CCJ‘s Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

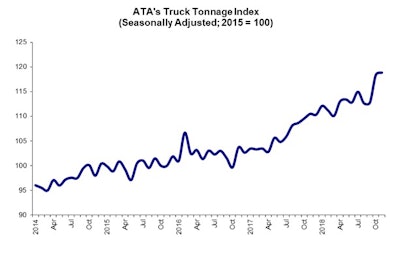

(Graphic from ATA)

(Graphic from ATA)Tonnage sees small gain in November: The amount of freight moved in November by for-hire carriers, as measured by the American Trucking Associations‘ monthly Truck Tonnage Index, climbed four-tenths of a percent from October. Moreover, year-over-year compared to November 2017, tonnage was up 7.6 percent.

Year-to-date through November, tonnage was up 7.2 percent from 2017.

“The fact that tonnage rose in November after a strong October is impressive. It was likely due to some continued pull forward of shipments from China due to the threat of higher tariffs, as well as solid retail sales last month,” said ATA Chief Economist Bob Costello. “With continued strength in November, tonnage growth is on pace to be the best year since 1998.”

Conditions for shippers looking brighter: Market conditions for shippers moved in a positive direction again in October, according to FTR’s monthly Shippers Conditions Index. Often, the SCI has an inverse relationship with FTR’s Trucking Conditions Index, a measure of market conditions for carriers, meaning that positive movement for the SCI means worsening conditions for carriers.

As capacity has eased of late, shippers have regained footing, FTR says. October’s reading “indicates the worst may be over” for shippers, the firm noted.

“Lower fuel prices and some lessening of the capacity crunch shippers experienced earlier this year have shifted overall conditions to a neutral posture,” says Todd Tranausky, FTR’s vice president of rail and intermodal. “That stance is expected to be maintained through the first half of 2019 baring an external shock to the supply chain.”

The index is based on four major metrics: freight demand, freight rates, fleet capacity and fuel prices.