Following a pilot program in 2022, freight coordination platform Leaf Logistics has found a way to eliminate 76% of empty miles from unloaded trucks driving on the road by coordinating multi-shipper moves across the transportation grid at scale.

Leaf has expanded its product offerings to include Flex Fleets, a multi-shipper dedicated trucking fleet, to solve for wasted truck capacity, which in turn has reduced environmental impact and driver turnover.

Today’s shipper-carrier game involves companies sending out requests for proposal to a multitude of carriers and brokers with the received rates ranked and executed in order. But Leaf Logistics CEO Anshu Prasad said that results in everyone managing just their lanes on a transactional basis instead of via contract, making it difficult for carriers and brokers to coordinate loads because there’s no commitment of capacity.

“We don't see the same carrier in use between Johnson & Johnson and its packaging vendor, so the chances they are using the same truck to deliver empty packaging in and then take Listerine out of J&J and get it to Walmart, it just doesn't happen,” Prasad said. “That coordination, or lack of, leads to a third to half of the truck capacity in the U.S. being wasted every day, and that's just a huge problem for all of us.”

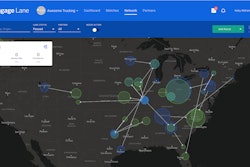

Shippers J&J, BASF and Party City have already joined Flex Fleets, which leverages Leaf Adapt technology to analyze data from more than 450 big shippers in the U.S. to coordinate multi-shipper moves. Leaf applies machine learning to compare a shipper’s demand profile against its transportation network to establish patterns and club together volume to reduce rate volatility and save on shipping costs.

With that data, Flex Fleets connects loads to reduce empty miles.

“If we know that there's three trucks a day in April going from L.A. to Phoenix on a schedule because it's contracted, that allows us to connect that load with other loads,” Prasad said. “Leaf sees other demand with other shippers that syncs up perfectly and allows that truck not just to get back but to get back loaded … These network moves were set up at a macro industry level – we like to call it the grid level – to see and orchestrate. There are a thousand times more opportunities like this with other shippers than any shipper has internally, so this becomes a sort of air traffic control role for Leaf to play, which leads directly into the Flex Fleets where in multiple areas of the country we see pockets of demand across multiple shippers that can keep fleets of trucks and drivers busy over a period of time.”

Flex Fleets gives shippers access to flexible, dedicated service in several regions across the United States with the agility of market contracted freight by allowing shippers, carriers and brokers to schedule fleets months ahead of time to lock in capacity, which Prasad said is typically 10% or more cheaper for shippers while providing higher margins for trucking companies. It also allows the shipper to scale as demand rises without having to purchase or lease their own fleet; they currently commit to fleets for years and have to pay for maintenance, regardless of utilization. Flex Fleets improves carrier asset utilization and brings cost efficiencies that save shippers up to 30% on their line haul costs and eliminate retailer late fees through 99.9% on time performance.

Participating carriers benefit from a dedicated stream of business and therefore budget certainty and consistent schedules without having to repeatedly bid. Prasad said Leaf is working on additional technology to better engage carriers and brokers when they show demand in a certain market.

“We map those areas of need against the demand picture and say, ‘We can soft circle a bunch of demand that will get your trucks and drivers back where you need them,’” he said. “That's the way we start to build stronger relationships on the supply side. We have this unique view of demand and how it flows over time that carriers can use to really balance or even grow their networks … If they have a book of business with J&J that they know is theirs for the next nine months, they can more confidently go out and buy trucks and trailers to expand their fleet.”

Prasad said Flex Fleets is also a very driver-friendly solution. It eliminates driver downtime and fleet empty miles (40% of all trucks on the road today ride empty), which in turn helps drivers earn more. He said it also allows them to work in a preferred location in a repeatable capacity, providing favorable schedules and guaranteed work and rates for months or years at a time.

“The more the trucks are rolling, asset utilization is obviously better for the trucking company, but if they're rolling with freight, the driver gets paid more, so driver pay has actually doubled in this fleet (example),” Prasad said. “Not only that, the drivers are staying home at night, and that's a huge tool for retention. So the drivers and the trucking companies that we work with, driver turnover is in the single-digit percentages, and in our industry it has ranged from 150% to 300% over the last 10 years.”

Sage Freight has seen driver turnover drop from 75% to 15% or less on dedicated freight.

“Sage Freight’s foremost priority is our people — our brokerage team and the carriers we work with,” David Norman, COO at Sage Freight, said in a news release. “Access to consistent and desirable freight is exactly what we want to give our driver partners. Through our partnership with Leaf, we’ve been able to offer our carriers high-quality freight, predictable schedules and coordinated multi-shipper moves that make empty backhauls a thing of the past.”

Prasad said Leaf is scaling its partnerships rapidly, expanding the amount of volume it manages by five times last year alone. Its Flex Fleets currently operates in eastern Pennsylvania, upstate New York, Atlanta, Dallas and Stockton, California, with a deployment roadmap for additional regions in the works with current customers. While there are dozens of opportunities based on density and demand, he said it’s more about coordination and what the “network or relay points of yards look like.”

The goal is to have Flex Fleets serve all major markets by year end, he said.