2013 certainly is shaping up to be an interesting year in the trucking industry The upcoming changes to the hours of service rule in less than two months, the pending regulation mandating electronic onboard recorders, the onset of added costs as a result of Obamacare and the realization of the Federal Motor Carrier Safety Administration’s Compliance Safety Accountability program’s impact on fleets all present significant headwinds, especially to small and medium-sized fleets (see our special report on CSA in May, or visit ccjdigital.com/csa to learn more). And that’s before we even talk about hiring and retaining skilled and qualified drivers. It’s enough to make owners of even healthy and profitable businesses think about exiting the market.

Meanwhile, for larger fleets with deeper pockets and small to medium-sized fleets with better books of business, 2013 is a year of opportunity as these carriers look to penetrate into new and underserved markets and increase capacity to existing customers.

As strong as the trucking company merger and acquisition market was in 2012, 2013 could be even stronger, says Mark Dyer, managing director, transportation practice for Allegiance Capital Corp. “There are a ton of companies on the sidelines in the form of private equity firms and strategic buyers, and they need to put that money to use, so it creates a ripe environment for merger and acquisition activity,” Dyer says. “There are also a lot of trucking companies on the acquisition trail. It is difficult in this industry to create organic growth, so it’s a lot easier to buy.”

This year, we’ve already seen a merger between Greatwide Logistics Services and Cardinal Logistics Services and Cardinal Management pairing long-haul service with last-mile delivery operations, and Celadon continues to gobble up smaller carriers with the acquisitions of Rock Leasing and Kelly Logistics. In addition, Boyd Bros. recently acquired owner-operator fleet Mid Seven Transportation to penetrate further into the Midwest and enter the machinery and agricultural equipment hauling market.

Carriers in acquisition mode also are getting pressure from shipper customers as they are consolidating the number of trucking companies hauling their goods to better control costs. In that case, an acquisition certainly makes sense and serves two purposes: The trucking company has a new market it is servicing, and it is servicing the customer that wanted them to go there in the first place.

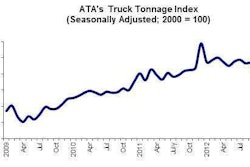

On the seller side, in addition to mounting regulatory constraints facing struggling carriers, many small fleet owners are nearing retirement age and don’t have a good succession plan or exit strategy. For these companies, Dyer says 2013 is a good year to sell as freight volume continues to strengthen and the economy continues to rebound.

For small fleet owners looking to sell their busi- nesses and exit the market, Dyer says it’s imperative to make sure your house is in order.

“They need clean and accurate historical financial data presented in a format standard in the industry,” says Dyer. “So often, the accounting is done by a family member or bookkeeper, so it makes it difficult [for a buyer] to look at historical profitability.” Dyer also says small companies are more likely to have “tribal knowledge – the owner has a lot of the information in his head, and it needs to be put down into written procedures.”

Editor’s note: Interested in setting your business up for the next generation? Check out “How to Plan for Succession,” one of five manuals available as part of CCJ’s Commercial Carrier University education program. To learn more about the program and to order the manuals, go to commercialcarrieruniversity.com.