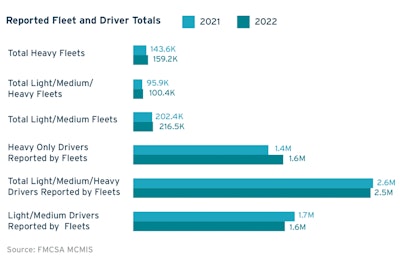

Fleet Sizes & Driver Reporting

As the demand for products to be transported both intrastate and interstate, there have been increases year-over-year on the number of fleets reported on the US roads, number of CDL drivers per fleet, and overall mileage recorded.

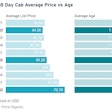

Leveraging data from Randall Reilly’s RigDig product, we can gain more insight into the trucks and drivers added to the interstates to feed the demand. The overall number of CDL drivers reported by fleets increased in 2022 compared to 2021, but there were slightly fewer drivers reported on light/medium/heavy trucks as well as the light/medium trucks. The growth focused on the heavy only fleets increasing driver counts, which coincides with more recorded mileage as the heavy trucks are taking on longer trips. This mileage increase is directly seen within the used market observations monitored by Price Digests.

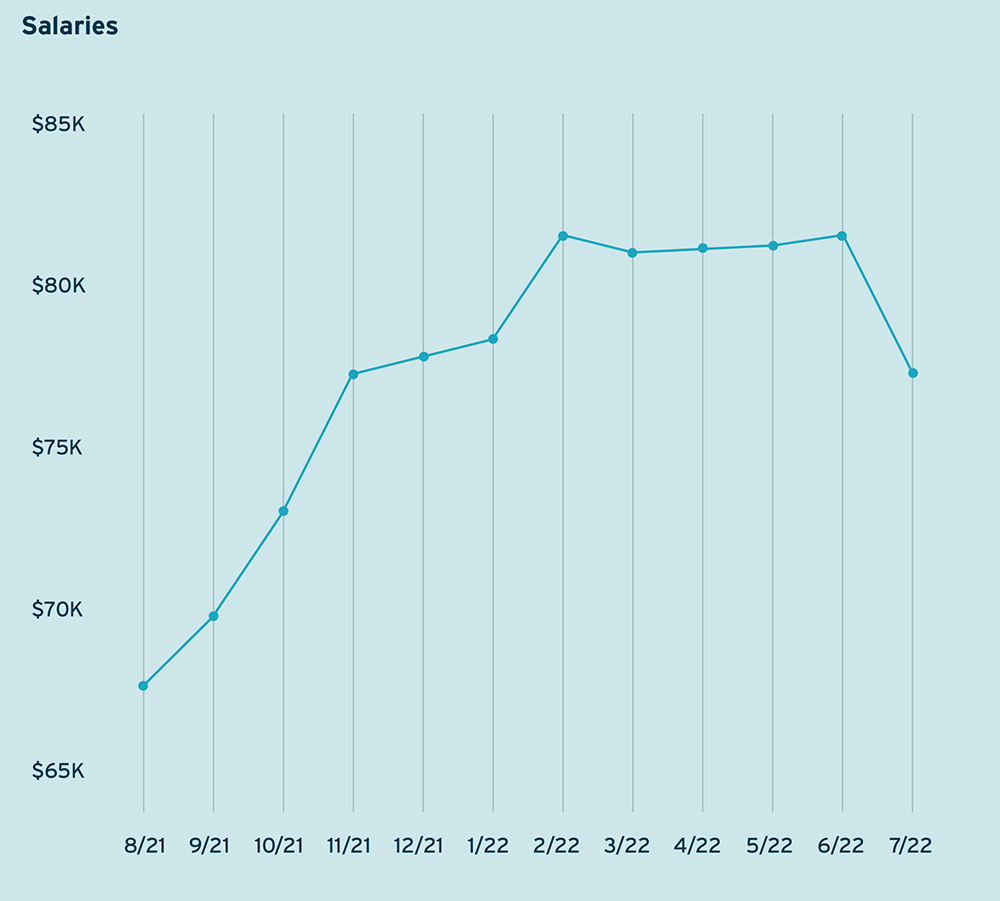

Trucking Jobs & Salaries

Using data from Indeed and the Bureau of Labor Services, we analyzed activity in the trucking job market in 2021 and 2022. In April 2021, the number of job seekers looking for roles in trucking hit a low of 1.1 million. In response to the shallow labor pool, many employers raised salaries. During the period between August 2021 and June 2022, average salary increased from 68,000 to 81,000.

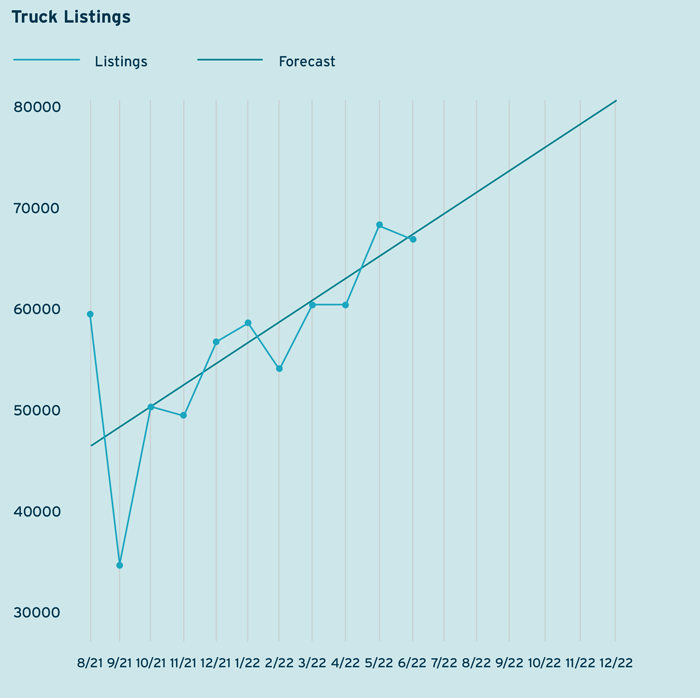

Increasing salaries isn’t the only strategy employers used to address labor challenges. In a survey last year, fleet owners said that improving driver retention was a key motivator for expanding their fleets. And that is likely a key driving force behind the steadily increasing activity we’ve seen on the resale channel this year.

Like the labor market, the truck resale channel is rebounding after a volatile year in 2021. We’re now seeing the highest number of truck listings in over a year. Due to that upward trajectory, we expect to see the number of resale listings reach nearly 80,000 in December, 2022.

The combined impact of an increase in job seekers and rising resale listings may mean that dealers should expect even higher levels of inventory in the months ahead.

Key indicators of trucking demand are consumer spending and the need for drivers that transport interstate commerce. In June, the adjusted personal spending rose 0.1% after May’s decline. Inflation was up 6.8% between June 2021 and June 2022, spending is slowing and truck driver job openings dipped in July. This brings foresight into the trucking marketing with anticipated inventory inclines and pricing stability.

This is Part 2 of a five-part series on managing fuel costs as part of the Price Digests Market Report on shifting truck values. (Read Part 1, Part 2, Part 3, Part 4, Part 5 or download the entire guide.)