CCJ’s Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

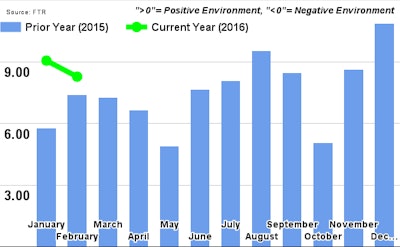

FTR did however point to high capacity utilization as a strong positive indicator for the industry. Regulatory headwinds expected to come to fruition next year, likewise, will have a positive impact on the index, FTR predicts. Continued regulatory changes for the industry, like an electronic logging device mandate set to be enacted next year, will likely strip industry productivity and capacity, thereby driving the index — and rates — upward.

“The market has certainly softened in 2016, yet there are still enough positive indicators to keep the freight markets afloat despite the weakness,” says FTR’s Jonathan Starks. “Freight loads are looking to slow this year, but 2 percent growth is still a reasonable environment for truck operations. What it doesn’t do is create pressure on capacity, which is what would be needed to improve the rate environment. The rate environment has deteriorated, but unless the market sinks further we should expect to see contract rates begin improving in the second half of the year.”

Starks also cautioned that a quick jump in fuel prices could bring back a trend seen in 2008 and 2009 when fuel prices skyrocketed — a surge in carrier bankruptcies.

“If prices rise quickly it could have a big impact on cash flow, especially for the smaller carriers. If that happens we would expect to see a jump in fleet bankruptcies, something that has remained at historic lows over the last year despite the headwinds that the industry has been facing.”

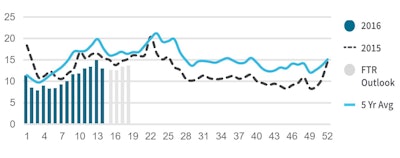

The MDI is based on spot market demand (loads posted by brokers, essentially) and available capacity — carriers looking for loads. A drop in the reading, such as the one reported April 11, signals either from a decline in available loads or an uptick in available capacity/trucks, or both.

For more details on the index and what drove this week’s reading, sign up for Truckstop.com’s Trans4Cast, published every Monda, at Trans4cast.com.