The 1970s OPEC oil embargo led to panic fuel buying and long lines at gas stations. What was less obvious was that it cemented the growth of higher efficiency imports from Japan, Germany and other countries. Within a decade, the mighty Detroit Big Three were struggling, facing bankruptcy and rapidly ceding market share to the upstart imports.

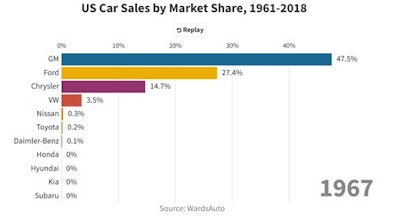

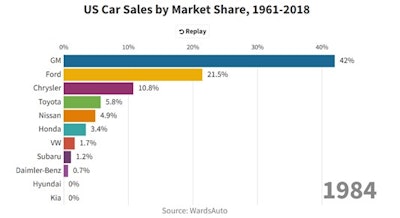

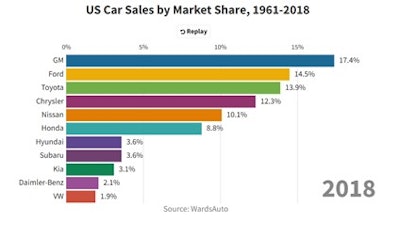

I came across this great Ward’s animated bar chart on U.S. annual market share by manufacturer from the American Enterprise Institute detailing trends since 1961. Below are three snap shots for 1967 and 1984 and then 2018 of how the Big Three lost market share over failing to adapt to real-world demands for better quality, less expensive and more fuel-efficient cars. And by being slow to evolve from the muscle car paradigm that had been so profitable to them for years.

A 2011 New York Times article by John Huffman aptly described Detroit’s reaction to imports as “in answering that challenge, American automakers were by the end of 1970 producing three of the most notoriously awful cars ever built — the American Motors Gremlin, Chevrolet Vega and Ford Pinto — and opening the door for the Japanese onslaught of the 1970s and 1980s.”

It’s somewhat ironic that we are now seeing this same arrogance from what is now the Big Four, including Toyota, while upstarts like Tesla and Rivian are gobbling up market share.

Failure to learn from history means it gets repeated. It’s a familiar saying in multiple forms. When a CEO of a major OEM announces they will not build a particular car because they can’t figure out how to make money off of it, and another stops production of a successful new model to focus on older technologies, it begs the question: where did these managers get their history lessons?

History is replete with similar industry examples where established companies failed to adapt to new market demands that were readily filled by new players. It stretches the imagination on the value of an MBA degree when such obvious past examples, in their own companies, are readily available.

One of the industries I’ve dabbled in is aerospace. In the 1940s, accelerated by the war, companies like Lockheed, Northrop, Bell, Grumman and more pumped out new technology aircraft at a phenomenal speed. The engineers at these companies became very experienced at what they did, so much so that in the post war 1950s they were still able to design and produce radically new planes relatively quickly. Over decades, those people retired, leaving new people with ideas and new technologies, but now one engineer may spend an entire lifetime trying to get one plane into production. The learning curve has changed dramatically for aircraft.

Truck makers have seen radical shifts in market share as well. Company brands like Ford’s Louisville, White, Marmon, Western Star, and others either ceased production or were swallowed up in mergers and acquisitions. Caterpillar chose to exit the Class 8 on-highway market all on its own, ceding it to Cummins and the various OEM in-house engine brands. Navistar managed to stumble on its own and cede huge market dominance to Daimler, PACCAR and Volvo. Lessons are out there on “how to fail” as well as “how to succeed.”

Rivian is likely thanking Ford for deciding to stop production of its Lightning pick-up truck and likely thanking those reluctant Ford dealers for not embracing EVs, as Rivian will undoubtedly win sales. The same could be true for Stellantis and Toyota, who seem resolved to lose EV market share to Tesla, Rivian, BYD, and others.

Sure, CEOs have a lot on their minds, balancing making money now with being in existence later. The automotive sector has a tremendous history seeking bankruptcy protection and rebranding, like a phoenix rising from the ashes such as when Lee Iacocca went big on the Chrysler mini-van and K-cars, and Ford went big on the Taurus. Those bottom-of-the-ninth inning home-runs are hard to find. I wish the Big Four luck.

The Class 2b through Class 8 market is watching the automotive world with both excitement and trepidation. But here, too, there are established giants like Daimler, Volvo, PACCAR, and Navistar facing rising competition from fledglings like Tesla, Nikola, Hyundai, and seemingly many others. New “potential truck makers” seem to pop into the news monthly.

It’s interesting to note that Daimler, Volvo and PACCAR dove headfirst into launching production Class 8 EVs, beating Tesla to production. They’ve all been going through some re-organization to sincerely tackle this new heavy truck zero-emission market. They even have partnered on battery development and seem agree on charging standards. Navistar jumped in on medium-duty trucks with the others, as well. While they still all make a good deal of cash off of diesel-based products, it seems like they recognize the risk of not actively participating in leading the market forward.

Quite frankly, I expect a wave of mergers and acquisitions in the future as there just are not enough annual truck sales to support in excess of 10 Class 8 manufacturers. Like the applicants for the Navy Seals team, look to your left and to your right, only one of you will be there in the end. That consolidation may be years in the making, but it will happen. Annual market demand of 300,000 to optimistically 400,000 Class 8 trucks split 10 ways would be 40,000 units a year, and that is not big enough to impress capital investors. There will be big pieces of the market share pie owned by just a few, and the rest will get crumbs.

Ten or 20 years from now, the heavy-duty truck market share graphs may have some new names just as Detroit’s Big Three saw happen with imports.