Thank heavens for a lack of drivers

Capacity constraints are critical in a volatile market

By Avery Vise

In April, the average price of diesel soared almost 20 cents – almost as much as the increase in March. And yet, it appears that for most of you, the rise in fuel prices wasn’t the top worry that month. Not even close. In a monthly tracking survey of about 70 carrier executives conducted by CCJ and its parent, Randall-Reilly, 24 percent listed fuel costs as their No. 1 concern in April. Another 6 percent listed cash flow as their top worry, and that certainly could be a function of rising diesel prices.

Avery Vise -- [email protected]

Even combining fuel costs and cash flow, however, doesn’t match the extent of concern over the driver shortage. Just over 40 percent of participants in the Randall-Reilly/CCJ MarketPulse survey listed driver availability as their top concern in April. Driver availability was the biggest challenge in March as well.

March and April mark a major – though not unexpected – shift in trucking executives’ biggest headaches. In February, the price of diesel soared about 28 cents, and fuel costs were, not surprisingly, the top near-term concern. Before then, freight pricing and freight volume were consistently the top worry.

And yet, carrier executives anticipated the current tight labor market. In a survey of the same executives conducted in early December, 32 percent predicted that driver availability would be their No. 1 challenge in all of 2011. Months before a lack of drivers – and many would clarify that we’re really talking about “good drivers” or “quality drivers” – truly took center stage, trucking executives understood that drivers wouldn’t be readily available when freight rebounded. The supply of drivers already was tightening as carriers by the end of 2010 had added back nearly 29,000 employees since trucking employment had bottomed out in March 2010. The first drivers rehired surely were among the best that had lost jobs during the downturn.

It wasn’t just that many drivers let go during the downturn were unemployable, especially in the era of the Federal Motor Carrier Safety Administration’s Compliance Safety Accountability program and widespread adoption of electronic logging devices. In addition, many carriers still had not rebuilt their full recruiting and hiring capabilities. Few new drivers had entered the market in the past couple of years, while many existing drivers decided to retire or look for another line of work.

And undoubtedly there are some former drivers – especially those with spouses who have jobs – who simply prefer to milk the maximum 99 weeks of unemployment insurance benefits. “We are turning down available freight because not enough drivers are available,” one survey participant said several months ago. “My recruiting department states that as long as they can get $500 per week unemployment, the drivers say they’ll go hunting and fishing.”

Some of these factors, such as carriers’ recruiting capacity and generous unemployment benefits, are temporary. Others, such as tighter compliance and an aging driver population, are systemic, however, and only will grow worse as the driver population ages. That’s actually great news. A ready supply of quality drivers would be hazardous to the trucking industry’s health.

For the past seven or eight years, the trucking industry has been mostly in either a boom or bust, in that order. During the height of the housing market and consumer spending spree, trucking companies couldn’t go wrong by adding capacity. And when the crash came, driver hiring largely evaporated. But now, we are in the midst of a more dangerous period – a time when freight volumes are volatile from month to month, week to week and perhaps even day to day.

With the construction industry still in the doldrums and unemployment still high, the key drivers of trucking activity are business investment, exports and periodic inventory replenishments. These activities are hard to predict and rely on. While surely your company is smart enough to avoid the trap, many carriers aren’t so savvy and would add capacity if they could get the drivers. Fortunately, drivers – or lack thereof – won’t let that happen soon.

– Avery Vise is executive director, trucking research and analysis for Randall-Reilly and senior editor, industry analysis for Commercial Carrier Journal. E-mail [email protected].

ATA’s tonnage index up in March

The American Trucking Associations’ advance seasonally adjusted For-Hire Truck Tonnage Index increased 1.7 percent in March after falling a revised 2.7 percent in February. The latest gain put the adjusted index at 115.4 in March, which was the highest level since January’s 116.6 reading. In February, the index equaled 113.5. The nonadjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 123.3 in March, up 20.7 percent from the previous month.

Compared with March 2010, adjusted tonnage climbed 6.3 percent, which was higher than February’s 4.4 percent year-over-year gain, but below the 7.6 percent jump in January. For the first quarter of 2011, tonnage increased 3.8 percent from the previous quarter and 6.1 percent from the first quarter of 2010.

“Despite my concern that higher energy costs are going to begin cutting into consumer spending, tonnage levels were pretty good in March and the first quarter of the year,” said Bob Costello, ATA chief economist and vice president. “While I still think the industry will continue to grow and recover from the weak freight environment we’ve seen in recent years, the rapid spike in fuel prices will slow that growth.”

ATA calculates the tonnage index based on surveys from its membership. The baseline year is 2000.

Trucking adds 4,500 jobs in April

The U.S. economy added 244,000 nonfarm jobs on a seasonally adjusted basis during April, and trucking companies accounted for 4,500 of those jobs, according to the preliminary estimates released May 6 by the U.S. Department of Labor’s Bureau of Labor Statistics. In addition, BLS revised its original estimate for March upward by 1,200 jobs. Compared to April 2010, the number of jobs in for-hire trucking was up 41,600, or 3.4 percent.

Total employment in trucking in April was more than 1.27 million – down 180,300, or 12.4 percent, from peak trucking employment in January 2007. The BLS numbers reflect all payroll employment in for-hire trucking, but they don’t include trucking-related jobs in other industries, such as a truck driver for a private fleet. Nor do the numbers reflect the total amount of hiring since they only include new jobs, not replacements for existing positions.

Although the economy added 244,000 jobs in April, the unemployment rate actually rose slightly to 9.0 percent as workers entered or reentered the job market at a faster rate than the number of jobs being created.

Inventories relative to sales lean in April

Ratio matches all-time low hit in March and April 2010

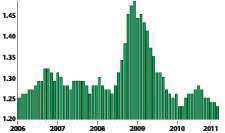

Although the dollar value of inventories rose 1 percent in April, the ratio of inventories to sales throughout the U.S. economy dipped to the lowest level ever recorded as sales rose 2.2 percent. Low inventories relative to sales represents a favorable situation for trucking companies because manufacturers, wholesalers and retailers need to respond to upticks in demand by buying more goods to keep warehouses and shelves sufficiently stocked.

Since the Census Bureau began tracking the data in the early 1990s, the ratio of inventories to sales has never been lower than the 1.23 level recorded in March, according to preliminary estimates.

The inventories-to-sales ratio for April was 1.23 on a seasonally adjusted basis, matching the all-time low recorded by the U.S. Census Bureau in the roughly 20 years since it has tracked inventories and sales. The entire economy also was at a 1.23 inventories-to-sales ratio in March and April 2010.

Inventories relative to sales are not consistently lean throughout the supply chain, however. At the manufacturer level, the inventories-to-sales ratio was 1.24 – slightly above the economywide average. But the ratio at the retail level was 1.33, while the merchant wholesale ratio was just 1.13. That suggests that stockrooms at department stores, for example, remain comfortably supplied, but there isn’t much supply at the wholesale level.

IN BRIEF

* New orders for manufactured goods rose for the fifth consecutive month in March, while orders for manufactured durable goods increased for the third straight month, the U.S. Census Bureau reported. Orders for all manufactured goods were up 3 percent to $462.9 billion on a seasonally adjusted basis, while orders for manufactured durable goods were up 2.9 percent to $209.5 billion.

* Growth in the manufacturing sector slowed during April, according to the Institute of Supply Management’s key indexes. The composite PMI index stood at 60.4 percent, while the new orders and production index levels were 61.7 percent and 63.8 percent, respectively – all strong by historical standards but below March levels.

* The Freight Transportation Services Index of for-hire transportation throughout all modes increased 1.9 percent in March from February to reach the highest level since July 2008, according to the Bureau of Transportation Statistics.

* TransCore’s North American Freight Index showed a 14 percent decline in spot market truckload freight volume for April compared to March but a 12 percent increase compared to April 2010. Freight volumes in the South and Midwest were hurt by the extreme weather conditions during April.

* U.S. rail carloads in April decreased 0.2 percent compared with the same month last year, while intermodal trailers and containers increased 9 percent in April compared with April 2010, according to the Association of American Railroads.

* Housing starts in April were at a seasonally adjusted annual rate of 523,000 – 10.6 percent below the March estimate and 23.9 percent below the revised April 2010 rate. Permits for housing construction in April were 4 percent below the revised March rate and 12.8 percent below the revised April 2010 estimate.