The Equipment Leasing and Finance Association’s Monthly Leasing and Finance Index, which reports economic activity for the $628 billion equipment finance sector, showed overall new business volume for December was $10.8 billion, up 20 percent from volume of $9.0 billion in the same period in 2010. Volume was up 74 percent from the previous month. Cumulative new business volume for 2011 rose 25 percent over 2010.

Credit quality metrics remained relatively steady. Receivables over 30 days rose slightly to 2.1 percent in December from 2.0 percent in November. Charge-offs were unchanged at 0.7 percent for the third consecutive month.

Credit standards eased as the number of lease applications approved increased to 79.3 percent from 76.2 percent the previous month; 70.8 percent of participating organizations reported submitting more transactions for approval during December, up from 65.5 percent the previous month.

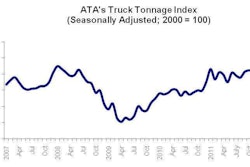

Finally, total headcount for equipment finance companies in December was unchanged month to month and down 1.0 percent year over year. Supplemental data show that the construction and trucking industries again led the underperforming sectors.

Separately, ELFA’s Monthly Confidence Index for January is 59.0, an increase from the December index of 57.2, indicating improved optimism about business activity amid continuing concerns about the global economic situation.

“The dramatic surge in December new business volume is the result of several factors, which, when combined, form an almost ‘perfect storm’ of unusually strong business activity,” says William Sutton, ELFA president and chief executive officer. “First, demand for the lease/finance product increased as businesses replenished their capital equipment stock. Related to this are reports from many ELFA member organizations of a highly competitive pricing environment.”

Sutton says the pickup in new business volume seems to support recent bank data that suggest that lenders are making more credit available to their commercial and consumer borrowers. “Add to the mix a frenetic pace for end-of-quarter and end-of-year closings, and the result is a very robust monthly performance,” he says.