North Carolina-based Solid Rock Carriers was hit with $27,000 worth of fuel card fraud in a single day via card skimming. Though the company was able to recoup the money, it had other ramifications when it came to addressing the fallout, including back-office stress and driver frustration.

The company has since employed the use of Relay Payments for fuel and unloading payments to reduce fuel fraud and improve processes for its fleet.

Most carriers experience some form of fuel fraud, from physical theft like siphoning to stealing card information, also known as card skimming. With consistently high fuel costs and the monetary, operational and reputational cost associated with fuel fraud, many have turned to technology to mitigate their losses. That technology includes digital payment methods and fleet management software.

The cost of fuel fraud

Though physical methods of fuel fraud like siphoning and puncturing fuel tanks are still used, as technology has progressed, bad actors have found easier ways to defraud carriers.

Over the last few years, the predominant method has been card skimming – directly correlated to the rise in cardless transactions primarily through mobile apps with limited security, said Steve DeMelis, vice president of product at Comdata.

“The ability to simply enter a card number into a mobile app and facilitate a transaction has made it significantly easier for fraudsters who previously had to rely on stealing the physical card or going through the process of creating a card to attempt a transaction,” DeMelis said.

Though technological advances have made it easier for external bad actors to commit fraud, he said it has greatly decreased the rate at which carriers are seeing internal fuel fraud committed, which has previously been the biggest threat. With digital payment solutions, many carriers are moving away from archaic payment methods like cash and checks – methods that made it easier for internal fraud.

Based on analysis of fraud cases between January 2022 and now, Comdata has found that card skimming – the primary fraud method used by external bad actors – accounts for 75% of fuel fraud, whereas internal employee fraud now accounts for 8.5%. The remainder is due to card theft. The FBI has reported an increase of 700% of card skimming at all businesses. The actual cost of fraud for trucking is unclear, but from conversations with carriers that switched to Relay for fuel payments, they estimated it was costing them $20,000 per month for a fleet that averages 100 trucks, said Relay Co-Founder and President Spencer Barkoff.

Security controls

There are physical barriers such as locking fuel caps and anti-siphoning devices to prevent physical fuel theft. With new payment methods, it’s about digital security controls.

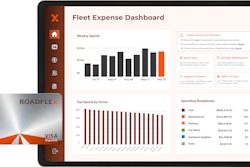

“External fraud can be significantly mitigated using technology and verification, employing such controls as spending limits, additional prompting at the pump, frequency controls and dynamic card blocking – all standard features of a Comdata fleet card,” DeMelis said. “We find that the best method to catch internal frauds is through having advanced levels of reporting as is offered with our OneLook product. OneLook aids fleets in looking at driver trends and identifying when a driver’s fueling activity is suspicious, such as if they have fueled the same amount of times as other drivers running comparable routes but have spent significantly more on fuel.”

Jim Gripp, senior director of program and product management at Powerfleet, said the best way to mitigate internal theft is to issue company fuel cards that can be configured with spending limits by day, time and location, as well as limits to fuel and maintenance product purchases.

Combined with fleet and asset intelligence software and telematics data, he said fuel cards are a very helpful management tool. They provide fleet managers with the ability to use fleet, route and vehicle fuel usage and economy data to proactively identify and eliminate fraudulent driver purchases. Further supporting fleet managers are trigger notifications sent from the SaaS system, flagging suspicious activity and summarizing fuel spending trends.

He said driver education and training are also key in prevention.

“While physical measures and driver education play essential roles in preventing fuel theft, the true game-changer lies in employing advanced fleet management solutions that offer a holistic view by aggregating and analyzing data from diverse sources in a single pane of glass,” Gripp said. “Crucial to thwarting fuel fraud is the seamless integration of fleet operations, routing and vehicle fuel efficiency metrics with external data points like fuel card transactions.”

Digital payments

While carriers and fuel-card issuers often set daily spend caps to limit fraud risk, Barkoff said scammers have various ways of working around these measures. That’s why Relay – and many truckstops – are advocating for all-digital payment methods.

“Most of the time, carriers only learn about card skimming fraud when a driver calls to tell them their card won’t work at the pump and they are stranded. This leads to immediate operational hassles, (driver frustration), and there could be delivery delays,” he said. “Carriers have to figure out how to get another card to the affected driver, but it often takes days or weeks to receive a new card, and then you have to deliver it somehow to the driver who’s on the road. You can quickly see how this is a substantial headache for fleets and drivers, and this doesn’t even take into account the cash flow issues and trying to recoup lost funds.”

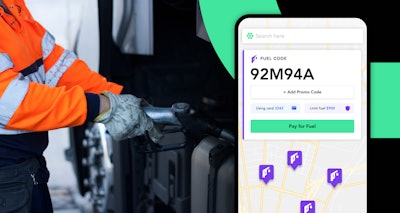

The simplest solution, Barkoff said, is no physical card.

Relay uses an app at the fuel pump that provides a one-time payment code that isn’t tied to any credit card and is further bolstered by geofencing technology and configurable driver policies, eliminating the opportunity for other forms of fraud.

Comdata addresses fraud via mobile apps by implementing multi-step verification processes to ensure who the individual is that is attempting the transaction.

Comdata offers prevention solutions that occur before or during the authorization process of a transaction to verify the individual making the transaction, limit the transaction to the fleet’s parameters, and confirm that the fuel purchased by the fleet is going into fleet vehicles.

Some features Comdata offers include things like card lock controls, vehicle location and fuel level data through telematics, spending limits and rule sets that will decline a transaction based on things like distance since the last swipe, for example.

“The ideal solution to fuel fraud is detecting and preventing (it) at the time of the transaction before any money is spent. The typical fleet manager doesn’t have the time to verify every transaction their fleet is making before the driver makes the transaction; this is where technology provided by payment providers is key to detecting and stopping fraud in real time,” DeMelis said. “It is through this application of technology that a fleet can identify and detect fraud activity before it happens.”

![Volvo Vnl Sleeper Review[20]](https://img.ccjdigital.com/mindful/rr/workspaces/default/uploads/2025/11/volvo-vnl-sleeper-review20.lrVppY9UDR.jpg?auto=format%2Ccompress&fit=crop&h=167&q=70&w=250)