A shortage of an estimated 24,000 truck drivers is leaving many trucks idle, costing the freight industry $95.5 million every week, according to a report by factoring service altLine.

According to its estimates, the industry could generate $47.4 billion in annual revenue if all registered trucks were operational.

The report examined data from Nov. 22 to Dec. 5, 2024, gathering 28,515 truck driver jobs from Google for Jobs postings and salary data aggregated from LinkedIn, Indeed, Glassdoor, ZipRecruiter, Monster and other public job sites.

While there are thousands of truck driver roles available in the country, the online job market represents only a fraction of the full job market. Job search platform Zippia found that just over 25% of available truck driving jobs are posted online, while 70% are filled through personal connections, staffing agencies and other offline channels.

The report found an average of 7,213 truck jobs advertised daily, pointing to an ongoing shortfall of approximately 24,043 drivers.

“Multiply this by the reported $3,971 revenue per week for every truck that is not being manned, and we arrive at the true cost to the freight industry – $95.5 million every single week,” wrote altLINE Freight Factoring Operations Manager Jennifer Fink, lead researcher of the report.

[RELATED: Cost of congestion tops $100 billion annually, nearly $8k per truck]

Potential of full utilization

Using census data, the report looked at the economic potential of the industry and the number of trucks registered for freight.

Looking at only tractor trucks, there are more than three times as many trucks as professional drivers. Adding in the approximately 10.5 million other heavy trucks further highlights the immense amount of underutilized equipment in the country.

While straight trucks generate slightly less revenue per week than tractor trucks, the sheer volume contributes to an additional $39.9 billion in potential annual losses, bringing the combined weekly shortfall to nearly $50 million.

“This number is merely hypothetical, but it is powerful in demonstrating the huge discrepancy in truck availability between truckers and drivers,” Fink said. “Millions of trucks sit idle in the U.S. every day, and each one represents a missed opportunity and losses for the freight industry and many more losses further down the supply chain.”

Regional differences

Regional disproportions show that Missouri has the highest demand for truckers nationwide, with an average of 202 listings per day. Considering that 70% of trucking jobs go unadvertised, the report suggests there are around 673 open positions in Missouri at any given time.

Wyoming has the highest demand relative to its population, with one unfilled trucking job for every 1,031 residents. Texas, despite its role in interstate trade, ranks only fifth in total trucker vacancies. When adjusted for population, the report found it has one of the lowest trucker-to-job demand ratios in the country, making it one of the most competitive states for drivers despite high overall demand.

Meanwhile, Nebraska has the readiest supply of truckers, making it the quickest state to fill trucking jobs.

[RELATED: Trucking jobs market suggests stability, as December data signals slow recovery]

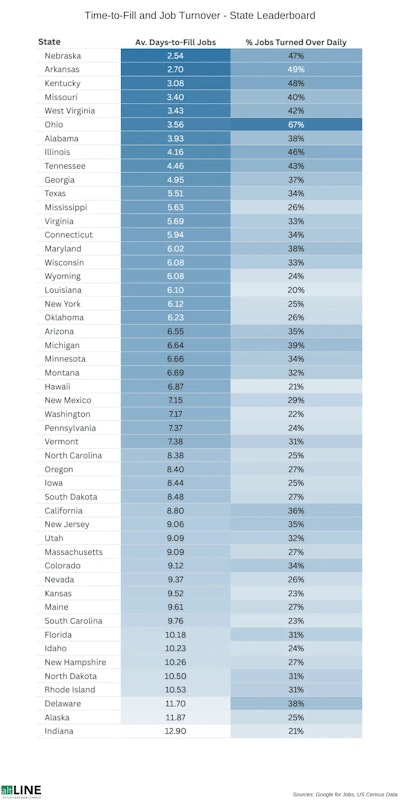

The speed at which trucking jobs are filled and created is also another critical measure of the local freight industry, Fink pointed out. The report also tracked the daily job turnover (the rate at which advertised jobs are filled and created), and the average recruitment time revealed significant regional differences.

Ohio has one of the fastest-moving job markets, with two-thirds of truck driver positions being filled and replaced daily, resulting in an average hiring time of just 3.6 days.

Nebraska leads in recruitment speed, with new hires averaging just 2.5 days, though its turnover rate of 47% suggests a backlog of stagnant job openings.

Indiana has the slowest-moving trucker job market, with a daily turnover of only 21% and an average recruitment time approaching two weeks, making it the most challenging state to find drivers.