From what TransRisk has seen in the data the futures provider uses from DAT Solutions, spot-market rates are coming back up, says Craig Fuller, TransRisk founder and CEO.

From what TransRisk has seen in the data the futures provider uses from DAT Solutions, spot-market rates are coming back up, says Craig Fuller, TransRisk founder and CEO.TransRisk, Nodal Exchange and DAT Solutions have entered into an agreement to market, develop, and list the first trucking freight futures and options on futures contracts.

The contracts are planned to be listed for trading on Nodal Exchange in late 2018 and will be financially settled using the DAT Truckload Rate Index, based on DAT’s data for major freight lanes in the U.S., subject to regulatory approval.

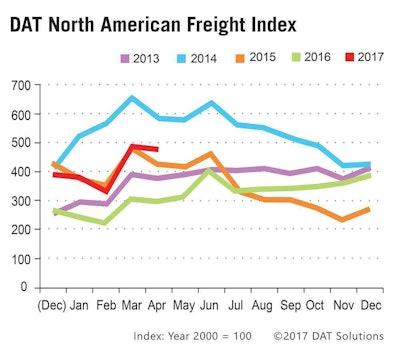

TransRisk is focused on addressing volatility in line haul freight rates, where spot prices can swing as much as 40 percent in a single week on certain major lanes.

The companies say the new contracts will provide shipper, carrier and broker participants risk management tools to hedge their freight lane exposure.

“Nodal Exchange grew from a cold-start exchange a decade ago to quickly become one of the largest players in the power markets. This entrepreneurial achievement is a testament to the quality of the exchange, clearinghouse, and culture of the firm,” said Craig Fuller, chief executive officer of TransRisk.

Nodal Exchange is a regulated derivatives exchange which currently offers over 1,000 electric power and natural gas contracts on hundreds of unique locations allowing market participants to hedge against price risks in the United States. All of the transactions on Nodal Exchange are cleared through its clearinghouse, Nodal Clear, a derivatives clearing organization under the Commodity Exchange Act that is regulated by the U.S. Commodity Futures Trading Commission (CFTC).

“Nodal Exchange is very happy to apply its risk management expertise toward expansion into new commodity markets including the trucking freight market,” said Paul Cusenza, chairman and chief executive of Nodal Exchange and Nodal Clear. “TransRisk and DAT are strong collaborators with extensive experience in the trucking marketplace. We look forward to working with them to design and list products that will effectively serve these markets.”

Established in 1978, the DAT on-demand freight exchange has projected 177 million loads and trucks will be posted in its marketplace in 2017, with spot and contract lane pricing data from actual freight transactions valued at $33 billion annually.

“The recent hurricanes, on top of economic growth and abundant agricultural harvests led to nationwide supply chain disruption and caused dramatic market price fluctuation,” said Claude Pumilia, president of DAT Solutions. “DAT was able to provide timely and relevant business intelligence to trucking and logistics companies to help them succeed during volatile market conditions. The trucking freight futures contracts under development with TransRisk and Nodal Exchange will provide a broader risk mitigation solution for industry participants and investors, and are long overdue.”