Capacity has continued to decline at a slow and steady pace, according to ACT Research.

Based on data from DOT operating authorities, Carter Vieth, research analyst at ACT Research, said that fleet revocations appeared to have peaked in the last quarter of last year and January of this year. “For context, almost 39,000 fleets revocations have occurred since October 2022, and 36% (13,800) occurred between October 2023 and January of this year. Net revocations totaled 1,100 in February, and while one month doesn’t make a trend, we expect numbers to be ‘less bad’ in the coming months,” said Vieth.

With fleets facing higher costs and low rates, Vieth said they see capacity declines continuing.

Avery Vise, vice president of trucking at FTR Transportation Analysis, stated that FTR is seeing a lower level of new entry and a historically high level of authority revocations net of reinstatements. “March (as was the case of March 2023) was an exception to the number of newly authorized trucking firms (5,187) marginally exceeded the number of authority revocations minus reinstatements (5,034),” said Vise.

FTR Transportation Analysis

FTR Transportation Analysis

Vise stated that although revocations have been declining recently, they are doing so from unprecedented levels and are still higher than even the worst months prior to early 2022.

Besides natural volatility, Vise said that a possible explanation for the stronger March results is the sharp increase in spot rates in late December, along with the temporary boost in rates due to weather in January.

Other industry analysts noted similar outlooks.

Ken Adamo, chief of analytics at DAT, noted that the upcoming spring season can bring a boost of demand in trucking, driven predominantly by produce, durable and non-durable home goods and general upticks in construction projects in snowier areas of the country.

“As we enter this seasonally strong time for shipping, if capacity is truly rebalanced, we should see rates follow the seasonal trend upward,” said Adamo, “I do expect it to be a bit muted given where we are in the macro freight cycle, but there should be substantially more freight moving in April than there was in February as example.”

Adamo emphasized that the supply side needs to get back into balance with the demand, which could accelerate if we see demand start to creep back up, though it’s something that hasn’t happened just yet.

He added that regulatory factors such as carrier insurance requirements and government-mandated speed limiters are also worth observing, as that could impact the supply side and cause spot rates to take off upward.

Jason Miller, Interim Chairperson and Professor of Supply Chain Management at the Eli Broad College of Business at Michigan State University, said that there’s a “slow, steady trickle” of capacity leaving.

Looking at payroll data from the monthly Current Employment Statistics survey, Miller said that these are benchmarked each year to population-level employment data based on the unemployment insurance tax filings, making it a reliable dataset.

Miller also said it’s worth looking at two factors: domestic manufacturing output, which accounts for approximately 59% of ton-miles of freight hauled by for-hire trucking firms, and single-family housing starts.

Tipping the balance

Fuel is a critical factor that can tip the balance, Adamo said. “If there's an unexpected spike in fuel prices, I could see that pushing more carriers out of business and tightening the markets.”

Demand shock in either direction could also be another factor.

Adamo pointed out, “Over the last 18-24 months, the big story has been the drawdown of capacity compared to rather static demand. If we see interest rate drops start to spur spending, that would be bullish for carriers if there’s a pullback in spending, that would be bearing.”

For markets to begin recovery and enter the new cycle, Miller stated that there needs to be an improvement in freight demand for the trucking sector to see pricing strengthen in carriers’ favor.

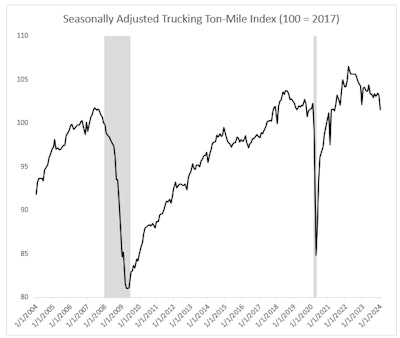

“While January 2024 saw freight demand decline due to the polar vortex, trucking demand is down 4.7% from March 2022 (the seasonally adjusted demand peak for the current cycle),” said Miller. “That is nearly double the decline we saw in the 2019 freight recession.”

Within freight, Vise suggested that the most likely sector to see increases would be in manufacturing, which has been sluggish, and in residential construction. However, a wild there is the housing market as a sustained increase in home building and home sales also would increase spending on durable goods for furnishing those homes.