CCJ‘s Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

(Graphic from DAT Solutions)

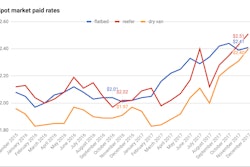

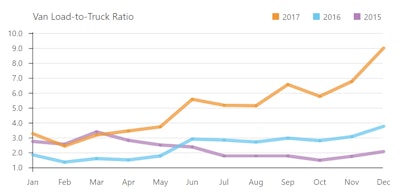

(Graphic from DAT Solutions)Record tightness on the spot market: The load-to-truck ratio on the spot market in the dry van segment closed December with a record-high 9-to-1 load-to-truck ratio, according to DAT Solutions. That’s the most tilted monthly average ratio since DAT began measuring load-to-truck ratios in 2010. Given the segment’s tightness, per-mile van rates jumped to $2.11, also a record-high for DAT’s spot market data.

The spot market in the second half of 2017 soared, with freight availability seeing big gains, and, thus, driving up rates.

For instance, van rates in January 2017 averaged $1.67 a mile, DAT said — 45 cents lower than December’s average. The load-to-truck ratio in January 2017 was 3.3 loads for every available van hauler on DAT’s board.

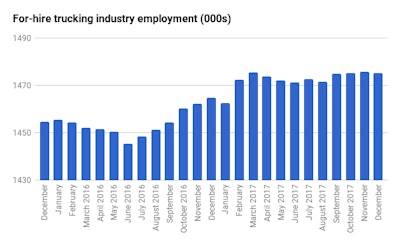

Source: Department of Labor

Source: Department of LaborTrucking employment dips after four-month rally: Total employment in the for-hire trucking industry fell by 600 jobs in December, according to the Labor Department’s monthly Employment Situation Report. That’s the first decline since a 1,000-job dip in August.

The DOL also downwardly revised November’s gains, down to a 700-job increase from the previously reported 1,800-job uptick.

The economy as a whole in December added 148,000 jobs, and the country’s unemployment rate held at 4.1 percent.

For-hire trucking employment totaled 1.4753 million in December, up 10,400 jobs from the same month in 2016. Those figures do not account for private fleet data and is based on the number of payroll employees in the month.

The construction industry in December added 30,000 jobs. Manufacturing gained 25,000 jobs. The transportation and warehousing sector, under which trucking falls, added 1,800 jobs in the month.