Though economic growth has certainly slowed in 2019, perhaps felt more abruptly and acutely by the trucking industry than in other sectors of the economy, there appears to be little risk of a recession on the horizon.

What’s more, market conditions for trucking, though no longer benefitting from a stark supply and demand imbalance that caused a rates boom in 2017 and 2018, are still historically strong, despite the market correction.

That’s according to a slate of economists and trucking-focused analysts who spoke Wednesday at the 2019 FTR Transportation Conference in Indianapolis, Indiana. Their general consensus: The economy continues to grow, despite a slowdown and despite a myriad of headwinds in the form of geopolitics, an inverted yield curve, Brexit deadlines, a dip in manufacturing and the Trump Administration’s trade war with China. Those factors have created a cloud of uncertainty about the economy’s strength and whether growth can be sustained, said Jack Kleinheinz, chief economist for Kleinheinz and Associates and formerly chief economist for the National Trade Federation.

Though the freight market “feels like a cliff,” said Eric Starks, FTR’s CEO, the market has instead stabilized, and growth is flat. FTR forecasts growth to remain stagnant as a market correction through the end of the year and for growth to resume in 2020.

Though the freight market “feels like a cliff,” said Eric Starks, FTR’s CEO, the market has instead stabilized, and growth is flat. FTR forecasts growth to remain stagnant as a market correction through the end of the year and for growth to resume in 2020.“We sort of have a jigsaw puzzle in front of us,” he said, that economists must try to piece together to create a forecast. “One could say there’s no precedent for this amount of uncertainty. There’s a lot of uncertainty, a lot of moving parts. And it’s created a lot of volatility. The data is moving around a lot.”

That uncertainty has impacted the economy, especially the stock market, of late. However, he says, “I’m optimistic about the economy,” with macrotrends not showing risk of a recession.

As has been the case throughout much of the ongoing 10-year growth cycle since the ’08-’09 Great Recession, consumer spending continues to underpin the economy’s strength, said Kleinheinz.

What all of this means for trucking, says FTR CEO Eric Starks, is a flat freight market. “It feels like a cliff,” he said, but in reality it’s simply “a holding pattern,” he said. “How many of you are used to a holding pattern? Nobody. We’re used to either going up or going down. We don’t know how to hold steady — it freaks us out.”

A convergence of several key factors in 2017 and 2018 constrained trucking capacity and chucked the market out of balance. Major hurricanes in late 2017, two key adoption deadlines for electronic logging devices in late 2017 and spring of 2018 and an already-tight capacity were layered with a surge in freight movement amid a larger economic uptick.

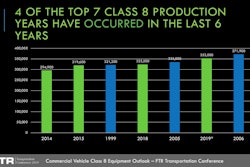

“What a difference a year makes,” said Bill Matheson, senior vice president and chief commercial officer at Schneider National. “It speaks more to 2018 than 2019. While it feels much different than 2018, we’re actually in the middle of a good year.”

For freight movement, 2019 likely will be the second best year in the long recovery period since the 2008 and 2009 recession, Matheson said. Recently, meeting with 25-30 shippers, Matheson said all but two said their volumes were up year over year compared to 2018. “I believe we’re in a fairly robust economic condition,” he said.

The key difference this year? An influx of supply (that is, a capacity boost via more trucks and carriers entering the market), more efficient shipping practices in the wake of the ELD mandate and a leveling off in freight demand. Those factors have moved the market toward equilibrium — and pressed spot rates back toward more historically normal levels. Spot rates, which began their ascent in late 2016 and peaked last June, in recent months have been trending below their five-year average.

Movement for contract rates, under which the vast bulk of freight is moved, was much more muted in 2017 and 2018, and contract rates are forecasted to stay flat, says Avery Vise, FTR’s vice president of trucking.

“There’s a lot of stability on the contract side,” Vise said. “As bid packages come up, those are all going to be recalibrated, but that’s our market outlook for now.”

Trade, tariffs, manufacturing chief causes for concern

Manufacturing output has been declining since the third quarter of 2018. The ISM index, a key measure of manufacturing strength, dipped below the 50 mark for the first time in three years, and is at its lowest point since January 2016, said Vise. A reading of over 50 signals growth, whereas a reading of below 50 on the ISM index signals shrinking manufacturing output.

In tandem with manufacturing output, inventories are inflated, which is contributing to the constraints on manufacturing.

Inventories are also overly inflated as shippers attempt to get ahead of tariffs scheduled to take effect later this year.

FTR forecasts that economic growth will be flat through 2019 as the market adjusts, but should resume growing in 2020. “Things are going down,” said Starks. “This is where we have to tighten the belt. We’re see a mid-market correction at this time, and if our hypothesis is correct, then the expectation is we’ll have flat growth — we forecast no growth — through balance of this year and then a slow increase next year.”