Click here to download the full copy of CCJ’s 2015 Trucking Outlook report.

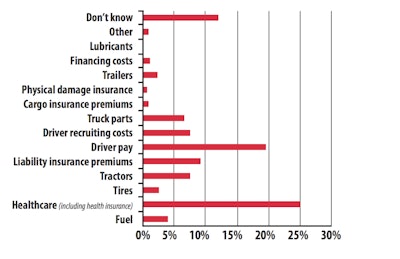

What company expense item will increase the most? More fleets think healthcare costs and driver pay will increase dramatically this year.

What company expense item will increase the most? More fleets think healthcare costs and driver pay will increase dramatically this year.Fleets aren’t only having difficulty finding employees to sit behind the wheel of a truck. The technician shortage has fleets scrambling to find people to work under the trucks as well. Training constraints and technological advancements in today’s power units all point to the need to raise technician wages to attract new entrants to the industry. “Fleets concerned about maintenance costs is another manifestation of a thinned-out labor pool,” says Meil.

Click here or the photo to download the full copy of CCJ’s 2015 Trucking Outlook report.

Click here or the photo to download the full copy of CCJ’s 2015 Trucking Outlook report. Aging equipment is a primary factor in increased maintenance costs. “There’s no doubt why Class 8 sales are going gangbusters,” says Costello. “A lot of fleets have old equipment that is nickel-and-diming them to death. If you’re not replacing trucks, you’re in a really bad spot because your maintenance costs are going up significantly. Yes, new equipment is more costly, but the good news is you’re not purchasing a truck that is getting 5 miles per gallon – you’re purchasing one that has 7 mpg or more.”

As fleets continue to shorten their equipment trade cycles, there are immediate gains in maintenance savings, but eventual maintenance costs on today’s more complex and technology-laden truck models will rise as those trucks age.

“The maintenance on a five-year-old truck today is lower than the maintenance costs on a five-year-old truck five years from now,” says Broughton, referring to new emissions, aftertreatment and sophisticated safety systems not found on many older trucks.

“Outside of fuel, I do think we have cost inflation that is certainly higher than inflation overall,” says Costello. “I’d lump in maintenance, equipment in general and obviously drivers. I caution carriers all the time not to take their eye off the cost ball. If they do that, there is room to slip up.”