The new oil – designated PC-11 or “Proposed Category 11” by the Diesel Engine Oil Advisory Panel – has been scheduled for its first licensing in December. According to Dan Arcy, global OEM technical manager for Shell Lubricants, additional details also have been nailed down.

There will be two new categories within PC-11’s overall framework. “The committee really wanted to keep things as simple as possible for our customers,” Arcy says. “It seemed logical to us to simply build on the old CJ-4 classification with the new oils.”

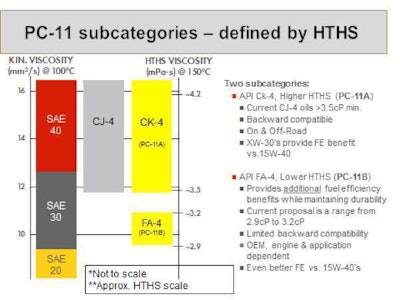

During PC-11’s development, the committee divided the new oil into two different formulations: One for older (pre-2017) engines, and a second thinner formulation that will be spec’d for Phase II GHG diesel engines.

Using this approach, PC-11A – the formulation that will replace SAE 40 weight oils – will be classified as CK-4. “This is a logical designation that will make it easier for fleets and technicians to identify the oil as the correct choice for older engines that currently run on CJ-4 blends,” Arcy says. PC-11B, which will replace some SAE 30 and 30 weight oils, will be designated as FA-4.

The Heavy-Duty Engine Oil Classification Panel cast its final ballots on the new oil last month in Austin, Texas, with an eye toward finalizing all of its aspects before the American Petroleum Institute issues finalized specifications in anticipation of a licensing date of Dec. 1, 2016.

Meanwhile, fleet testing – in addition to the 22 million test miles the industry already has logged with the new oil – will continue, Arcy says. Also, packaging guidelines will be finalized ahead of getting the product into the marketplace early next year in time for 2017-compliant engines that also will be entering the market.

Driving changes

In an era where the trucking industry has been forced to deal with seemingly unending waves of regulations, a new oil category may seem like piling on to beleaguered technicians and fleet managers. But it’s been almost 10 years since a new heavy-duty oil category was released.

Shawn Whitacre, senior staff engineer of engine oil technology for Chevron Lubricants, says the industry is long overdue for a more modern oil to enter the market to address the many changes that have taken place over the past decade. “The main driver behind the PC-11 category has been new and emerging emissions regulations,” says Whitacre, who also chairs the ASTM Heavy-Duty Engine Oil Classification Panel.

Shell showed off the durability of ‘thinner’ oil in this engine teardown demonstration last year.

Shell showed off the durability of ‘thinner’ oil in this engine teardown demonstration last year.The last round of emissions regulations, which culminated in 2010, focused on nitrogen oxides (NOx) and particulate matter, while the new standards set to become more stringent next year target carbon dioxide (CO2) and other GHG. “Add a whole host of engine design changes that will enter the market in 2017, and the need for a more modern engine oil becomes obvious,” he says.

Whitacre says the biggest single performance improvement the new oils will offer will involve oxidation control – the ability of the oil to withstand high temperatures for long periods of time without breaking down. This new characteristic ultimately may create opportunities for longer oil-change intervals in fleet operations.

According to Whitacre, heavy-duty diesel engine OEMs recognize there are two main oil components that impact long change intervals: Total Base Number Depletion and the Oxidation Number. “There used to be a third consideration – soot levels in the engine,” he says. “That is becoming less important as diesel exhaust emissions systems have improved.”

Fleets used to have to drain oil because pre-2010 engines produced a lot of soot due to increased exhaust gas recirculation (EGR). But soot control has been addressed by improvements in CJ-4 oils and the advent of ultra-low-sulfur diesel fuel. “Modern diesel engines today are a lot cleaner in that regard,” Whitacre says.

Details on 2017 engines are few at the moment, but Whitacre says they generally will run from 5 to 15 degrees hotter than today’s engines.

“OEMs have really stressed that the new oil have the ability to stand up to hotter temperatures,” he says. “We’re not talking large temperature increases, but it is very important to carefully balance all the heat transfer that goes on in these engines, and that puts a bigger demand on the oil itself. We have to make sure that when the new oil gets hot, it doesn’t break down.”

Also, much work has been done to make certain the new oils will work with preexisting engine systems. “PC-11 brings no new filtration requirements from engine manufacturers or oil suppliers,” says Jonathan Sheumaker, technical adviser for liquid filtration research and technology at Cummins Filtration.

“The media and technology we have today will work with PC-11 oils,” he says. “There should be no impact on the filter, although a lower-viscosity oil should provide less restriction as it flows through the filter, which can help improve engine efficiency and fuel economy.”

The split category explained

PC-11 will be different in that it is what lubricant suppliers are calling a “split category.” In essence, this is because the new oil formulations will be required to service both older and new-generation diesel engines. But industry experts stress that careful thought is being given as to how these two oils will be marketed, packaged and presented to the industry to minimize confusion.

Lower high-temperature high-shear (HTHS) viscosity means thinner oil that can improve fuel economy by reducing the amount of horsepower required to pump it throughout the engine. But a lower HTHS viscosity also usually comes at the expense of wear protection.

Lower high-temperature high-shear (HTHS) viscosity means thinner oil that can improve fuel economy by reducing the amount of horsepower required to pump it throughout the engine. But a lower HTHS viscosity also usually comes at the expense of wear protection.“PC-11A (CK-4) oils will replace today’s lubricants and will be completely backwards-compatible with all current vehicles,” Arcy says. “They will be designed with improved oxidation resistance, shear stability and aeration control.”

The second oil, designated FA-4, also will meet those new requirements while adding lower-viscosity grades. “These oils are designed for next-generation diesel engines to help maximize fuel economy without sacrificing engine protection,” he says.

That requirement reinforced the need for a split category because some older engines were not designed to operate with lower-viscosity grades. “Testing already has confirmed that the new oils will deliver fuel economy boosts from 2 to 4 percent depending on the engine and application,” Arcy says.

PC-11 will not affect every business the same, says Paul Cigala, commercial vehicles applications engineer for ExxonMobil Fuels & Lubricants. “It’s possible that some fleets will only see a small impact from PC-11,” says Cigala, who cites an example of a fleet operating older equipment and mixed engine types.

In this scenario, he says, the fleet only may need to transition from its current CJ-4 engine oil to the newer CK-4 formulation. This also would apply to off-highway equipment used in operations such as mining and construction, which are expected to use only the CK-4 formulation for the time being.

“In comparison, a fleet with a mix of older and newer equipment may choose to stock both CK-4 and FA-4 formulations,” Cigala says. “CK-4 oils will be suitable for use in both older and newer equipment, but if the fleet is looking to enhance the fuel economy of its newer engines, it will likely decide to use the new FA-4 formulation.”

Fleets operating newer trucks with advanced engines should consult their OEM for recommendations on using both CK-4 and FA-4 formulations, Cigala says. “While some OEMs may factory-fill newer engines with FA-4 oils, they will likely not require fleet managers to fill with FA-4 oils,” he says. “We anticipate that some fleets will want to be the earliest adopters of the highest-performing newer engines, along with high-performance FA-4 oils. These fleets will probably share a commitment to meeting aggressive sustainability-related goals.”

Whitacre says that from a fleet perspective, the split category designation primarily reflects 30-weight oils, since 40-grade oils have viscosity that is much higher than the FA-4 category will allow. However, he cautions that there is the possibility of confusion with 30-weight oils within the PC-11 framework.

Both 10w-30 and 5w-30 PC-11 formulations could be marketed as CK-4 or FA-4 depending on their high-temperature high-shear (HTHS) viscosity, Whitacre says. “Some will be backwards-compatible and will meet the CK-4 requirements,” he says. “But there will also be a new subcategory called FA-4 that will encompass oils that are thinner.”

For those reasons, Whitacre stresses that work is ongoing at API to figure out exactly how the industry will communicate all of this information to fleets, technicians and drivers.

“The key here is that people have historically focused on the SAE viscosity grade when selecting heavy-duty engine oil,” he says. “Now the emphasis will be on both the SAE grade and the API category. Those criteria will be more important than ever before, especially for both low-viscosity or conventional formulations.”