A robust rate environment drove solid financial gains for transportation companies in 2015, but truckload carriers saw declining utilization and other transportation service providers reported mixed results.

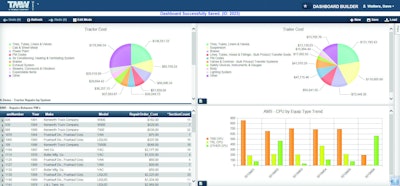

These and other trends surfaced during the most recent 12-month reporting period (mid-2014 to mid-2015) of a newly released Transportation & Logistics Study from software provider TMW Systems.

Participation in the underlying survey grew by more than 15 percent over the preceding year, TMW says.

Most truckload irregular and dedicated fleets posted significant improvement in financial performance, and twice the number of irregular and nearly three times as many dedicated carriers reported healthier operating ratios. However, those gains were driven almost exclusively by rate increases. Utilization, another fundamental contributor to profitability, declined for many fleets over the same period.

“There’s room both for enthusiasm about respondents’ improved financial performance and concern regarding the challenges that continue to negatively impact operational efficiency,” said TMW President David W. Wangler. “I am pleased to see that more and more fleets and non-asset enterprises use the market intelligence provided in this study to benchmark their operational performance and potentially uncover areas where they might need to take corrective action.”

Among the insights addressed in the newly released study are:

Driver Retention

Fleets posting increased driver miles per week generally experienced lower turnover, with additional factors – wages, fleet size, average length of haul and tractor-to-fleet-manager ratio – continuing to affect both driver turnover and, by extension, asset utilization.

Asset Utilization

Hours of Service (HOS) rules and, increasingly, fleets catering to driver preferences such as increased home time continue to impact many fleets’ daily working percentages.

Dedicated Services Adopting More Flexibility

Data points to a trend replacing some traditional dedicated contract freight services with hybrid blends of dedicated and regular service that come with more flexible pricing and adaptive service levels on select lanes.

Service Expansion

A growing number of carriers with plans to diversify are targeting the brokerage and 3PL segments, while fewer intend to expand into dedicated carriage and warehousing.

Fuel Cost Management

Lower fuel prices benefitted fleets, but respondents continued to aggressively adopt idle reduction technologies such as APUs and in-cab heaters.

Participants in the annual TMW Transportation & Logistics Study survey receive a comprehensive version of the report containing aggregate detailed response metrics for more precise benchmarking insights and KPI planning. To access and download a summary version of the study and to sign up to receive the survey questions for the 2016 study, visit: www.tmwsystems.com/study.