Veritable Vegetable, an organic produce distributor based in San Francisco, uses the Kenworth TruckTech+ Remote Diagnostics service. Proactive maintenance alerts are sent to its local dealership, NorCal Kenworth.

Veritable Vegetable, an organic produce distributor based in San Francisco, uses the Kenworth TruckTech+ Remote Diagnostics service. Proactive maintenance alerts are sent to its local dealership, NorCal Kenworth.The costs of planned versus unplanned downtime are miles apart.

When a vehicle has an unexpected service event, a fleet loses between $700 and $1,500 a day in revenue, and pays extra for repair costs since technicians have to go through trouble-shooting diagrams, or trucks have to wait for maintenance bays to open up and for parts to arrive.

To keep downtime to a minimum, fleet managers have to know what problems may be developing far enough in advance to flip an unplanned maintenance event into a planned event. Critical to this process is to understand the risks of when, and for how long, a vehicle can safely operate before it needs service.

Tom Howard gets email alerts whenever his fleet of Kenworth T680s or T880s detect issues that require servicing.

As fleet director of Veritable Vegetable, an organic produce distributor based in San Francisco, he uses the Kenworth TruckTech+ Remote Diagnostics service. Alerts are also sent to his local dealership, NorCal Kenworth.

“Kenworth TruckTech+ helps us avoid all these hassles by allowing us to determine if there’s an easier fix or if the truck can be driven to a Kenworth dealership instead of having it towed in. That’s great for our company’s bottom line,” he said.

Truck manufacturers and dealers have become predictive fleet maintenance information and service providers. With wireless connections to vehicles, and powerful data analytics, they are able to accurately diagnose problems remotely and initiate actions plans to help their customers maximize uptime.

CCJ recently got an exclusive, behind-the-scenes look at what actually takes place inside a truck manufacturer and its dealer network to supply motor carriers with the right information and services to make real-time business decisions for vehicle maintenance.

Accurate diagnosis

Virtually any telematics device is able to connect to a vehicle’s Controller Area Network (CAN bus) to capture and transmit diagnostic trouble codes (DTCs). However, these codes in raw format are practically useless for fleet operators, drivers and technicians to make decisions.

Fleets can receive a vehicle health report via Navistar’s OnCommand Connection every morning.

Fleets can receive a vehicle health report via Navistar’s OnCommand Connection every morning.In the past few years, truck manufacturers and dealerships have been able to solve very complex data challenges needed to accurately diagnose problems remotely and take the necessary actions to maximize uptime.

Many DTCs that appear do not actually require immediate service. Vehicles can keep moving without fear of breaking down. Some codes also randomly appear and disappear, creating “false positives” that might lead fleet managers to send drivers to the shop for an unnecessary diagnosis, however.

In 2015, Volvo Trucks North America (VTNA) implemented a software platform from SAS to solve a data challenge and offer expanded services to its customers. In addition to the new, broader telematics system with SAS, the OEM strove to increase efficiency and improve uptime by filtering out false positive error codes, and to accurately diagnose problems and send meaningful alerts to customers and dealerships to expedite repairs.

Now when a truck comes in, dealers are able to skip the process of hooking up a diagnostics tool as this step is completed remotely. “We are able to drill down and pinpoint what the issue is based on the data we receive from the telematics platform. And when we do that, we take the risk,” says Mark Curri, VTNA’s senior vice president of uptime and customer support. “If we are wrong, we will still make good on it. We are taking the risk away from the customer. Only the OEM can do that.”

Certain DTCs, such as from a vehicle’s emissions system, will cause a de-rate condition if the problem is not fixed in a timely manner. OEMs understand the conditions with a high probability of escalating to a de-rate situation, says Joe Edmonds, project manager of Connected Services for Navistar.

Navistar’s remote diagnostics service, OnCommand Connection (OCC), has a Fault Code Action Plan that gives its fleet customers insight into the probability of a failure for each event. With this information, fleets are able to make a decision about when and where to send trucks for service.

“Aside from physical damage there are virtually no conditions that would result in a de-rate if the vehicles are being properly managed,” he says.

With data analysis Navistar has also been able to combine faults for a specific condition to determine the probability of a specific failure. As one example, the company is able to predict the failure of AC compressors with such a high confidence that it is paying for warranty replacements before the part fails, he says.

Inside the Uptime Center

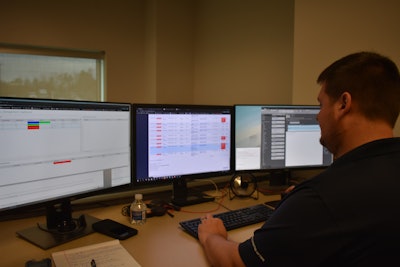

Bobby Weisneck, supervises the remote programming and diagnostics team in Volvo’s Uptime Center.

Bobby Weisneck, supervises the remote programming and diagnostics team in Volvo’s Uptime Center.On Friday, Dec. 6, CCJ had an exclusive opportunity to interview employees on the front lines of Volvo Trucks’ Uptime Center to find out how they turn information into an “action service.”

Employees in the Uptime Center are structured within departments that support a customer-facing group called Volvo Action Service. This group has about 55 employees who monitor and manage the maintenance needs of the OEM’s fleet and owner-operator customers, from start to finish.

Volvo’s Uptime Center’s integrated support staff includes specialists in parts ordering, warranties, product reliability, body builders, ECU programming, dealer IT support and more.

“It’s been quiet today,” says Bobby Weisneck, who prefers working from a stand-up desk. He supervises the remote programming and diagnostics team in the Uptime Center.

Before CCJ started the interview, an employee from the Dealer IT support group came to Weisneck’s desk to ask for help with solving an issue. This type of cross-departmental interaction on the floor is an example of why VTNA brought everyone together in one building for customer and dealer support.

Everyone in the Uptime Center uses a cloud-based platform, Volvo ASIST, to stay connected with all parties involved in a service event or “case.” Alerts sent to a fleet manager via email or directly to a cell phone app when a DTC occurs initiate a case.

“A lot of times we notify the fleet before the driver knows there is a problem,” explains Eric Swaney, manager of connected vehicle uptime solutions.

Weisneck, a former diesel technician, has many cases in his work queue. None of the cases involve critical “red” fault codes; those were resolved quickly, within 30 minutes. Examples of a red code include trucks with a low coolant level or high oil temperature, he says.

Many non-critical yellow code events can be corrected with a software update, he explains. Others may need a sensor to be replaced. For software updates, Weisneck is able to program ECUs that include engines, transmissions and some vehicle parameters over the air.

More than 250,000 connected trucks from Volvo are on the road today, dating back as far as the 2012 model year. Using the Volvo ASIST software, Weisneck sends customers an email or phone call to set up a date and time to run the programming.

“Normally, they will call in and we’ll do it right then and there,” he says.

With wireless connections to vehicles, and powerful data analytics, OEMs and dealers are able to accurately diagnose problems and initiate actions plans to help fleets maximize uptime.

With wireless connections to vehicles, and powerful data analytics, OEMs and dealers are able to accurately diagnose problems and initiate actions plans to help fleets maximize uptime.Weisneck says his group programs a range of trucks each week. Since Volvo introduced remote programming to the market in mid-2018, the OEM has completed approximately 7,300 cases.

If a customer is routed into a dealership for repair, the diagnostics information in the case file is visible to technicians to speed the repair. The connected service has reduced diagnostics time on the shop floor by 70 percent, says Ash Makki, product marketing manager of connectivity.

Before a case is closed, the technician reports how the problem was fixed within ASIST. The information is used by the SAS platform to improve the accuracy of diagnostics.

Looking under the hood

Reducing diagnostics time is only part of the solution. VTNA has been able to reduce repair times by more than 20 percent now that trucks are routed to dealerships with a diagnoses on file and have the right parts on hand, Makki says.

Bryan Martin, an uptime support business analyst, receives inbound calls through the Volvo Action Service for items that are not triggered by remote diagnostics.

Bryan Martin, an uptime support business analyst, receives inbound calls through the Volvo Action Service for items that are not triggered by remote diagnostics.Volvo Trucks North America’s dealerships in 90 percent of the major markets are Certified Uptime Dealers, meaning they have dedicated lanes to handle cases that require both basic and advanced repairs.

Bryan Martin, an uptime support business analyst, says his work queue has also been “pretty clear today,” when interviewed by CCJ. Martin receives inbound calls through the Volvo Action Service for items that are not triggered by remote diagnostics. Examples include blown tires, dead batteries and broken air lines. He says he works multiple cases at a time.

Through Volvo ASIST he has access to vehicle telematics data, if a truck with an event uses a telematics system from Volvo. As an example, Martin showed CCJ a case he resolved two days ago. A driver called in to say his truck had shut down and was overheating.

Martin looked at the telematics data, which showed the truck had plenty of coolant but the temperature was high.

“That means it must have been a fan clutch or fan belt,” he says. In this and other cases, Martin looks for signifiers to diagnose problems remotely before he dispatches technicians to make roadside repairs.

The customer profiles in ASIST have detailed information about how each fleet wants to handle cases. Some want Volvo Action Service to call a manager for approvals during office hours and pre-authorize emergency road calls outside normal office hours.

Martin showed how he uses ASIST to locate dealers and preferred vendors in the customer’s area. He also can check inventory at dealers for parts availability. And by keeping the service record in ASIST, six months down the line if the same part had to be replaced again, the system keeps track of warranty details to help the customer.

“We manage the case from end to end,” he says.

RushCare manages the end-to-end customer experience from diagnostics through repair.

RushCare manages the end-to-end customer experience from diagnostics through repair.Because fleets typically do not operate only one vehicle brand, some dealerships now offer remote diagnostics and maintenance services that are compatible for all vehicles.

The largest dealership for several OEM brands is Rush Truck Centers. Its remote diagnostics service, RushCare, brings together telematics data from OEM-installed devices as well as from an independent telematics devices it uses from Geotab.

Rush Truck Centers developed proprietary software to bring telematics data in from any source to have one platform to proactively manage its customers’ remote diagnostics and breakdown maintenance, says Cindy Hunter, technology sales director.

RushCare manages the end-to-end customer experience from diagnostics through repair. A dedicated concierge team monitors fault codes and receives calls from customers to schedule preventive maintenance to one of the company’s facilities. The team keeps the customer updated throughout the entire process, says Chad Wellborne, general manager of RushCare.

Expanding connected trucks

OEMs and dealerships are analyzing all the data they can to improve customer service, uptime and their physical products as well.

Diamler Trucks uses its telematics data to inform its design and product development process, says Sanjiv Khurana, general manager of digital vehicle solutions. One of the benefits of having constant feedback from connected truck data streams is for engineering to improve vehicles’ advanced safety systems.

“Our engineering teams have visibility to specific cases across the country where we have the most critical safety events,” he says. “Using this information and insights, our engineering teams works to constantly improve and refine our trucks’ advanced safety systems and algorithms.”

Perhaps David Pardue, vice president, connected vehicle and contract services for VTNA, summarized the evolution of aftermarket services the best. Fleets are not just buying equipment from OEMs anymore. They are buying uptime from data analytics companies.

“We are an analytics company that happens to build trucks,” he says.