The following is an exerpt from How to Evaluate Life Cycle Costs, a manual produced by Commercial Carrier University and sponsored by Castrol. CCU is an educational program produced by Commercial Carrier Journal that includes business management manuals, seminars aimed at improving management skills and a website. For more information, visit www.commercialcarrieruniversity.com.

When you make this assessment, establish a priority ranking that will guide you through the replacement cycle. Any vehicle targeted for replacement should receive a physical inspection by operating, maintenance and specification professionals to determine whether it is feasible to extend the vehicle’s life with some added investment in maintenance and repair. A vehicle assessment report will help you develop a ranking system to determine which vehicles should be replaced first.

Set priorities to determine which vehicles to replace with the available funds. The following method is one possible approach.

If a vehicle is due for replacement, project the total cost of the unit for the following year and compare it with the proposed replacement price. The price difference indicates whether the vehicle is beyond its economic point of replacement.

This priority ranking approach can be developed for an entire fleet by class of vehicle. If funding is available for equipment replacement, develop a replacement priority rating list to guide replacement decisions. To maintain the lowest vehicle cost and greatest vehicle availability, consider replacing older vehicles when the cost of operating and maintaining them is higher than the price of a new vehicle.

Identifying such costs requires meticulous data entry. But once you do that you have a wealth of information in various formats that you can analyze and use to make the most-informed equipment decisions. This is a basic concept of life-cycle costing and good business sense.

Broadly speaking, life-cycle costing helps you measure and compare ownership costs with operating costs. The object is to replace an old vehicle just before incurring significant maintenance costs and after amortizing a large investment.

Ownership costs represent the principal and interest costs incurred on a monthly basis until the vehicle is paid off. Ownership costs can be depreciated (reduced on a fixed period, such as five years) until full value is reached.

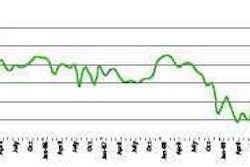

Operating and maintenance costs are familiar expenses. Operating costs include fuel, taxes and registration fees. Maintenance costs include labor and parts. You can track vehicle costs either manually or on a computer to accumulate life-cycle costs. Ownership costs are the most predictable. Maintenance and operating costs are less predictable, showing peaks and valleys. As the vehicle ages, additional costs are incurred. Measuring these additional costs allows you to predict future performance from historical information.

Vehicle costs can be scheduled or unscheduled. Scheduled component costs are preferable, because they usually are lower than their unscheduled counterparts. Brake replacement is scheduled; brake repair is unscheduled.

As you record and analyze vehicle costs, you can use historical data to predict costs for a new model in the same class. By modifying vehicle specifications, you can limit or minimize unnecessary future expenses. You might require higher-capacity alternators to lengthen the service life of electrical starting and charging systems. If one brand is more successful than another, incorporate the most cost-effective brand into the specifications.

Although identifying such costs requires lots of data entry, you can then extract the statistical data in various forms and evaluate it.

Grouping similar vehicles allows you to calculate a class average and compare individual units with this average. If a vehicle is below average, its historical cost trends, compared with the average for the class, will help determine an economical replacement time.

Total unit costs are affected by each of the following costs and the rates at which they rise, alone and together:

• Depreciation. This is the cost you incur due to the declining value of a vehicle as it ages. Equipment depreciates fastest early in its life. A new vehicle has higher principal and interest payments based on its higher purchase price. When the cost of borrowing money is high, when vehicle trade-in incentives or resale prices are low, and when a difficult economic climate affects business growth and profitability, a strong case can be made for extended vehicle trade cycles. Resale values, due to supply of and demand for new vehicles, affect depreciation rates. Depreciation rates must be calculated and included in the annual analysis.

Federal law allows taxpayers to use an accelerated depreciation method to recover the cost of acquiring and operating an asset. The method is called the modified accelerated cost recovery system (MACRS). It allows an asset to be depreciated on a double-declining-balance method over the asset’s depreciable life. Tractors are three-year property in terms of depreciable life, for example, and trucks and trailers are five-year property.

• Operations. These costs tend to increase gradually due to rising fuel prices, lower miles per gallon and related costs.

• Maintenance. As vehicles age, the cost of servicing and maintaining rolling stock tends to increase. Controlling these costs through effective scheduled maintenance — including preventive maintenance inspections, driver support and timely component replacement — can help you keep these vehicles longer, provided they don’t become obsolete.

• Downtime. When a truck sits idle due to a scheduled or unscheduled repair, it costs you money. These costs should be recorded and any unacceptable variations highlighted. Servicing a vehicle during nonuse periods eliminates downtime.

• Obsolescence. When the vehicle can no longer perform its job, it is obsolete. Remove it from the fleet and replace it with a usable vehicle. Use the resale revenue to offset the purchase price of the new vehicle.

• Inventory. Have the necessary consumables and components available to maximize vehicle availability with minimal inventory.

• Life costs. This is the sum of fixed and variable expenses over time and mileage. n