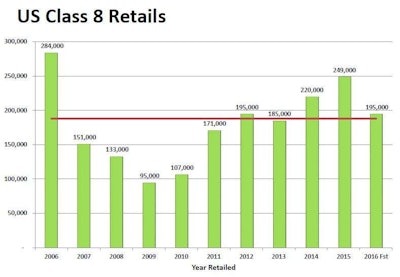

2014’s and 2015’s high truck build numbers will flood the used market starting next year, Clough said, which will put downward pressure on used truck pricing until 2019 or 2020.

2014’s and 2015’s high truck build numbers will flood the used market starting next year, Clough said, which will put downward pressure on used truck pricing until 2019 or 2020.Given the high truck build rates in 2014 and 2015, the market for 3- to 5-year-old tractors is set to be flooded in the coming few years, a supply-side pressure that will continue to put downward pressure on used truck prices, said Arrow Truck Sales President Steve Clough.

“Used truck supply goes a long way in determining the environment” for pricing, Clough said. “The supply of used trucks has already been determined based on what was retailed 3, 4 and 5 years ago. That’s a wall of inventory that’s coming.”

Clough spoke Thursday, Sept. 15, at the 2016 FTR Conference in Indianapolis, Ind.

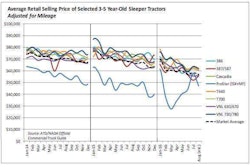

He said as of July, prices for 5-year-old tractors (2011 model) were down about 15 percent year over year, 4-year-old (2012) tractors were down 16 percent and 3-year-old (2013) tractors were down 18 percent.

“The amount of trucks I anticipate coming back as used trucks for the first time will continue to grow,” he said. “It will probably peak in 2019 or 2020. Increasingly, supply will continue to put downward pressure on pricing.”

In recent years, used truck pricing had been accelerating, as the low truck builds of the Great Recession and after — 2008, 2009 and 2010 — capped the used market’s supply. The new truck build rates of those years caused a “shrinking, shrinking, shrinking” supply until 2013, Clough says, when the market stabilized some.

Used truck demand jumped into the pricing equation in 2015, when freight and rates began fizzling. Since the middle of last year, both truck supply and truck demand caused used truck prices to begin tumbling.

“Spot rates affect used truck buyers more,” Clough said, “because they tend to work that market more.”