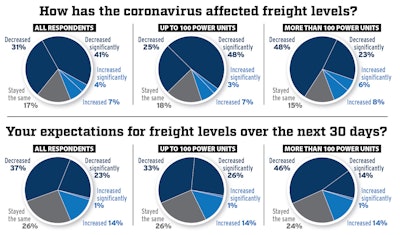

More than 70% of the 270 fleets surveyed last week by CCJ reported that the coronavirus crisis has caused freight to sink, with 41% reporting a significant decline. Fleets surveyed range in size from those with 10 trucks to those with more than 1,000.

More than 70% of the 270 fleets surveyed last week by CCJ reported that the coronavirus crisis has caused freight to sink, with 41% reporting a significant decline. Fleets surveyed range in size from those with 10 trucks to those with more than 1,000.The U.S. economy posted its worst employment numbers in more than a decade in March, a record that is likely to stand for only a month.

Nearly 17 million Americans have applied for unemployment benefits in the last three weeks, with 6.6 million people filing jobless claims in the week ending April 4, according to the Department of Labor.

Roughly 10% of the U.S. labor force is now out now of work, but the transportation industry managed to sneak by mostly untouched last month – losing just 200 jobs, according the DOL’s monthly employment report.

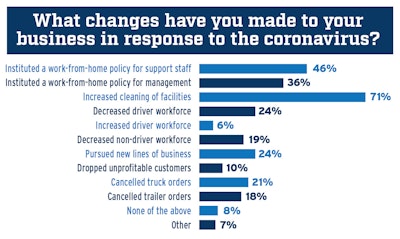

April, however, is shaping up differently as results of a weekly survey conducted by CCJ to measure the coronavirus‘ ongoing impact on motor carriers show the number of fleets laying off personnel has increased in each of the last two weeks. At the end of March, only 15% of respondents said they had been forced to reduce their non-driver workforce, and 13% forced to eliminate drivers. As of the week ending April 11, that jumped to 19% and 24%, respectively.

Nearly a quarter of fleets surveyed by CCJ said they have had to decrease their driver workforce, and 19% said they have already reduced their non-driving workforce.

Nearly a quarter of fleets surveyed by CCJ said they have had to decrease their driver workforce, and 19% said they have already reduced their non-driving workforce.“Rates are not paying enough to keep the doors open,” wrote a for-hire carrier with fewer than 25 units. Another respondent, a fleet in the Pacific Northwest with less than 25 trucks, said the company had “parked all trucks.”

Not all staffing cuts are coming from the top down, as one carrier noted that “25% of our owner-operators have chosen to stay home during this time,” and another writing the company had a “fleet of 18 power units sitting.”

An increasing number of drivers concerned about contracting the virus are pulling themselves off the highway. Almost half (48%) of the fleets with 100 trucks or more said some of their drivers had asked to come off the road, compared to 34% of smaller carriers.

“We want everyone safe. Some drivers are realistic and have to keep going. Some prefer to stay away,” responded a for-hire carrier with less than 25 trucks. “Mostly the older drivers are staying home. It is their choice. We do not force dispatch.”

Employee headcount may be down but the number of carriers reporting a decrease in freight levels is up – having doubled in the last three weeks. The number of carriers seeing any kind of load increase has dropped 20% in the same time, and survey respondents tied it all all back to skyrocketing unemployment.

“The lack of people working decreases the amount of freight, even for necessary items,” wrote a for-hire carrier with less than 25 units. “Over half of our customers have shut down,” noted another for-hire carrier with up to 250 trucks, “and the bulk of our fleet has sat.”

“I have watched fleet of 20 drivers go from all working to three-quarters now sitting,” added a for-hire carrier with less than 25 units.

Tough trucking economics continue to hamper truck and trailer sales, even with many of those production facilities currently idled. The number of fleets reporting truck and/or trailer order cancellations jumped 6% over last week.

Carriers that have enough trucks, drivers and freight are finding many of their customers suffering the same pains, and are in need of the same kind of help.

Though the average is 4.03, 20% of respondents reported last week was their “worst week ever” for business.

Though the average is 4.03, 20% of respondents reported last week was their “worst week ever” for business.A rental and leasing operation with more than 1,000 units penned on CCJ‘s most recent survey that the company had increased loads through essential business servicing grocery and hospital clients, but have had “numerous requests to abate charges or defer charges for 60-90 days.”

“Not sure what is putting downward pressure on rates,” added a for-hire refrigerated carrier with up to 100 trucks, “but this week we have seen a big push downwards from brokers and customers, too.”

“Business has been good, however, a couple of our largest customers have withheld payments and are 90-120 days behind,” wrote another.

Better days, according to respondents, may not be on the horizon as 60% said they expect freight levels to continue to drop over the next 30 days.

“We are ready to move freight. We want to help,” responded a for-hire carrier with less than 25 trucks. “There are still shortages at the grocery stores and we could help with that, but there is nothing on the load boards. Big companies have that locked up. They’re not doing a very good job either. I still can’t get toilet paper and paper towels.”

Spot truckload volumes and rates rose sharply for dry van and refrigerated freight during the first three weeks of March before spending the final week of the month in free fall that ended well below seasonal norms, according to the DAT Truckload Volume Index. Truckload volumes continued to drop during the week ending April 5, with the number of available loads on the spot market falling 39%, according to DAT Solutions.