Businesses are inherently risky. It’s the core nature of market-based systems. It’s how investors make or lose money. Essentially, it's gambling.

New businesses come and go every day. Even well-established companies with huge brand recognition suddenly find themselves in bankruptcy because the market changed.

In writing the NACFE report Intermodal and Drayage: An Opportunity to Reduce Freight Emissions, I came across some examples of the term “stranded assets,” where the market shifted unexpectedly and left capital investments unfulfilled.

Trains made the U.S. economy. Railroads created a network connecting suppliers and consumers all over North America that enabled many industries to flourish. Rail’s need for steel and coal influenced investment in mills, mines and all the associated infrastructure, including ships and ports on the Great Lakes. Rail was so influential that more than once, investment speculators created stock market and real estate bubbles and crashes that impacted the entire nation’s economy.

The amount of rail trackage in the U.S. peaked in 1916 at over 250,000 miles. Today the estimate is 137,000 miles. The U.S. Surface Transportation Board has a map of the abandoned trackage. But abandoned trackage is more than just wooden ties and rails.

Let me introduce an old term: “tank town.” When the U.S. was expanding and rail technology was based on burning wood to make steam, designers were faced with the issue that all that steam required water to be carried on the train, and that steam was exhausted to the air as the train ran and had to be frequently replenished.

Train system designers had to make trade-offs regarding range and tare weight versus how much water and wood (fuel) could be carried. Very early trains required fuel and water nearly every 10 miles. As train technology matured, the rail industry settled on roughly 100-mile increments between fuel and water stops.

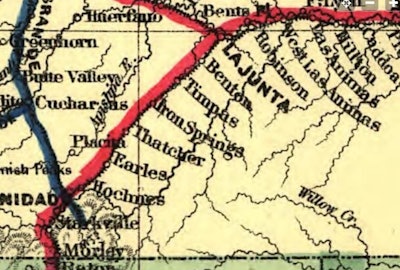

An 1883 example of the Sante Fe railroad courtesy of the Library of Congress shows stops being very uniformly distributed along the rail line. The towns sprung up around these stops and became known as “tank towns.”

Map of the Sante Fe rail.Library of Congress

Map of the Sante Fe rail.Library of Congress

As train technology evolved into coal-powered steam engines capable of higher speeds and distances, some of those tank stops were abandoned. Later the technology changed to diesel-electric, carrying thousands of gallons of fuel and capable of going hundreds of miles between fuel stops. More tank towns were by-passed.

The diesel-electric trains did not need as much maintenance, so engine repair facilities could also be spread further apart or consolidated. The infrastructure for providing coal to railroad stations also disappeared. The U.S. highway system and freight industry deregulation combined to create competitive alternatives to rail, often bypassing tank towns entirely.

Some tank towns disappeared into history. Other evolved and adapted, finding alternative businesses and practices.

Stranded assets are those capital investments that fail to have their projected economic lifespan. Abandoned rail lines common in the U.S. are examples of a stranded asset. Abandoned rail lines also impacted entire towns and regional economies.

Diesel trains and trucks today depend on oil drilling, refineries and a distribution network that includes massive storage tanks, extensive pipelines, refineries, tanker ships, tanker trucks and dispensing stations. Vehicle manufacturers have complex supply chains with worldwide footprints to support building products. Over a century of infrastructure and technology development has built a simply massive amount of capital investment assets to support gasoline and diesel use in transportation.

Capital investments have life spans. They are tools that age with time and use. In time, they need replacement and reinvestment. The electric grid is no different than the oil industry.

Take, for example, the simple yet ubiquitous power pole. Often made of wood, these poles have born-on-dates and expiration dates. They weather and age, and they are impacted by catastrophes like tornadoes and floods. Utilities have to plan for the replacement of these assets. Sometimes they can do life-extensions by adding supports, other times they have to replace them with new poles. I discovered at a DistribuTECH International utility conference that power pole asset management is pretty sophisticated, with geospatial heat mapping by age and condition, drone monitoring and surveillance and predictive maintenance software.

But what if the power poles are replaced with underground wiring? All those poles become stranded assets. Just as fuel pipelines may become stranded assets in a zero-emission transportation world. Those challenges have been faced by telecoms, where copper overhead telephone lines have been sequentially replaced by underground fiber optics and then cellular towers.

Assets stranded by technology and market shifts will occur. That is the inherent risk with capital investments. Timing, however, is everything. As assets age, they need more repair and replacement. The switch from coal-powered steam trains to diesel electric ones in the 1950s was largely enabled by increasingly old steam assets needing replacement. At that time, many of the steam engines were nearing 50 years old, and the service and repair infrastructure was equally aged. Diesel-electric trains were an opportunity for many railroads to make new capital investments that could significantly reduce operating costs on a number of levels.

Today, Zero-emission vehicles are presenting truck fleets with similar opportunities. There are a considerable number of older trucks in operational use. Maintenance and repair facilities may also be aging. The workforce – drivers and technicians – also appears to be aging and retiring with fewer new faces entering the employment pool.

New technologies will continue to evolve, rapidly improving performance and reducing cost. Older technologies are at a different stage of maturation where more performance generally means more cost and complexity with decreasing cost-benefit ratios.

Are there going to be stranded assets because of zero-emission vehicles? Undoubtedly, yes. Older technologies will be abandoned for newer ones and those newer technologies will also find their economic lives cut short by rapid innovations. Just as was seen in the history of railroads and telephones.

Those fleets and manufacturers that can better time capital investments to retire older technologies will be better equipped to minimize market risk.