Venture-capital investors continue to pour money into freight tech startups. Funding this year is expected to be 12% more than 2019, according to analytics firm CB Insights, with the Covid-19 pandemic raising interest in companies who have a fresh approach for easing the strain on supply chains.

Investment in freight tech startups in 2020 has accelerated to squeeze out more costs from fleet operations and supply chains.

Investment in freight tech startups in 2020 has accelerated to squeeze out more costs from fleet operations and supply chains.Freight tech startups have typically focused on the intermediary process of connecting shippers with carriers to speed transactions using freight matching platforms with on-demand pricing and “book it now” features to secure loads or capacity.

One area that has been overlooked to squeeze costs out of supply chains is speeding the velocity of shipments by reducing drivers’ dwell times. This has always been a structural inefficiency in the trucking industry and has intensified by massive shifts in supply chains spurred by the coronavirus.

Passing the baton

Tech startup, Baton, is taking aim. The company was founded in October 2019 by Nate Robert and Andrew Berberick in San Francisco, after they worked as entrepreneurs for 8VC, one of the largest venture capital firms in transportation and logistics.

Baton received investment from 8VC and others as a tech-enabled final mile delivery company. It developed proprietary software to coordinate and optimize the first and final mile of long haul truck routes through its secure network of drop zones and local drivers. It sources the drivers from fleets and independent contractors.

The trucking customers of Baton drop off and pick up trailers from its drop zones. Local drivers in the network shuttle loads to their final shipping and receiving facilities.

At present the company has drop-off zones in Los Angeles and Atlanta with plans to launch next year in Dallas and Chicago.

CSRT International (CCJ Top 250, No. 20), one of the largest privately held transportation and logistics companies in the United States with 6,000 trucks, is an early Baton customer and recently saw its delivery efficiency double in Southern California for the loads managed by Baton.

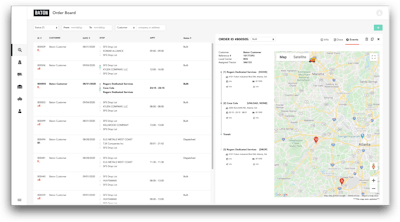

CRST in August started working on a 30-day pilot by sending five loads a day through Baton’s software platform to stage pickups and drop-offs at a single drop zone in Los Angeles. The Baton platform gives CRST full shipment visibility and status updates on each load.

After one week, CRST decided to triple the load volumes and added a second Baton yard. The on-time service performance for the more than 270 loads Baton has managed for CRST to date in the region is higher than 98%.

Turnaround time for CRST drivers at the Baton drop zones is no more than 30 minutes, an 83% decrease from the average dwell time of three hours in the trucking industry.

Besides reducing dwell time, CRST has lowered in-transit dwell – a measurement of slack time that drivers bake into their schedules to hit appointments. The fleet has also seen a reduction of inter-appointment dwell when drivers wait for backhauls.

Baton gives carriers and shippers visibility of loads that it manages final-mile pickups and deliveries for.

Baton gives carriers and shippers visibility of loads that it manages final-mile pickups and deliveries for.“We’re always looking for ways to prioritize driver satisfaction and efficiency gains regardless of market conditions,” said Chad Brueck, president of CRST Expedited Solutions. “Dwell is especially costly in our team-based environment and was causing massive inefficiencies for CRST. By partnering with Baton, we can now capture more freight, keep our drivers moving more consistently and improve our customers’ experience all at the same time.”

Baton’s Head of Operations Erik Malin said Baton is able to create efficiencies in the final mile by consistently picking up and delivering to the same locations in major metropolitan areas. By studying each location that it services, Baton can identify the root causes and solutions for detention with shippers and receivers, like changing arrival times to off-peak hours.

The company also collects data from “a lot of different sources” to gain insights on dwell time for the locations it services, Malin said, and having the same drivers visit the same locations also helps.

“Familiarity is a big thing,” he said. “The drivers we work with will visit the same facility a lot and have relationships that we benefit from that we can proliferate across the driver network.”

“One of the things we are focused on is optimization and saturation,” he noted, which comes by working with local dedicated fleets and having technology at the yard level “to move drivers in and out as quickly as possible.”

Ride sharing for truckloads

Flock Freight is another tech startup targeting an often overlooked structural inefficiency in trucking. The company has developed algorithms to identify opportunities for “shared” truckload shipments of less-than-truckload freight headed in the same direction.

This year, Japanese-based SoftBank led a $113.5 million investment in the company and was joined by Volvo Group’s venture-capital arm, among others.

Flock Freight was founded in 2015 by Oren Zaslansky in San Diego. After more than 20 years of experience as an owner of a trucking and logistics company, he saw an opportunity to change how freight moves in the LTL world.

Palletized shipments in LTL typically move through a hub-and-spoke model where carriers pick up, unload and reloaded freight several times between origin and destination locations. The shuffling of freight increases the risk of theft, loss and damage as well as adds cost, said Jeff Lerner, Flock Freight’s vice president of marketing.

About 80% of truckload shipments are not completely full, he noted, and carriers could use this space to add LTL shipments that are going in the same direction.

Freight pooling is a common practice for LTL carriers and third-party logistics providers. Where Flock Freight has differentiated itself in the market is by offering shippers a guarantee for shared truckload.

The company launched this offering in 2019 after it had built up sufficient lane density and created algorithms to optimize freight pooling based on many different factors, Lerner said.

The guaranteed shared truckload offering gives shippers upfront pricing for a pooled shipment, when available. The algorithms know the likelihood that a shipment can be pooled and price the freight accordingly. Shipments with more flexible pickup and delivery schedules, for instance, have a higher probability of a guaranteed offer.

As an example of freight pooling, Lerner said that Flock Freight may have eight pallets that ship from San Diego to New York City; 10 pallets from Los Angeles to Philadelphia; and six pallets from Las Vegas to Detroit. It can offer these combined shipments to a truckload carrier to make the pickups and deliveries in sequence.

Shippers only pay for space they use on a trailer and get the service advantages of a full truckload, he said, by being loaded at the origin and unloaded at the destination with no cross-docking.

Flock Freight sets appointment times for pickups and deliveries by working with the carrier who accepts its pooled loads, Lerner said. Its shipper customers and carrier partners can book loads online or through its app.