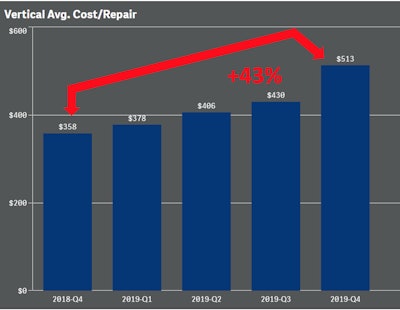

At $407, the average cost of mechanical repair was 24% higher than the same quarter 2018. The average cost per tow averaged $1,485 for the past three quarters, and towing events increased 30-plus percent from Q3 to Q4 2019. When factoring in tire expenses and a tow, the average cost of repair hit $450 last quarter – a jump of 26% over the year. Accounting for fleets that submitted data to FleetNet in 2019 that were not accounted f0r the year prior, the average cost of repair skyrocketed to $513 – a surge of 43% over 12 months.

“Cost per repair looks like a permanent headwind our industry is facing and it would be advantageous to fleets to seek to address this,” said TMC Executive Director Robert Braswell.

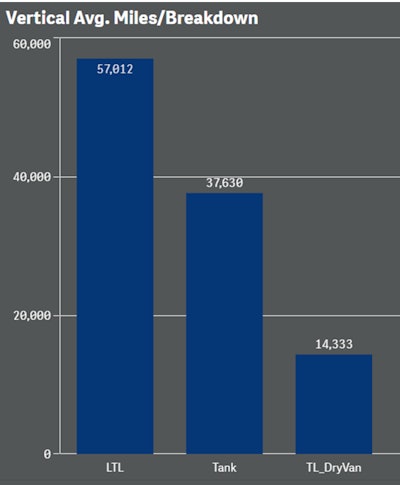

The report, co-authored by TMC and FleetNet America, looks at repair costs in the truckload, less-than-truckload and tank sectors, and showed roadside repairs vary significantly across all three sectors.

In every VMRS system, the average truckload carrier saw significantly more roadside repairs – meaning trucks are traveling fewer miles between breakdowns – than the average LTL or tank fleet. The best-in-class truckload carrier, however, outperformed the LTL and tank vertical averages in some VMRS systems.

Truckload and LTL carriers each saw an increase in the number of miles traveled between breakdowns. Truckload carriers improved by 20% (an improvement of 2,400 miles) from Q3 2019 while LTL carrier got 15% (almost 8,000 more miles) between incidents.