CCJ‘s Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

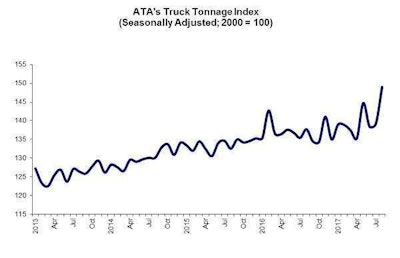

““Tonnage was stronger than most other economic indicators in August and more than I would have expected,” said ATA Chief Economist Bob Costello. “However, prep work for the hurricanes and better port volumes likely gave tonnage an added boost during the month. I suspect that short-term service disruptions from when the storms made landfall, as well as the normal ebb and flow of freight, could make September weaker and tonnage will smooth out to more moderate gains, on average.”

Year to date through August, tonnage was up 2.1 perecent.

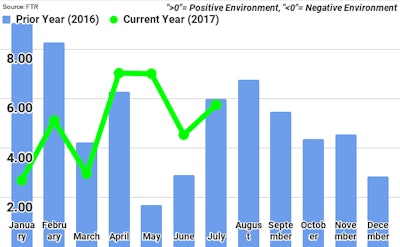

Though contract rates have remained level, spot market rates continue to gain steam, with data on the spot market pointing to near-100 percent utilization, says FTR.

“The combination of multiple hurricanes, strengthening spot market conditions, and the final push towards ELD implementation means trucking is ready to shift into a higher gear,” says FTR’s Jonathan Starks, Chief Operating Officer. “Fleets are finally starting to talk positively about market conditions after being stuck in a relatively sluggish environment for more than a year. Spot rates were up double-digits versus last year before the hurricanes hit and have surged further since then. When you add in a slightly more robust economy, capacity reductions due to Hurricanes Harvey and Irma, extra freight for storm recovery, and productivity reductions as ELDs are fully implemented; that’s a market which gives fleets a reason to be optimistic as we head towards 2018.”