New trucks are beginning to stack up on dealership lots and capacity is outpacing freight in the pipeline. That doesn’t sound like a recipe for a financially fruitful 2016, but things – while slow out of the gate – aren’t expected to drag down what still could be a somewhat not awful year.

That’s right. With 11 months still to shake themselves out, somewhat not awful is a strategic benchmark on the spectrum of optimism.

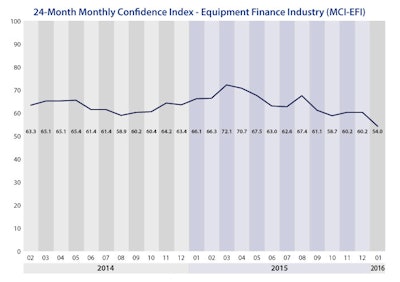

The Equipment Leasing & Finance Foundation released Thursday its Monthly Confidence Index for the Equipment Finance Industry (MCI-EFI). These type things tend to be more helpful in sniffing out trends than election year commercials, although they are sorely lacking for entertainment value.

The majority of the respondents, primarily banks and lenders, to the group’s January query forecast that, at a minimum, business conditions would not get worse over the next four months. That’s a win, right? Not getting worse.

Nearly 11 percent of the executives responding said they believe business conditions will improve over that time. Almost 79 percent believe business conditions will remain the same. While almost 11 percent think business conditions will worsen, that’s a drop of more than a percent from the month before.

“I still see small-business customers concerned about making non-essential equipment purchases and taking longer than normal to make decisions,” says Valerie Hayes Jester, President, Brandywine Capital Associates, Inc. “The tax incentives that were reinstated and extended at the close of 2015 may help tip the scales in favor of investment.”

The pause is likely to hold through the Spring if for no other reason, the short-term outlook – driven by oil prices and China – just isn’t clearly coming together.

The only thing some of the experts in the industry mostly agree on is they don’t think business conditions will get worse. In fact, the popular response to most of the group’s questions was that respondents expect conditions to remain about the same.

• 71.4 percent believe demand for loans and leases will “remain the same” during the same four-month time period.

• 75 percent of survey respondents expect the same access to capital to fund business, and that is up nearly 5 percent from December.

• 32.1 percent report they expect to hire more employees over the next four months, while 64.3 percent expect no change in headcount over the next four months. That’s up from 14 percent from last month.

• 75 percent of survey respondents indicate they believe the U.S. economy will “stay the same” over the next six months.

It’s worth noting this survery isn’t specific to trucking, but trucking and transportation is part of it and certainly affected by it. When confidence is up, consumers and businesses are more likely to spend on consumer goods, equipment and durables. When confidence decreases, it tends to fall. Confidence is about a 54 out of 100 right now – a 24 month low.

If the outlook of buying new trucks and trailers isn’t something you’re currently entertaining, it’s not likely you’ll seriously look into it before the first pitch of the Cardinals/Pirates game on MLB’s Opening Day. But don’t be quick to write 2016 off entirely.

Truck freight volumes are already expected to slide, but the overall outlook for 2016 is still fairly decent – or, in keeping with our theme here, somewhat not awful.

Exactly where somewhat not awful falls between good and bad will depend largely on how well and how quickly you adapt.