FMCSA wants EOBRs for interstate carriers

Plan would apply to all carriers that use logbooks

All interstate commercial truck and bus carriers that now use records of duty status (RODS) to track compliance with hours-of-service regulations would have to use electronic onboard recorders under a proposed regulation issued Jan. 31 by the Federal Motor Carrier Safety Administration. The proposal would relieve carriers of the current requirement to retain certain HOS documents, such as delivery and toll receipts, that now are used to verify the number of hours the vehicle is in operation. About 500,000 carriers would be affected by the proposed rule, FMCSA said.

In addition to eliminating logbooks, FMCSA’s proposal to require EOBRs would relieve interstate carriers of the current requirement to retain certain HOS documents, such as delivery and toll receipts.

In addition to eliminating logbooks, FMCSA’s proposal to require EOBRs would relieve interstate carriers of the current requirement to retain certain HOS documents, such as delivery and toll receipts.Last year, the U.S. Court of Appeals for the District of Columbia ordered FMCSA to issue a notice of proposed rulemaking (NPRM) on HOS supporting documents by yearend. In December, the court gave the agency another month – until Jan. 31 – to comply. The court order stemmed from a lawsuit the American Trucking Associations filed more than a year ago to compel FMCSA to move forward with a regulation as mandated by Congress in the mid-1990s.

By the time ATA filed its lawsuit, FMCSA already had announced that it was planning to link new regulations on supporting documents to an expansion of the EOBR mandate. In April 2010, FMCSA issued a final rule requiring carriers that have a history of serious log violations to install EOBRs. That rule takes effect in June 2012.

“We cannot protect our roadways when commercial truck and bus companies exceed hours-of-service rules,” Transportation Secretary Ray LaHood said. “This proposal would make our roads safer by ensuring that carriers traveling across state lines are using EOBRs to track the hours their drivers spend behind the wheel.”

Although ATA did not issue a formal statement on FMCSA’s proposal, ATA President and Chief Executive Officer Bill Graves did address it in a speech last month to the members of the Technology and Maintenance Council, which was meeting in Tampa, Fla. Graves said carriers should accept the inevitability of an EOBR mandate and begin embracing the technology. Citing studies that show positive correlations between companies that log driver hours electronically and the overall safety of those companies, Graves said it is difficult for ATA to oppose such a mandate.

“We are on that glide path today where every vehicle very soon will be required to use electronic logging,” said Graves. “As much as we still have individuals in our industry unwilling to embrace electronic logging, it is simply going to happen.”

In the NPRM, interstate carriers that currently use RODS logbooks to document drivers’ HOS would be required to use EOBRs. Short-haul interstate carriers that use timecards to document HOS would not be required to use them. Carriers that violate this EOBR requirement would face civil penalties of up to $11,000 for each offense. Noncompliance also would negatively impact a carrier’s safety fitness rating and Department of Transportation operating authority.

“This proposal is an important step in our efforts to raise the safety bar for commercial carriers and drivers,” said FMCSA Administrator Anne Ferro. “We believe broader use of EOBRs would give carriers and drivers an effective tool to strengthen their HOS compliance.”

Last year, U.S. Sens. Mark Pryor (D-Ark.) and Lamar Alexander (R-Tenn.) introduced legislation that would have required all interstate carriers to use EOBRs. The measure won the support of a new coalition, The Alliance for Driver Safety & Security, which was formed by J.B. Hunt, Knight Transportation, Maverick USA, Schneider National and U.S. Xpress. The bill died at the end of the 111th Congress.

Under a preliminary regulatory analysis released by FMCSA, the total costs of EOBRs – the cost of the devices themselves plus the productivity loss due to stricter compliance with hours-of-service regulations – would barely exceed the paperwork savings the agency estimates from no longer having to maintain paper logs and supporting documents. Excluding the productivity losses, FMCSA projects that the paperwork savings would exceed the cost of EOBRs themselves by $379 million industrywide. Almost all the net benefits of the rule flow from the anticipated safety benefits.

The proposal, supporting documents and comments are available at www.regulations.gov by searching FMCSA-2010-0167. Also, DOT is working with Cornell University on gathering public comment as part of the department’s e-Rulemaking Initiative. For more information, go to www.regulationroom.org.

– Avery Vise and Jeff Crissey contributed to this article.

Annualized costs and benefits (in millions)

EOBR cost $1,586

HOS compliance cost $398

Total costs $1,984

Paperwork savings $1,965

Safety benefts $734

Total benefits $2,699

Net benefits $715

Source: FMCSA Preliminary Regulatory Analysis. Assumes the regulation applies to all interstate

motor carriers that use records of duty status to manage drivers’ compliance with hours-of-service regulations.

IN BRIEF

* A federal truck weight reform bill known as the Safe and Efficient Transportation Act was reintroduced in the U.S. House of Representatives as H.R. 763. Under SETA, each state would have the option to set interstate weight limits of up to 97,000 pounds.

* FTR Associates reported that January Class 8 truck total net orders for all major North American OEMs were 27,009 units, a 1 percent increase over the strong December 2010 activity and a 324 percent increase from January 2010 (6,400 units).

* FreightWatch reported in its annual Global Threat Assessment that the volume of cargo theft grew throughout the western hemisphere in 2010, resulting in billions of dollars in direct losses, downstream costs and derailed efficiencies.

* The inventories-to-sales ratio in December was 1.25 – essentially unchanged from November on a seasonally adjusted basis, according to the U.S. Census Bureau.

* Spot market freight volume was the highest in TransCore’s 30-year history for the month of January, according to the company’s North American Freight Index. TransCore says the spot freight market experienced a year-over-year 62 percent increase in truckload freight availability in January and set a record for same-month volume.

* Intermodal market share declined by 0.2 percent in the fourth quarter of 2010 after steady increases for the previous three quarters, according to FTR Associates. The fourth-quarter 2010 share was 1.7 percent higher than the fourth quarter of 2009.

* TransCore’s CarrierWatch CSA 2010 Industry Report found that larger carriers had significantly lower BASICs than smaller carriers. The report, which was based on goverment data published Dec. 12, also found that carriers based in certain states appear to be scored more stringently than carriers based in other states. The report can be downloaded for free at www.transcorefreightsolutions.com.

* The Q1 2011 Fleet Sentiment Report Buying Index as reported by CK Commercial Vehicle Research rose to a new high of 102.3. In January 2011, 58 percent indicated they were planning to place orders for power equipment during the next three months, and 42 percent planned to place trailer orders during the same period.

* The Pipeline and Hazardous Materials Safety Administration and the Federal Motor Carrier Safety Administration are proposing to prohibit a motor vehicle driver from entering onto a highway-rail grade crossing unless there is sufficient space to drive completely through the grade crossing without stopping. Comments may be submitted at www.regulations.gov; the docket numbers are PHMSA-2010-0319 (HM-255) and FMCSA-2006-25660.

* The California Air Resources Board initiated the second year of grants totaling $19 million under the Hybrid Truck and Bus Voucher Incentive Program. For more information, go to www.californiahvip.com.

* The Freight Transportation Services Index rose 1.5 percent in December from its November level, the U.S. Department of Transportation’s Bureau of Transportation Statistics (BTS) reported.

* Volvo Trucks North America announced that it will present the Volvo Trucks Safety Award for the third year. The award, which also is sponsored by Michelin, is open to all U.S. and Canadian fleets operating at least five Class 8 units. Fleets must have at least one Volvo tractor in operation. For more information and the entry form, go to www.volvotruckssafetyaward.com.

* Werner Enterprises Inc. announced that Gary Werner, 53, will replace Clarence L. “C.L.” Werner, 73, as chairman in May. C.L. Werner will become chairman emeritus and continue to serve on the board. Gregory Werner, 51, will become vice chairman and remain chief executive officer. Also, Derek Leathers, 41, will become president and chief operating officer.

* US 1 Industries Inc. agreed to be acquired by Trucking Investment Co. Inc. – an entity formed by US 1’s senior executives.

HOS Listening Session:

Speakers support status quo

Trucking industry executives speaking at a Feb. 17 meeting to discuss proposed hours-of-service changes urged the Federal Motor Carrier Safety Administration to retain the current regulations. In a listening session and webcast organized by FMCSA, representatives from carriers and trucking groups said proposed changes wouldn’t lead to improvements and would complicate requirements for companies and drivers alike.

Dave Osiecki, head of policy and regulatory affairs for the American Trucking Associations, said the HOS proposals aren’t the best way to address cost-benefit solutions for fatigue among truckers. Osiecki pointed out FMCSA isn’t following sound safety research in making the proposed changes. He called the 34-hour restart change an “unjustified overreach” of the regulation.

“The current rules are working,” Osiecki said, adding FMCSA should withdraw the HOS proposal issued Dec. 23. “To better address the causes of fatigue in transportation and trucking, the FMCSA should focus its expertise, energy and resources on sleep disorder issues, including screening and training, and promote use of fatigue risk management programs.”

Don Osterberg, senior vice president of safety and security at Schneider National, said the proposed changes wouldn’t enhance safety. “It certainly won’t make it worse. I don’t think you can say it will improve safety, either,” he said to FMCSA staff members attending the Washington, D.C.-area listening session.

Referring to the impact of the proposals on business, Osterberg said productivity would drop 4.72 percent. Schneider drivers would get home 25 percent less under the proposal, he said. The average daily mileage would fall from 501.7 miles to 478. To compensate for that loss, the company would have to increase driver pay by $3,000 annually to offset the productivity decline, Osterberg said. “We will have to increase driver pay anyway [because of ongoing supply and demand], but that would be a component that would add cost to the supply chain,” he said.

On the restart provision, Osterberg said, “I don’t believe the restart proposal will have a significant negative impact on productivity. It will be a nuisance. The average restart break our fleet takes is 62 hours.”

Osterberg also made a pitch for the electronic onboard recorder mandate proposed by FMCSA on Jan. 31. “Let’s measure the compliant driver by the effects of the current hours-of-service rules, and if they need to be changed, change them then,” he said.

Bob Petrancosta, vice president of safety at Con-way Freight, contended the proposed rules would hurt drivers, the environment and the economy without improving safety. He said under current HOS rules, his company’s reportable accident rate has remained stable.

“By reducing the number of hours drivers can operate every day, it would necessitate the use of more vehicles, which will lead to greater traffic congestion,” Petrancosta said. “Further, reduced industry capacity will result in higher shipping costs, which we will have to pass on. Reducing the work day from 14 to 13 hours will result in less wage-earning capability for our drivers. While the individual driver may be earning less, our company costs will increase as more drivers are needed.”

Todd Spencer, executive vice president of the Owner-Operator Independent Drivers Association, reiterated the need for rules flexibility for drivers. Spencer also cited the negative role of shippers and receivers on drivers’ schedules, health, safety and fatigue and their ability to comply with HOS regulations. “The overwhelming majority of drivers are not happy with any reduction in available driving time, the mandatory half-hour break or the two overnight midnight-to-6 a.m. rest periods required for their 34-hour restart provision,” he said.

Spencer added that some OOIDA members suggested that if a reduction in driving time should be considered, it should be focused on newer drivers with less experience and those more likely to get into accidents.

Just before the listening session, FMCSA placed three additional documents in the public docket concerning the cumulative fatigue function, coefficient estimates and an explanation of coefficient names as requested by ATA; and an Excel spreadsheet containing data using the formula in the HOS Regulatory Evaluation to link the hours worked in the previous week to fatigue the following week.

Also just before the session, ATA released an independent review of FMCSA’s hours-of-service Regulatory Impact Analysis that found the agency overstated the proposal’s benefits. The Edgeworth Economics review argued that while FMCSA states its proposal would result in up to $380 million in annual benefits, the proposal actually would result in net costs, and not benefits, of about $320 million a year. According to the study, FMCSA made unreasonable assumptions about the safety of the trucking industry by sampling only carriers it subjected to a compliance review, generally for not following federal safety rules; and in formulating its proposal, FMCSA used crash data collected before the current rules went into effect. – Max Kvidera

Obama’s budget proposes $129 billion for DOT

U.S. Transportation Secretary Ray LaHood on Feb. 14 praised President Obama’s $129 billion budget proposal for the U.S. Department of Transportation, saying that it would lay a new foundation for economic growth and competitiveness by rebuilding the nation’s transportation systems, enabling innovative solutions to transportation challenges and ensuring transportation safety for all Americans. Others – including the American Trucking Associations – weren’t as convinced.

The Obama administration’s six-year transportation plan would provide $336 billion to rebuild roads and bridges and $119 billion in funding for sustainable and efficient transit options.

The Obama administration’s six-year transportation plan would provide $336 billion to rebuild roads and bridges and $119 billion in funding for sustainable and efficient transit options.“President Obama’s budget for the Department of Transportation is a targeted investment in America’s economic success,” LaHood said. “If we’re going to win the future, we have to out-compete the rest of the world by moving people, goods and information more quickly and reliably than ever before. President Obama’s investments in rebuilding our crumbling roadways and runways, and modernizing our railways and bus systems, will help us do just that.”

LaHood said the transportation investments proposed in Obama’s fiscal year 2012 budget, the first year of a six-year transportation plan, would put Americans to work repairing bridges and repaving roads, while supporting the development of the new electric buses and high-speed rail lines of America’s future.

Meanwhile, the budget proposal consolidates DOT programs, institutes government reforms and cuts red tape, LaHood said; more than 55 separate highway programs would be streamlined into five core programs to eliminate overlap.

The administration’s six-year proposal would provide $336 billion, a 48 percent increase over the previous authorization, to rebuild roads and bridges, and $119 billion, a 128 percent increase over the previous authorization, in funding for sustainable and efficient transit options.

The budget would establish a National Infrastructure Bank that would leverage private capital to build complex large-scale projects that hold significant economic benefits to a region or the nation as a whole. A new competitive incentive program, called the Transportation Leadership Awards, would reward unique projects that find new ways to connect people to opportunities and products to markets. And to promote DOT’s safety efforts, the budget also would provide $50 million for the department’s ongoing campaign against distracted driving, as well as $35 million to promote seatbelt use and combat drunk drivers.

‘Short shrift to our nation’s highways’

ATA, however, said that the Obama administration’s budget and outline for reauthorization fall short of dealing with the transportation needs of the nation’s consumers and shippers. “While very substantial increases in funding are proposed for high-speed passenger rail, transit, an infrastructure bank and a ‘livability’ initiative, the proposal gives short shrift to our nation’s highways, which Americans overwhelmingly rely on for their daily transportation needs and goods movement,” said Bill Graves, ATA president and chief executive officer.

Graves said that while the administration is proposing large increases in funding for surface transportation, “it has yet to solve the mystery of how to pay for the program, including how to pay to rebuild and expand our network of highways and bridges.” He said ATA continues to support an increase in federal taxes on gasoline and diesel fuel to finance needed road and bridge projects “even though we have been told a fuel tax increase is off the table – because our members understand that roads aren’t free and they’re not cheap. While the administration is correct that we need massive long-term investments in transportation, these proposals beg the question of who is going to pay for it and what are they paying for.” – Dean Smallwood

TMC bestows Silver Spark Plug Awards

The Technology & Maintenance Council of the American Trucking Associations awarded its highest honor – the Silver Spark Plug Award – to five trucking industry professionals during the council’s 2011 Annual Meeting: Jerry Hubbell, vice president of business development for Vehicle Enhancement Systems; Dale Overton, manager of corporate integrity for Accuride; Randy Patterson, senior field engineer for Bridgestone-Bandag Tire Solutions; Kevin Rohlwing, senior vice president of training for the Tire Industry Association; and Chas Voyles, fleet service manager for Navistar International.

The five individuals were awarded the Silver Spark Plug for their outstanding contributions to the improvement of equipment, maintenance, industry-related technology and management practices.

In addition, Mike Baird, national sales manager for Alcoa Wheel Products, was named a Recognized Associate, which is presented for outstanding contributions to the improvement of equipment, its maintenance and maintenance management.

Capacity shortfall seen through 2013

A combination of the trucking industry trying to catch up with the economic recovery and adapting to government regulations that are still being developed will extend a capacity shortage through 2013, a trucking economist said at an online seminar.

The shortfall will peak above 250,000 units in 2012 but continue at about 150,000 units in 2013, predicted Noel Perry, a senior consultant with FTR Associates and principal of Transportation Fundamentals.

FTR’s Trucking Condition Index rose to 7.1 in December, the highest level yet recorded during the current recovery. The TCI reflects tightening conditions for hauling capacity. According to FTR, current conditions and strong prospects going forward are expected to raise this index steadily – possibly to a new record in early 2012.

Perry said the industry is pursuing productivity increases through greater utilization of existing equipment, and miles per tractor were up more than 10 percent in 2010. Without that productivity improvement, “this crisis could be twice as bad, peaking at around 400,000 units,” he said.

Perry added that capacity utilization has recovered to above 90 percent, but rate increases haven’t kept pace. He said carriers are more productive and profitable, without increasing rates much. “From now on, if a [carrier] wants to handle more freight, he is going to have to hire drivers and buy equipment,” he said.

Asked about the proposed hours-of-service changes and their impact on trucking, Perry predicted driving hours will be cut to 10 from 11. “We figure it’s going to cost the industry about 5 percent in productivity,” he said. Perry also projected that driver pay will increase by double digits in the second half of 2011 and continue “for at least another year.”

FTR lowered its Shippers Condition Index to reflect tightening carrier capacity, particularly in the truckload sector. The SCI sums up all market influences that affect shippers; a reading above zero suggests a favorable shipping environment, while a reading below zero is unfavorable. January’s -8.8 reading is the most negative (unfavorable) reading for shippers yet seen during the current recovery.

Larry Gross, an FTR senior consultant, said that rail and intermodal shipments were slowed during recent bad weather but will rebound in the next few months. Perry added that shipper demand will pick up and trucking also will recover from the weather slowdown, and he forecasted a 5 percent tonnage increase in 2011.

– Max Kvidera

ATA backs handheld ban, continued use of hands-free devices

The American Trucking Associations announced its support of the Federal Motor Carrier Safety Administration’s proposed prohibition on the use of handheld mobile phones, though it urged the agency to allow the use of hands-free devices, citing agency research demonstrating the net safety benefits of such devices.

“ATA’s progressive safety agenda calls for the safe use of technology, and our associations’ policy calls for laws and regulations that ban all motorists from using handheld mobile phones while driving,” said Bill Graves, ATA president and chief executive officer. “Recognizing the risks of handheld mobile phone use, it simply makes sense to prohibit their use by all motorists to make the highways safer for everyone.”

To this end, ATA has supported laws and regulations banning handheld phone use for all motorists at the state and federal levels. ATA reiterated this position in comments filed Feb. 22 on FMCSA’s proposed ban for truck drivers. Last year, ATA supported DOT’s ban on texting by drivers of commercial vehicles while their vehicles are in motion.

However, while ATA agreed with FMCSA that “drivers should be prohibited from dialing a telephone number while driving,” it urged the agency not to limit drivers from pushing “a limited number of buttons in order to initiate a hands-free call.” ATA also objected to the proposed prohibition on reaching for a mobile phone while driving.

Doing so, ATA argued, would prevent drivers from initiating hands-free calls which, as the agency’s research demonstrates, can have a net safety benefit. Further, ATA claimed, it is inconsistent to permit drivers to reach for other objects but prohibit reaching for a cell phone.

FMCSA’s proposal to ban handheld cell phone use by commercial vehicle drivers operating in interstate commerce was published in the Federal Register on Dec. 21. Initial comments were due by Feb. 22 and could address any issue raised in the NPRM and the background documents in the docket. Reply comments are due by March 21.

Trucking still hauls most of the freight, survey shows

Trucking remains the predominant mode used by businesses to ship freight in almost all states, according to “State Summaries: 2007 Commodity Flow Survey” from the Department of Transportation’s Bureau of Transportation Statistics. BTS, a part of the Research and Innovative Technology Administration, reported that at least 60 percent of the total value of shipments for 42 states and the District of Columbia in 2007 was carried by trucks alone. By weight, trucks transported at least 60 percent of shipments originating in 40 states, including the District of Columbia.

At least 60 percent of the total value of shipments for 42 states and the District of Columbia in 2007 was carried by trucks alone, according to the BTS survey.

At least 60 percent of the total value of shipments for 42 states and the District of Columbia in 2007 was carried by trucks alone, according to the BTS survey.The CFS measures domestic freight flows from establishments in mining, manufacturing, wholesale and selected retail industries, as well as shipments from auxiliary establishments. The 2007 CFS was undertaken through a partnership between BTS and the Census Bureau.

In the South, eight states and the District of Columbia had more than 80 percent of the value of originating shipments transported by trucks. Only in Louisiana and Texas did trucks carry less than 60 percent of the freight. In the Northeast, New Hampshire was the only state where trucks carried less than 70 percent. The states in the West generally had the lowest percent of freight carried by trucks. Six states in the West had less than 60 percent of originated freight by value transported by truck, and trucks carried more than 70 percent only in Arizona and Nevada.

In all Northeast states, trucks carried more than 75 percent of the originating freight by weight. In contrast, in the West, trucks carried more than 75 percent in only four of 13 states. Trucks carried less than 50 percent by weight in North Dakota, New Mexico, Louisiana, Montana, West Virginia and Wyoming. Trucks still carried the most freight in those states, except for Montana, West Virginia and Wyoming, where rail was the predominant mode. Only 5.6 percent of Wyoming freight by weight was transported by truck.

The report, available at www.bts.gov/publications/ commodity_flow_survey/2007/state_summaries/, summarizes and highlights freight shipments for each of the 50 states and the District of Columbia. CFS data in its entirety for 2007 is available through the Census Bureau’s American FactFinder at www.census.gov.

GPS task force: Multiple databases confusing, not easy to access

An Illinois state task force charged with investigating the use of Global Positioning System technology as well as compliance with the Designated Truck Route System last month submitted its report and eight recommendations to Illinois’ governor and General Assembly. One of the findings by the task force, made up of government and industry representatives, was that the state currently maintains multiple databases with critical truck-specific data that is not easily accessible by the commercial trucking industry. Such data is important to keep large trucks on approved roadways and away from hazards – such as low bridges – that can cause public safety issues.

The Global Positioning System Technology and Designated Truck Route System Task Force was established last September and charged with considering advances in and utilization of GPS technology related to routing information for commercial vehicles. The task force also was directed to study the implementation and compliance with the Designated Truck Route System, Statute 625 ILCS 5/15-116. In its exploration of the current environment, the task force found several challenges that make accessing and using appropriate truck-specific information difficult.

In Illinois, the information that impacts truck routing is stored in various databases belonging to the Illinois Department of Transportation, the Illinois Commerce Commission and local agencies. Local jurisdictions oversee the regulation of truck-prohibited roads and preferred truck routes within their communities. According to the task force, information is not universally present in any one database, making it cumbersome for commercial trucking drivers and firms to access and use the information.

The task force’s recommendations center on four key areas: merging databases together; requiring local jurisdictions to report their designated truck networks and preferred routes via a simplified reporting process; making the database more accessible to the commercial trucking industry; and educating truck drivers on the differences between GPS devices designed for trucks and those used in cars.

Trucker wins fatigue inspection case

A federal judge ruled that Minnesota State Patrol conduct during a 2008 fatigue inspection violated a trucker’s rights against unreasonable search and seizure. In May 2008, officers pulled over Stephen K. House, owner of Eagle Trucking Enterprises, for a Commercial Vehicle Safety Alliance Level III inspection during a FIST patrol event. FIST is an acronym for fatigue impairment, seatbelt violations and other traffic violations, which is checked mostly through these inspections at weigh stations.

The officers made inquiries regarding House’s neck size, urination habits, financial affairs, allergies and family illnesses, according to the suit. Officers also asked if he had specific items in his cab, including adult magazines, food wrappers, food and a computer. Law enforcement placed House, a trucker of 32 years with at least 3 million accident-free miles, out-of-service for 10 hours. The Owner-Operator Independent Drivers Association and House consequently filed suit.

On Jan. 28, Judge Donovan Frank, U.S. District of Minnesota, ruled the defendants’ investigation exceeded what the law entitles. “In doing so, defendants continued the detention of House beyond what was reasonably related to the circumstances that justified House’s detention at the beginning of the weigh station stop,” Frank wrote. “Defendants did not have a reasonable articulable suspicion that House was impaired, and the continued duration of the detention as well as the broad scope of questions by the defendants constituted a seizure in violation of House’s Fourth Amendment right against an unreasonable seizure.”

The parties were to meet March 2 for a settlement-mediation to discuss prospective remedies. Frank stated he assumed the conference would focus on the current procedures, which did not exist when House was placed out of service. The conference also should address if other truckers similarly cited during the event are entitled to having their records wiped clean, he said.

In 2010, the patrol issued an order clarifying limitations and restrictions of inspectors and troopers who conduct North American Standard Training and Inspections when impairment is due to fatigue, illness or other causes. – Jill Dunn

ATA supports streamlining cross-border trade

The American Trucking Associations voiced its appreciation for the U.S. and Canadian governments for renewing efforts to streamline the flow of trade between the two countries and improve security coordination. “The trucking industry appreciates the efforts of President Obama and Prime Minister (Stephen) Harper to advance the cause of trade between the United States and Canada,” said Bill Graves, ATA president and chief executive officer. “This agreement is a positive first step to increasing the competitiveness of businesses on both sides of the border.”

ATA members met with U.S. Customs and Border Protection Commissioner Alan Bersin to discuss ways to improve U.S.-Canada cross-border trucking operations.

ATA members met with U.S. Customs and Border Protection Commissioner Alan Bersin to discuss ways to improve U.S.-Canada cross-border trucking operations.According to ATA, trucks carry about 60 percent of the value of trade between the United States and Canada, the U.S.’s single largest trading partner. “Removing bottlenecks and speeding the flow of goods across the border will not only help carriers in both countries, but also their customers who depend on timely and efficient cross-border operations,” Graves said.

At the same time that Obama and Harper were meeting, ATA members and staff met with U.S. Customs and Border Protection Commissioner Alan Bersin to discuss ways to improve cross-border trucking operations. Steve Russell, chairman and CEO of Celadon Group Inc., represented ATA’s member carriers at the meeting with CBP.

“I want to commend Commissioner Bersin for his openness in wanting to work with us to reduce unnecessary costs and delays at both our northern and southern borders,” Russell said. “We encourage the Obama administration to develop a process that expedites the flow of low-risk trucks into Canada, but also to streamline the movement of goods with Mexico.”

California Dump Truck Owners Association sues CARB

The California Dump Truck Owners Association filed suit against the California Air Resources Board to challenge the legality of the agency’s Truck and Bus Regulation. The lawsuit, California Dump Truck Owners Association v. Air Resources Board (Case 2:11-cv-00384-MCE -GGH), was filed in the U.S. District Court, Eastern District of California, Sacramento Division, on Feb. 11.

In the lawsuit, CDTOA asserts that CARB’s regulation is unconstitutional as it is preempted by the Federal Aviation Administration Authorization Act and seeks an injunction prohibiting CARB from enforcing its rule. CDTOA notes that it has “attempted to work with CARB for more than four years to find reasonable solutions that accomplish the goal of cleaning California’s air while avoiding the needless devastation of the state’s trucking industry and specifically the dump truck industry.”

The association says that the dump truck industry is struggling to survive due to a depressed regional economy, a construction industry suffering through 50 percent unemployment and rampant construction price deflation as contractors fight for what little work is available. CDTOA says the compounding damage caused by the construction industry depression, escalating costs and now the impacts of the CARB regulations “will cause incalculable damage within the construction transportation industry.”

The association claims that CARB has repeatedly refused to address these many economic challenges. CDTOA notes that due to what it calls “a lack of cooperation and empathy,” it was left with no choice other than litigation. “Our members are experiencing the worst economic conditions in living memory, and CARB continues to place impossible regulatory burdens on them at a time they can least afford it,” said Lee Brown, executive director of CDTOA. “Our members support clean air, but the air we breathe can’t be more important than the people that are breathing it.”

CARB’s Truck and Bus Regulation essentially requires all heavy-duty diesel vehicles currently on California’s roads to be replaced with new CARB-compliant vehicles. However, CDTOA says its members have based their businesses on the ability to use their trucks for at least 800,000 miles, and they only average 50,000 miles a year.

Because the rule requires replacement of what CDTOA says are “otherwise perfectly useful, and in most cases, clean trucks” much earlier than would otherwise be required, the majority of CDTOA members will be unable to comply and forced to close their businesses — leaving hard-working employees (drivers, mechanics, support personnel and managers) and their families jobless. CDTOA points out that for most of its members, their dump trucks are the sole asset for their business — essentially serving as their office, tool of their trade, sole source of capital and investment, and only basis of income and livelihood.

A new CARB-compliant truck costs more than $150,000 to purchase. However, dump truck rates are down 40 percent. CDTOA also asserts that the rule drastically diminishes the resale value of currently-owned trucks because they cannot be operated on California’s roads. This means companies have lost their primary source of capital for purchasing new CARB-compliant trucks. Truck retrofit devices also are purported to be a short-term solution under the rule, yet they still cost tens of thousands of dollars and may be mechanically unreliable, according to CDOTA.

Rob McClernon, CDTOA president and small business owner, noted that, “Food on the table, a roof over your head and health care for your family are just as important if not more than nominally cleaner air. From what I can tell, joblessness is far more unhealthy than the air we breathe anywhere in this state today.”

In 1994, the U.S. Congress explicitly acted to retain sole oversight over motor carriers in the United States in order to prevent state agencies from overregulation. The FAAAA prohibits any state or any political subdivision from enacting or enforcing any regulation related to the price, route or service of a motor carrier.

– Tina Barbaccia

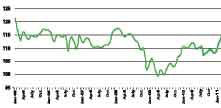

Monthly tonnage index up 3.8% in January

The American Trucking Associations’ advance seasonally adjusted For-Hire Truck Tonnage Index increased 3.8 percent in January after rising a revised 2.5 percent in December 2010. The latest jump put the adjusted index at 117.1 in January, which was the highest level since January 2008. In December, the adjusted index equaled 112.7.

ATA Chief Economist Bob Costello was pleased with January’s robust gain considering the winter storms during the month.

ATA Chief Economist Bob Costello was pleased with January’s robust gain considering the winter storms during the month.ATA recently revised the seasonally adjusted index back five years as part of its annual revision. The nonadjusted index, which represents the change in tonnage actually hauled by the fleets, equaled 105.4 in January, down 2.9 percent from the previous month.

Compared with January 2010, adjusted tonnage climbed 8 percent, which was the largest year-over-year increase since April 2010. For all of 2010, tonnage was up 5.7 percent compared with 2009.

ATA Chief Economist Bob Costello said he was pleased with January’s robust gain, especially considering the winter storms during the month. “Many fleets told us that freight was solid in January, although operations were a challenge due to the winter storms that hit large parts of the country,” he said.

Costello said the latest tonnage numbers indicate that the economy is growing at a good clip early in 2011 and that he expects a solid first half of the year. “At this point, the biggest threat is the recent run-up in oil prices, which could dampen consumer spending,” he said.

ATA calculates the tonnage index based on surveys from its membership. The report includes month-to-month and year-over-year results, relevant economic comparisons and key financial indicators. The baseline year is 2000.

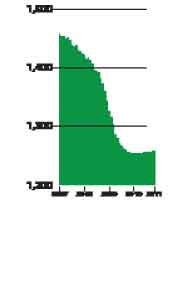

Trucking jobs surge with November revision

Preliminary figures show that trucking companies added 3,200 new employees on a seasonally adjusted basis in January, but the real news is that the U.S. Department of Labor’s Bureau of Labor Statistics again revised upward its November 2010 estimate – this time by 8,500 jobs. The month before, BLS had added 3,000 jobs to its initial November figures. With the further revision and January increase, BLS numbers released Feb. 4 show 9,200 more jobs in trucking than the agency’s report the previous month.

Payroll employment at for-hire trucking companies in January was 27,200 jobs, or 2.2 percent, higher than in January 2010.

Payroll employment at for-hire trucking companies in January was 27,200 jobs, or 2.2 percent, higher than in January 2010.Payroll employment at for-hire trucking companies was 27,200 jobs, or 2.2 percent, higher than in January 2010, according to the preliminary figures. Since the beginning of March 2010 when the slump in trucking jobs hit bottom, trucking companies have added 32,100 jobs, according to the latest estimates.

According to preliminary BLS figures, total employment in trucking in January was more than 1.25 million – down 193,900, or 13.3 percent, from peak trucking employment in January 2007. The BLS numbers reflect all payroll employment in for-hire trucking, but they don’t include trucking-related jobs in other industries, such as a truck driver for a private fleet. Nor do the numbers reflect the total amount of hiring since they only include new jobs, not replacements for existing positions.

Figures for trucking do not include the express delivery companies, which fall under the category of “couriers and messenger” in BLS data. According to preliminary numbers, employment in that category plunged by 44,800 jobs as companies like UPS and FedEx eliminated the temporary jobs added to handle peak holiday season deliveries.

Nationwide, the employment picture improved as the unemployment rate dropped 4 percentage points to 9.0 percent. The economy added 36,000 nonfarm payroll jobs in January. – Avery Vise

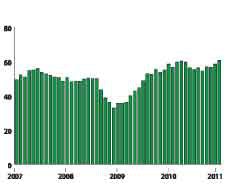

Manufacturing surge continues in January

Economic activity in the manufacturing sector expanded in January for the 18th consecutive month, according to the Institute for Supply Management’s monthly survey of U.S. supply executives. The PMI – ISM’s composite index of manufacturing activity – stood at 60.8 percent in January, up 2.3 percentage points from December. Index values above 50 percent mean that the manufacturing sector is growing.

The 60.8 percent reading for the PMI – ISM’s composite index of manufacturing activity – is the highest level since May 2004.

The 60.8 percent reading for the PMI – ISM’s composite index of manufacturing activity – is the highest level since May 2004.The near-term outlook is rosy as well. The index for new orders – a component of PMI – was up 5.8 points to 67.8 percent. The production index also was slightly higher in January.

The 60.8 percent reading for the PMI is the highest level since May 2004, said Norbert Ore, chairman of ISM’s Manufacturing Business Survey Committee. “New orders and production continue to be strong, and employment rose above 60 percent for the first time since May 2004,” Ore said. “Global demand is driving commodity prices higher, particularly for energy, metals and chemicals.” – Avery Vise