Bill Straus, economist for the Federal Reserve Bank of Chicago.

Bill Straus, economist for the Federal Reserve Bank of Chicago.The number of Class 8 trucks on the highway reached about 3 million units in 2016, consistent with 2015 and about the same as the pre-recession period from 2006 through 2009.

Speaking at the Heavy Duty Aftermarket Dialogue in Las Vegas Monday, MacKay and Co. President Stu MacKay notes the truck population today is consistent with pre-recession numbers, but utilization rates have not followed.

“We’re running at a lower utilization rate now than we were a decade or so ago,” he says. “Probably some of it is driven by hours of service regulations, impacting how effectively and efficiently the equipment can be used.”

Equipment utilization was about 85 percent in 2016 while trailer utilization fell about one percent from 2016 to 2015, and the coming ELD mandate is likely to further shake those figures.

John Blodgett, vice president of sales and marketing for MacKay and Co., forecasts utilization to improve by 2 percent in the U.S. in 2017, with a 1 percent price increase in the next year over 2016.

Bob Dieli, president RDLB, Inc., says ELDs are likely to change how both drivers and their equipment is used, having some level of impact on efficiency.

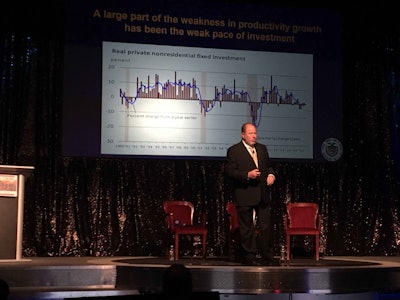

Bill Strauss, senior economist and economic advisor for the Federal Reserve Bank of Chicago, says it’s too early to tell if the Trump administration will have any effect on the economics of trucking.

“When you talk about what the future holds, you first have to make assumptions about what comes into being law,” he says, “and we don’t make assumptions to changes in policy.”

Strauss says the expectation is that the economy will grow at a better rate than the 1.7 percent posted in 2015, “but it’s not going to be anything of a substantial note.”

The Federal Open Market Committee expects Gross Domestic Product (GDP) growth from 1.9 to 2.3 percent this year. “Just a bit above trend,” Strauss notes.

A popular presidential campaign platform was GDP growth, with Donald Trump championing the potential for 3 to 4 percent gains – a figure Strauss says will be difficult to reach.

“Labor force growth is about 0.8 percent and I think it’s going to be hard to see significant gains,” he says, noting growth could be stoked by incentivizing bringing the jobless back into the market. But he adds that would only lead to gains of “tenths of a percent.”

“Can we get a 3 to 4 percent [growth] for a year or two? Absolutely,” he says, but adds maintaining it long term would be challenging.

Dieli forecasts economic expansion through at least third quarter this year, if not into next year.

Industrial production is forecast to improve in 2017 but expand at a pace below its historical rate.

By the end of 2019, the overnight lending rate is expected to reach its neutral rate between 2.8 and 3 percent, Strauss says.

Last year was favorable for trucking employment, accounting for about 1.5 million jobs according to Dieli.

Employment in general freight, which moved about 69 percent of all goods last year, reached just more than 1 million. Long distance truckload jobs hit about 525,000 last year, well down from 550,000 posted pre-recession.

“The trend has been upward, but nowhere near as rapid and not to the level we had previously,” Dieli says.