CCJ’s Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

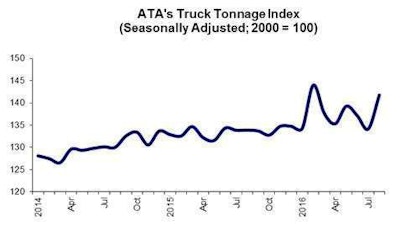

Per ATA, tonnage was up 5.9 percent in August from the same month last year.

“Volatility continues to reign in 2016. This month’s tonnage reading highlights this fact and underscores the difficulty in determining any real or clear trend in truck tonnage,” said ATA Chief Economist Bob Costello. “What is clear to me is that normal seasonal patterns are not holding in 2016.”

Costello says he predicts truck freight to remain “softer than normal,” as retailers continue to sit on out-of-balance inventories. “With moderate economic growth forecasted, truck freight will improve as progress is made with the inventory overhang,” he said.

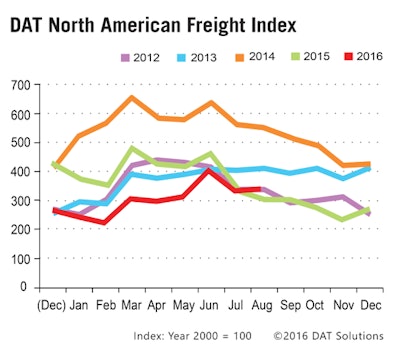

Compared to last August, van loads were up 32 percent, and reefer availability was up 31 percent. Flatbed posted an 11 percent decline in the month, which DAT attributes to cutbacks in flatbed-centric sectors, such as oil and gas, steel, coal, construction and manufacturing.

Compared to July 2016, van freight climbed 8.7 percent and reefer rose 24 percent. Flatbed volume dropped 16 percent.

Though freight was up, rates weren’t, DAT reported, continuing a roughly two-year-long downward trend.

Compared to last August, linehaul rates were down 6.6 for van, 5.1 percent for reefer and 7.2 percent for flatbed.