Class 8 preliminary net orders for December came in at 26,620 units, according to FTR, 26% below November and down 6% year-over-year but within expectations given seasonal tendencies.

Total Class 8 orders for the previous 12 months have equaled 253,000 units, and more recent run rates are even stronger. The annualized rate over the past 6 months has been 302,000 units, and the three-month annualized rate is 362,000 units.

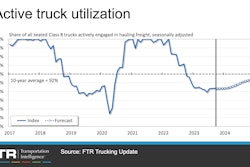

FTR Chairman Eric Starks said truck OEMs are still able to fill build slots at a healthy rate and despite the slight year-over-year decrease in orders in December, the market is still performing at a high level historically. "Even as the freight markets have been weak for an extended period, fleets are still ordering equipment," he added. "Order levels were above the historical average but continue to follow seasonal trends, reinforcing our expectations for replacement demand in 2024.”

The convergence of continued strong build rates, a fading U.S. tractor sales trend, and early in the year sales seasonality risk a Class 8 inventory surge early this year. Some of that dynamic can already be seen with more inventory accumulated the past two months ending November — 4,300 units — than the 3,300 units accrued across the preceding twelve months, as published in the latest release of ACT Research's North American Commercial Vehicle OUTLOOK.

“Something we marveled at, as late as this September, was the close correlation between build and sales that had kept Class 8 inventory levels, both nominal and relative, near perfectly positioned very late into the cycle,” said Kenny Vieth, ACT president and senior analyst. “Increasingly, with inventories already rising and the sales calendar becoming unfriendly in early 2024, the data suggest this cycle will not provide an it’s different this time outcome, with more inventory accrued in the last two months than the preceding 12 months.

Vieth noted that if there is a silver lining, ACT assumes that much of the end-of-2023 inventory build occurred in California because of expensive and complex CARB regulations that went into effect this month.

“The Class 8 forecast has anticipated a production slowdown beginning in Q1. As any significant inventory stockpiling won’t occur until January and February, we are probably early in our call for build rate cuts sooner," he said. "The U.S. Class 8 tractor sales rate has been trending lower since Q2’23, and even in good markets, January and February are far and away the worst months of the year for retail sales.”