Inventory Data Good News for Trucking

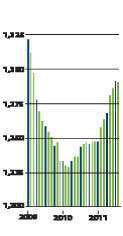

While there are some signs of slowing in manufacturing, inventories relative to sales remain lean, suggesting that businesses are maintaining normal replenishment and shipment cycles. According to the U.S. Census Bureau, the inventories-to-sales ratio throughout the economy was 1.27 on a seasonally adjusted basis in July, down slightly from May and June and only slightly higher than the all-time low of 1.25 in March.

Manufacturing orders slump

The composite PMI stood at 50.6%, suggesting slight growth in the overall manufacturing sector.

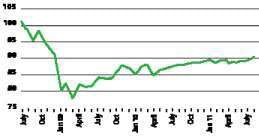

(Seasonally adjusted: 2000=100)

Although up 2.9% over the prior August, truck loadings in August were just 0.3% higher than the month before. (Loadings by commodity as well as a forecast of loadings are available at TruckGauge.)

Trailer and container loads for U.S. railroads were up 0.4%in August.

Trucking sheds a few jobs in August

Indicators

The American Trucking Associations’ advance seasonally adjusted For-Hire Truck Tonnage Index decreased 1.3% in July from June.

Permits authorized for privately owned housing units were up 3.2% in August from July, while housing starts dropped 5%.

The Ceridian-UCLA Pulse of Commerce Index fell 1.4% in August on a seasonally and workday adjusted basis following a 0.2% decline in July.

Fretting over drivers

Driver availability – 45%

Freight volume – 17%

Political climate – 9%

Regulation – 7%

Freight pricing – 14%

Other – 8%

For the sixth straight month, the top concern of trucking executives in August was driver availability, according to the Randall-Reilly MarketPulse survey. Meanwhile, the cost of fuel –the No. 1 worry in February – has virtually disappeared as a concern, appearing only as part of the 8% that chose something other thanone of the top 5 concerns.