FMCSA should delay CSA 2010 release

Vicarious liability, misused data are a bad mix

By Henry Seaton

Q We heard that on behalf of some small trade associations you have opposed implementation of Comprehensive Safety Analysis 2010. If so, why?

A Neither I nor the parties I represent oppose in principle the use of CSA 2010 methodology for its intended purpose as a progressive intervention tool to be used by the Federal Motor Carrier Safety Administration in determining which carriers are fit and safe for use. But all parties would acknowledge, I believe, that the CSA 2010 methodology, the data it collects, the weight assigned to that data, the peer groupings and the algorithms used by the agency in coming up with percentile rankings is a complex work in progress; 800 changes to the system were made in August.

Henry Seaton --- [email protected]

Henry Seaton --- [email protected]On behalf of small carriers, we have expressed a number of different concerns about the science and the math behind the methodology and ultimately want to ensure that the data is as fair and accurate as possible. But that issue is better reserved for the rulemaking proceeding that FMCSA must complete before it can use the methodology for rating carriers.

While ultimately the devil may be in the details, problems with the CSA 2010 methodology are not the source of our angst. Rather, it is what many believe is the premature and unwarranted release of the data to the public as currently scheduled for early December. While the issue of the proposed release of the data may be resolved or in litigation by the time this column is published, it is important that the readers understand that the issue is more nuanced than blanket opposition to CSA 2010 methodology.

Disclosure could cost thousands of carriers business and jobs.

Over the summer, the industry first began to recognize the unintended consequences of public release of CSA 2010 data when provisions began appearing in shipper/broker and shipper/carrier contracts that effectively would terminate the contracting broker’s or carrier’s access to business if the carrier was marginal or deficient in any of the seven CSA 2010 Behavior Analysis and Safety Improvement Categories (BASICs) when published or if the broker used such carriers.

The reason for these contractual provisions and the consequences on the industry as a whole immediately became clear. Large shippers, brokers and equipment providers are frightened of vicarious liability and the possibility that plaintiff’s bar will name them in a truck accident case as liable for having selected or retained unsafe carriers negligently. Large shippers and brokers, and the counsel who advise them, accordingly were alarmed by the release of CSA 2010 data and the real possibility that plaintiff’s bar would use the published data to argue that the shipper or broker was required to second-guess FMCSA’s ultimate decision.

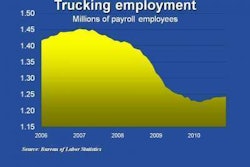

Based upon the enforcement levels set by FMCSA in each of six BASICs – the crash indicator BASIC will not be disclosed publicly – about two-thirds of the for-hire carriers placed in peer groups thus could be barred from access to the marketplace with a resulting loss of business and jobs. It is this unintended consequence of public release of CSA 2010 data that truly is alarming.

Since the decision to release the data in December had the unforeseen consequences of blackballing carriers the agency otherwise found safe to operate, we filed a formal motion to postpone with the agency asking that public release of the data be delayed and the issue be considered as part of the impended rulemaking. That motion can be found at www.transportationlaw.net/CSA2010.html.

To its credit, the agency met with us in October to discuss our concerns and requested proposed acceptable language that would treat our vicarious liability concerns and permit release of the data as scheduled. Unfortunately, the agency’s Nov. 18 notice of its intended modifications, while a step in the right direction, does not allay our concerns or provide a sufficient disclaimer to preclude CSA 2010 data and percentile rankings from being used improperly in vicarious liability lawsuits.

I believe that the unintended consequences of public release of CSA 2010 data in its proposed form still will have a chilling effect on competition and will jeopardize many carriers’ viability, including their ability to raise financing, obtain insurance and compete. FMCSA should make the ultimate safety determination, and shippers and brokers should be able to rely upon the agency’s determination without fear of being dragged into a lawsuit just because the carrier is a small business and plaintiff seeks deep pockets.

By the time this article appears in print, I foresee the issue either will be resolved or litigation will be commenced to require Administrative Procedure Act review of FMCSA’s actions as a prerequisite to publication of this material in its proposed present form.

— Henry Seaton is a lawyer who represents motor carriers. n

IN BRIEF

* A superior court judge in Maricopa County, Ariz., has certified as a class action a lawsuit charging that Swift Transportation underpays drivers by 7 to 10 percent on average by calculating pay using a software program rather than on actual miles driven. The lawsuit, which alleges breach of contract, was certified by Judge Richard Gama as encompassing all drivers or owner-operators employed on or after Jan. 30, 1998, and paid based on miles.

* Nathan Lee Kapp, a controller at C.R. England, was arrested Nov. 9 for mail fraud and money laundering in an alleged embezzlement of about $1.3 million since January 2007. Kapp, who was responsible for reconciling cash receipts from C.R. England’s driver school operations, allegedly deposited more than $10,000 a week into his personal bank account.

* Panther II Transportation and its insurer Zurich American are not liable for covering damages from an accident that occurred while a leased driver was using his truck – at his own request – to attend mandatory orientation at Panther headquarters, the U.S. Court of Appeals for the Sixth Circuit ruled. Carolina Casualty, which provided non-trucking insurance to cover the truck and wasn’t engaged in Panther’s business, had denied coverage, but the appeals court ruled that Panther and Zurich were not liable.

* The U.S. Court of Appeals for the Fourth Circuit upheld a lower court’s grant of summary judgment in favor of Brisk Transportation and Super Valu in the case of an independent contractor for Brisk who was injured in a landing gear incident at a Super Valu facility. The appeals court agreed that the contractor had failed to offer any admissible evidence regarding what had caused the incident.