I’ve been posting about U.S. diesel fuel prices for several months now as it becomes an increasingly large operating cost for the trucking industry. In fact, at today’s prices, diesel fuel is the single-largest cost burden incurred by truckers, regardless of whether it’s a fleet or owner-operator.

In the chart below of the U.S. national average retail diesel price for the period Jan. 1, 2021 to May 2, 2022, the price is shown in blue on the left vertical axis with the gray dashed line indicating the period’s average price of $3.60 per gallon. The related fuel surcharge (pump price per gallon – $1.25 per gallon base price\6 miles per gallon) is shown in green on the right vertical axis.

Following my posts, several commenters have needlessly politicized the economics education by assigning blame to the current White House occupant. The chart, however, leads to a different factual conclusion.

First, I pointed out that there was a step function dated around Feb. 24, 2022, when Putin’s Russian army invaded Ukraine, when the national average diesel price jumped from $4.06/gallon to $5.25/gallon within three weeks. To be clear, this $1.19/gallon three-week jump is not tied to the President’s long-term energy sector agenda. Rather, this reflects short-term volatility that rests squarely on Putin’s egregious action.

Second, the long-term trend is and has been upward. Unfortunately, the COVID pandemic had a devastating effect on the global market from March 2020. Consumer demand and manufacturing production was all but shut down. The resulting decline in U.S. GDP suppressed diesel demand, effectively putting a lid on diesel prices. With the new administration’s change in COVID response, the economy began to rebound, which increased demand and shored diesel prices. However, Putin’s saber-rattling rhetoric, where the Russian military built-up at the beginning of 2022, stoked fear in the global crude market, accelerating the price rise up to the invasion.

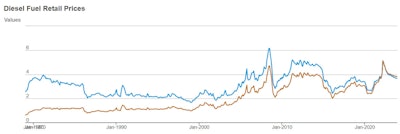

It’s also important to look at the current diesel price within a broader time frame. Looking back some 40+ years from January 1980 to present, when you compare the actual monthly diesel price to the same price, adjusted for inflation, as shown below in blue and orange, respectively, we are not at the all-time high, which occurred in 2008 – and we all remember the economic recession and trucking bloodbath that happened around that time. But, we are close! So a cautionary word, my trucking friends: Fuel efficiency is your competitive advantage.

A bit of irony: When diesel prices were low, folks derided fuel efficiency because “fuel is cheap.” Conversely, when fuel is pricy, as it is today, the same folks cannot afford to add fuel-efficient technologies as trucks are expensive and operating margins are tight, so there is no extra money to spend on fuel-saving aerodynamic devices.

For example, a truck today getting a fuel efficiency average of 7.0 miles per gallon during a 10,000 mile month will spend $7,871 for fuel (a $94,457 annual cost). At just 8.0 miles per gallon, that truck will spend a full $1,000 less for fuel, each month.

Consider further Volvo’s state-of-the-art D13 with Turbo Compounding and I-Torque technology that commonly yields double-digit-plus fuel economy, that truck’s fuel cost is $5,500 per month. Together, this aerodynamic, fuel-efficient rig will burn 30% less fuel, adding nearly $2,361 per month – to the bottom line, minimum.

According to a 2019 Owner-Operator Truck Driver survey of 160,884 owner-operators, owner-operators rake in an average gross revenue of $220,591. But many owner-operator's net bottom line pre-tax profit – the all-important take-home pay – is between $45,000 and $80,000 per year. Taking the midpoint of that range, $62,500 is about 28% of the top-line gross revenue figure.

To achieve that same $2,361 monthly fuel savings, an owner-operator needs to generate $8,468 in additional monthly revenue (over $101,600 annual rate) – that means he has to increase revenues by 46% – nearly half. That means the owner-operator has to work another full 9 days each month – a full 5.5 months worth in a year – just to make up for the fuel savings that he’s losing. That, my friends, is not smart business.

Small fleets' and an owner-operator’s very competitive advantage is operational efficiency, while fleets leverage scale of operations to their advantage. We all know trucking is cyclical. The only certain we can rely on is that nothing remains steady for long. Freight rates rise intra-year with seasonality and inter-year as supply-demand equilibriums shift across the spectrum. But how long will ill-prepared small carriers and owner-operators be able to withstand a bloodbath market as we witnessed previously? Real businesspeople understand the economic benefits of becoming the low-cost producer of freight capacity, that aerodynamics pay dividends, that fuel-efficient tractors will survive a downturn, and those operators will reap the benefits of a culling of capacity.

When an owner-operator cedes fuel economy, they are effectively committing economic business suicide as the fleets have much lower asset costs, buy fuel in bulk quantities and can hedge their fuel cost risk and have lower driver pay scale – about which I’ve written extensively with respect to the Motor Carrier Exemption to the Fair Labor Standards Act – all of which combine to overwhelm owner-operators, especially prescient in a falling freight rate market scenario. All the more important that owner-operators preserve, protect and exploit that competitive advantage or risk a forced business exit.